Harvest Exchange Traded Funds

Investors seeking a reliable source of income usually favor investing in dividend-paying stocks of large, established companies which pay regular dividends and have the potential to increase payouts over time.

These businesses are typically associated with major global brands, which are leaders in their respective market space; have a demonstrated record of profitability, have the capacity to flourish in good times and survive the bad times, and their products and services permeate nearly every aspect of our lives.

Take, for example, global brands such as Nike Inc., Alphabet Inc., Microsoft Corporation, Citigroup Inc., Visa Inc., and Intel Corporation, they all have a comparative as well as a competitive advantage in the respective market space which they operate. Similarly, they are amongst the best positioned to benefit from increasing demand for their products and services in an environment of rising global growth.

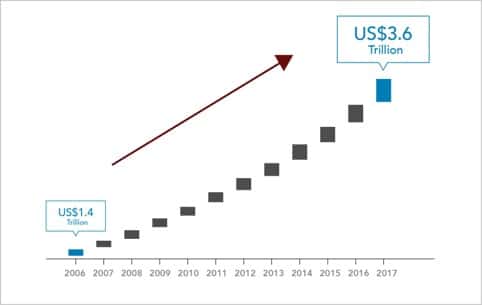

The value of global brands has increased from US$1.4 Trillion to US$3.6 Trillion (11 years)

Source: BrandzTM Global Top 100, Kantar Millward Brown, 2017

Incidentally, global growth is expected to trend higher over the next two years, based on April 2018 forecasts by the International Monetary Fund[1].

As a result, global brands which have strong leadership and understand the markets in which they operate, are likely to perform well, and potentially benefit from growing free cash flows from their geographically diversified operations. Accordingly, they have the ability to pay and potentially increase their dividends over time.

In an article written by Bryan Borzykowski for CNBC, June 7, 2018, he states that in the US, for instance, 187 companies, including global brands such as Apple Inc., have either increased or initiated a dividend during the first five months of 2018 according to S&P Dow Jones Indices.

Dividend payouts in the US have risen by an average of 13.85 % since January 1, 2018. This trend puts 2018 on pace to be one of the best years for dividend increases for US companies, including those that are global leaders.

CHARACTERISTICS OF A GLOBAL BRAND

In general, the characteristics of a global brand fall into all or most of these categories:

- Established record of stable earning power

- A long record of dividend payments to common stockholders

- Earn high returns on capital, especially as measured by return on equity

- Have a strong balance sheet and income statement

- Are significantly larger than the typical corporation, often ranking among the largest companies in the world measured by stock market capitalization and enterprise value

- Enjoy a “competitive advantage” that makes it hard for other firms to win market share over them

- Are a large part (usually) of a countries exchange index, such as the S&P 500

- Can offer some form of safe harbor during economic adversities

In addition, Paul MacDonald, CIO & Portfolio Manager, and his team can write covered call options on up to one-third of the Harvest Brand Leaders Plus Income ETF (TSX: HBF) portfolio, to generate income and enhance regular quarterly corporate dividends.

HBF holds 20 positions that read like the who’s who of the dividend elite. The ETF incorporates metrics like free cash flow, dividend growth, brand value and other financial metrics in the security selection process.

For more information about the Harvest Brand Leaders Plus Income ETF (TSX:HBF), please click here.

_________

[1] World Economic Outlook, April 2018. Cyclical Upswing, Structural Change, IMF