By Harvest ETFs

The rise of direct dealers, no-fee brokerages and widely accessible online investment platforms have benefitted individual investors. These new tools represent a huge leap forward, creating investment opportunities that had once been under the thumb of high commission brokers. But, for all their positives, many of them focus on short-term trades over long-term gains.

Through user interfaces borrowed from video games, incentives like offering the first 50 trades for free, or a constant stream of notifications, many of these platforms are encouraging ordinary investors to become day traders.

Through user interfaces borrowed from video games, incentives like offering the first 50 trades for free, or a constant stream of notifications, many of these platforms are encouraging ordinary investors to become day traders.

Day traders execute a high volume of trades during market hours to make money on equity price fluctuations during the day. They might hold a position for an hour or two, or hold it for a few milliseconds, before selling. Some day traders can make money, but long-term success requires a high degree of sophistication and self-discipline, as well as a more technical toolkit than ordinary investors have access to on their phones or laptops. Plenty of retail investors on these platforms have gone on great short runs, only to see their investments demolished by a single decision. It can feel a bit like playing roulette.

To one industry veteran, these incentives to day trade are moving ordinary investors away from the investment strategy that has consistently shown itself to be the best source of return: long-term investing.

“A large number of investors on these platforms have got away from the three fundamentals of wealth creation,” said Michael Kovacs, President & CEO of Harvest ETFs.

“Those fundamentals are: invest long term, grow your capital tax free, and compound your returns.”

Long-term strategies echo the best business leaders

Long-term investing, Kovacs explained, is the approach taken by some of the greatest business leaders of our time. Warren Buffett has famously espoused the strategy, and taken the approach himself, refusing to sell shares of Berkshire Hathaway. The same applies to Elon Musk and his Tesla stock, or Jeff Bezos and his Amazon stock. Business owners invest in themselves for the long-term and grow accordingly.

Even if you are not a business owner, you can invest in the businesses or portfolios of businesses you think are great for the long-term, and hold onto them as they grow. Looking over several decades, we see that stocks as an asset class have outperformed other securities, demonstrating the wisdom of investing in businesses for the long-term.

Taxation on investments makes the difference

Kovacs emphasized that the other key benefit to long-term investing, and drawback to day trading, is tax liability. Capital gains tax is imposed at the sale of an asset. That means day traders are racking up huge tax bills as they sell multiple sets of positions per day. That also means long-term investors aren’t getting taxed on their appreciating asset until they have to sell it.

Many long-term investors hold their investments in registered accounts like RRSPs, meaning they can actually gain tax advantages by investing long-term. While those strategies end up resulting in a tax bill during retirement, that is still generally a far more advantageous tax situation than accruing huge tax bills from a massive volume of daily trades. While TFSA accounts can shelter some trades from capital gains tax, the kind of high-volume activity involved in day trading can invite a CRA investigation into whether a trader is “carrying on a business,” thereby incurring fresh taxes. “Many of these apps and people giving day trading advice for ordinary investors gloss over the tax disadvantages of this approach,” Kovacs said. “In the rare cases a retail investor comes out ahead by day trading, they can end up with a huge tax bill they never saw coming.”

Compounding investments: the true power of long-term strategies

Kovacs also noted that by executing day trades, or even just pulling money out of the market when things take a downward turn, investors are missing out on the single most powerful force on their side: compounding.

“Compounding is the simplest and most virtuous principle in investing,” Kovacs said.

Kovacs took the example of compound returns over 10 years, assuming an index investment in the S&P 500 which has averaged around 8% per year for decades. A $10,000 investment compounding at 8% for 10 years without any additional contributions will be worth $21,590 at the end of the decade.

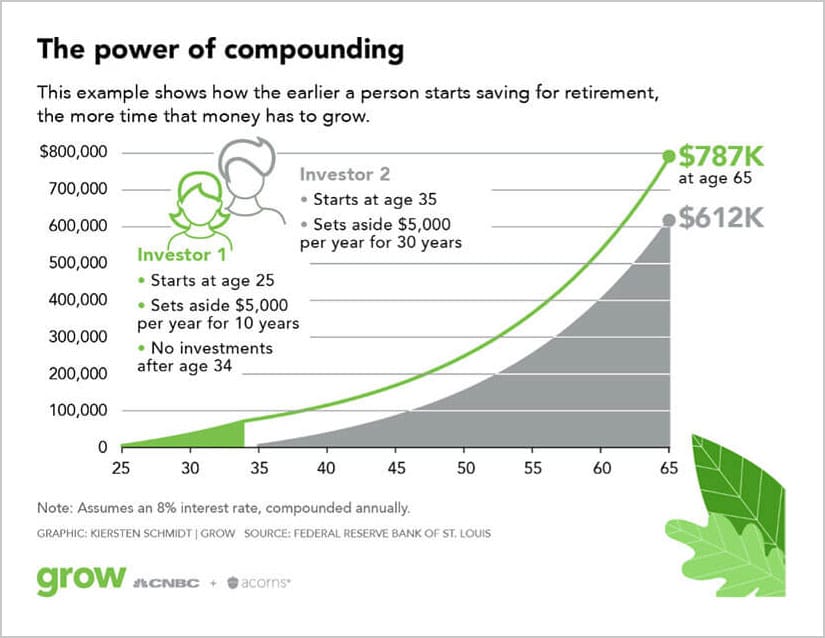

That huge growth over time comes down to a simple fact: the money you gain as your investments grow stays invested in the market and continues to grow as well. The below chart from CNBC demonstrates the principle in a similar way.

Source: Federal Reserve Bank of St. Louis

It’s no wonder Albert Einstein once called compounding “the most powerful force in the universe.”

So, while the gamification of trading apps and low-fee brokerages may incentivize day trading, Kovacs maintains that ordinary investors should consider the power of the three investment fundamentals.

“Invest long term, Grow your capital tax efficiently, and Compound your returns,” Kovacs said. “Align yourself with the great business owners of the world. Search for quality investments, hold them and let them compound.”

Disclaimer: The content of this communication is for informational purposes only. All comments, opinions and views expressed are of a general nature and should not be considered as advice and/or a recommendation to purchase or sell any securities or used to engage in personal investment strategies. Information contained in this document is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times.

To find out how your clients can benefit from this strategy call Harvest ETFs 1-866-998-8298.

For more on Harvest Equity Income ETFs & Harvest Growth Income ETFs click here.

Quoted in this article

|

Michael KovacsPresident & CEO Harvest Portfolios Group |