Global Brands have powerful advantages

They are a reassuring purchase in all conditions

The world’s top brands stand for quality, consistency and reliability in any language or culture. They thrive in good times and bad and emerge from challenging environments even stronger.

Why? Because consumers trust the purchases to satisfy their needs. They turn to them regardless of the economic cycle.

For investors, these companies have the size and scale to withstand market downturns and the ability to adapt while relying on core businesses to generate sales and profits in the meantime.

That means dividends and share prices that are poised to grow over time, working towards offering investors rising income and capital appreciation.

The unique qualities that drive brands

2020 was a tough year for the global economy. But many multinational brands ended the year better off than when they started. Of the 20 companies in the Harvest Brand Leaders Plus Income ETF, 13 increased their dividends year over year. Only one Walt Disney Co., suspended its payment. But even Disney saw its share price rise 22%.

Disney’s response to the pandemic shows the ability of global brands to thrive in adversity. With its theme parks and theatres closed, Disney turned its creative energy to expanding Disney+, a streaming service it launched in November 2019.

From a standing start of 10 million subscribers, Disney+ hit 100 million in March, 2021. Disney forecasts the platform will have up to 260 million subscribers by 2024.

Features of global brand

The Harvard Business Review[1] looked at the main attributes of global brands and came up with some common features. One is a simple marketing message that is consistent across all of its markets. Google is synonymous with ‘internet search’. This two-word description creates lasting economic value by ensuring consumers know what Google is and what it does. The company name is the brand. All marketing is concentrated on reinforcing that name. Apple, McDonald’s, Nike. UPS. Caterpillar. A Google Home will not answer you unless you say: ‘Hey, Google.’ Access to the global village. Consuming the brand equals membership into a worldwide club. You can buy a Pepsi or a Big Mac in Ho Chi Minh City in Vietnam with the same lettering and script as one in Hartford, Connecticut. A Big Mac in Delhi, India, is instantly recognizable. But brands also adapt to local tastes. In India, the most popular Big Mac sandwich is vegetarian, though it also comes in chicken. It looks exactly the same including the packaging. Social responsibility. Consumers expect global brands to lead the way on social responsibility, leveraging their technology to solve the world’s pressing problems. Nike’s global brand image is enhanced by a commitment to reducing its carbon footprint. This includes better manufacturing processes and using renewable energy to power its factories. It is also committed to a diverse and inclusive workplace.

[1] How to Build a Global Brand, John Quelch. Harvard Business School. 16.10.07

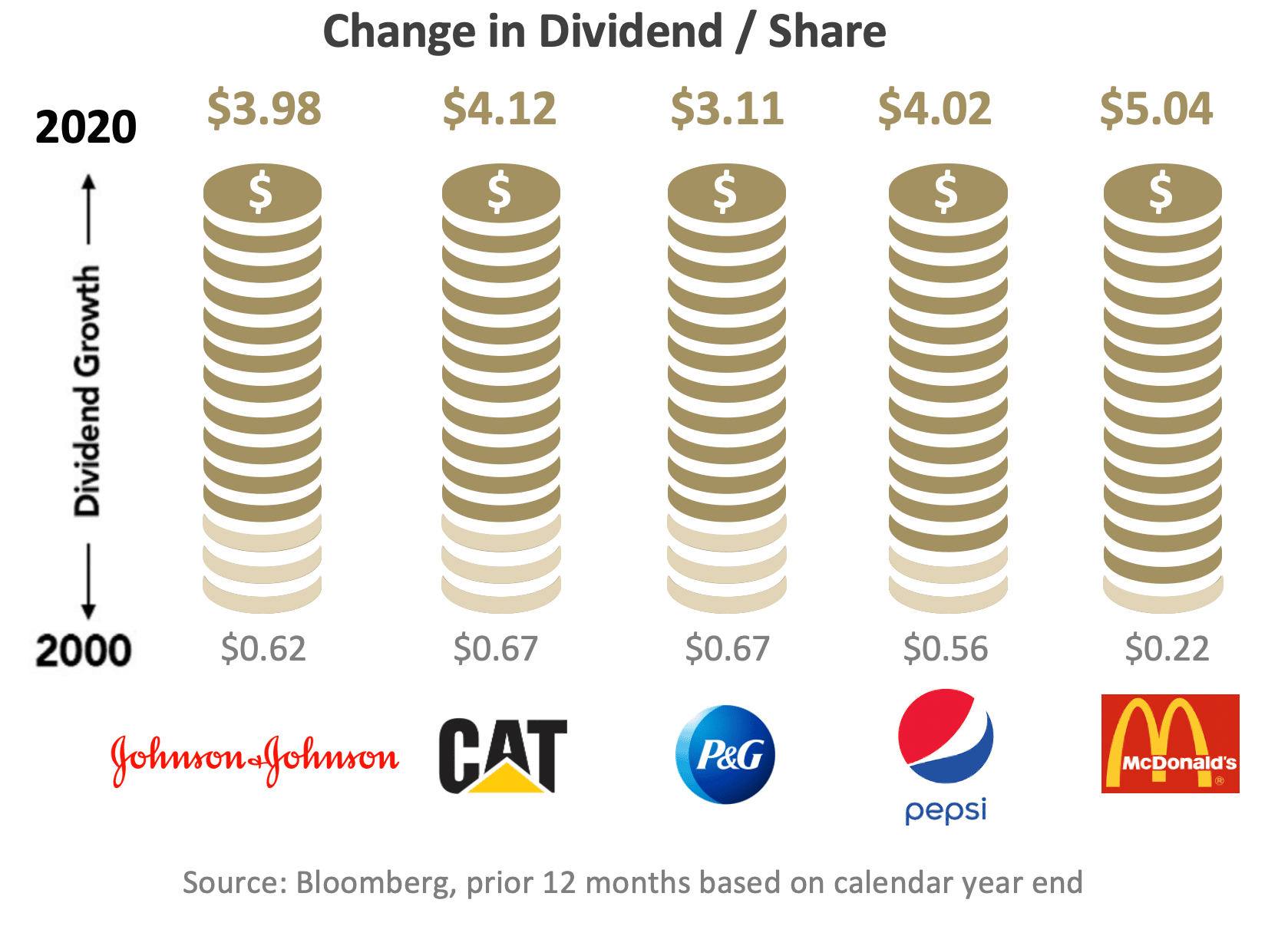

Global Brands can offer strong dividend growth

Strength of global brands

The Harvest Brand Leaders Plus Income ETF

The Harvest Brand Leaders Plus Income ETF is designed for financial advisors and investors looking for an ETF chosen from the world’s Top 100 Brands. It provides a consistent monthly income along with the opportunity for growth. Harvest uses an active covered call strategy to generate a competitive and tax efficient distribution stream.

• Globally diversified by sector and region;

• Chosen from a universe of the best global brands;

• Provides a dividend stream that has grown over time;

• Uses a covered call strategy to generates an additional income stream.

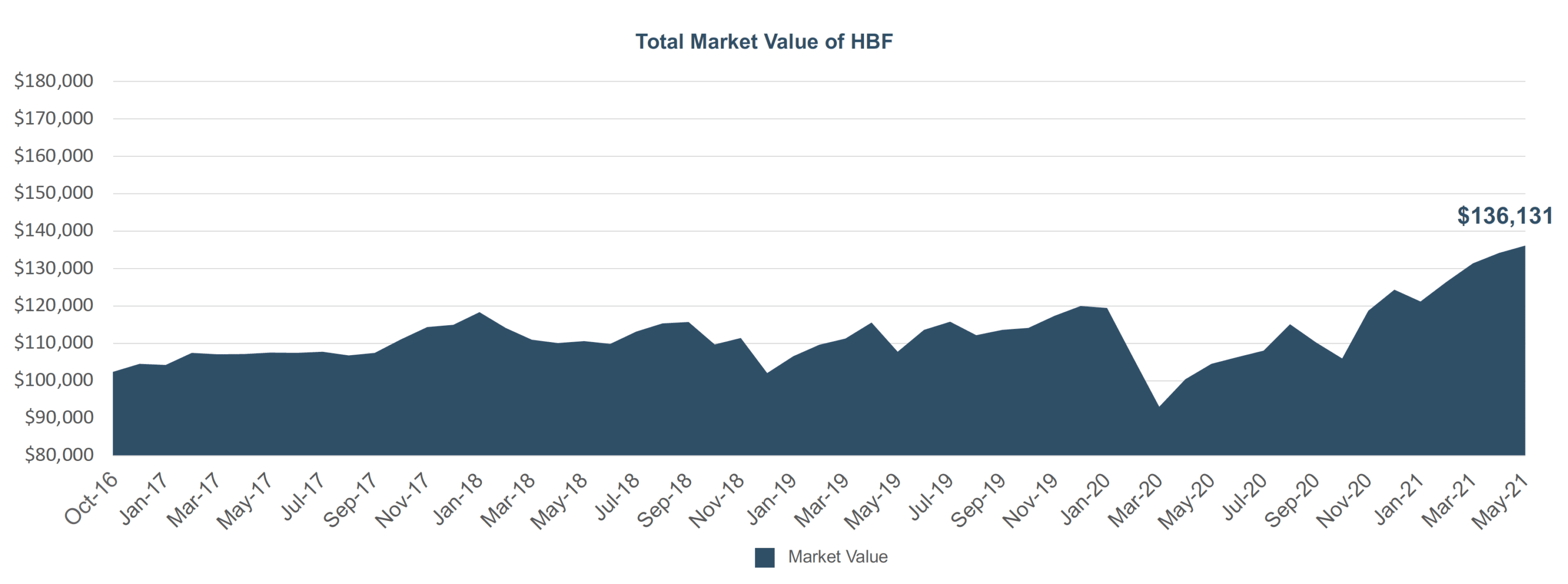

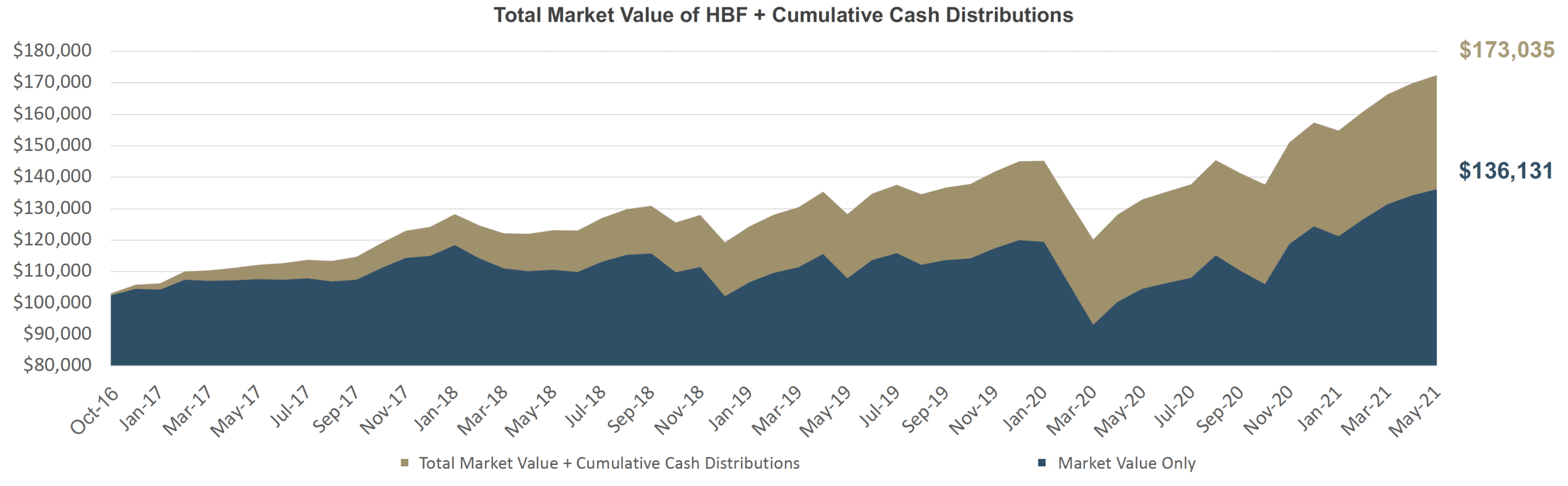

Illustrative Chart of the Market Growth + Distribution Chart

For illustrative purposes only. The chart above is based on a hypothetical initial $100,000 CAD investment and only shows the market value per unit of Harvest Brand Leaders Income Plus ETF (“HBF”) using the daily market close on the TSX and identifies the monthly cash distributions paid by HBF on a cumulative basis. The cash distributions are not compounded or treated as reinvested, and the chart does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder. The chart is not a performance chart and is not indicative of future market values of HBF or returns on investment in HBF, which will vary.