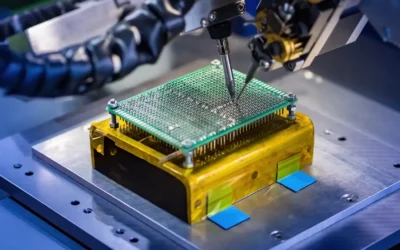

Companies that offer data centres for cloud computing and last mile delivery are one area of REIT growth.

BY ADAM MAYERS JUNE 2, 2020

Real Estate Investments Trusts (REITs) once the go-to products for investors looking for safety and high dividends have been hard hit by the coronavirus fallout.

The S&P/TSX Capped REIT Index is down by about 25 per cent year to date, more than double the approximately 11 per cent decline of the S&P/TSX Composite Index. Some REITs have cut dividends while others, particularly in the office and retail space, aren’t sure which of their tenants will be able to pay their rents.

But there are some opportunities amid the REIT rubble, including companies that cater to growth in the digital economy.

“It’s a huge mistake to think REITs are not the place to be,” says Sri Iyer, managing director of systematic strategies for Guardian Capital Group in Toronto. “We are most excited about specialized and industrial REITs.”

Mr. Iyer is lead portfolio manager of Guardian’s Global Equity Fund and Global Dividend Fund. His team uses sophisticated analytic techniques to find companies with high dividends and high dividend growth rates. The analysis also rates the sustainability of the dividends.

Mr. Iyer and Paul MacDonald, chief investment officer at Harvest Portfolios Group, Inc in Oakville, Ont., say REITs that offer data centres for cloud computing are one area of growth. These companies provide facilities with high speed data and communications links. Their clients include the biggest tech companies such as IBM, Facebook, Amazon and Microsoft, as well as banks, insurers, energy and healthcare firms.

A second area is REITs that own warehouses and storage for so-called last mile deliveries of goods. As online shopping expands these facilities are in demand.

Mr. Iyer says the coronavirus has accelerated trends that were underway, “hastening a global transformation in the way we live and work.” The phrase coined to capture this, that ‘Big Data is the new big oil,’ is apt, he says. Just as oil drove every aspect of the industrial economy, cloud-computing and data storage are driving the new one.

Mr. MacDonald agrees with the thesis, joking that: “the cloud isn’t really up in the sky. It’s down here, physically stored.”

Canada does not have players focused on this space exclusively. One REIT both portfolio managers like is Digital Realty Corp (NYSE: DLR), the “global gorilla” as Mr Iyer calls it. Digital Realty is a holding in Guardian’s Global Equity Fund as well as the Horizons ETFs Canada (Management) Inc. Active Global Dividend ETF (TSX:HAZ) and Active US Dividend ETF (TSX:HAU) which Guardian sub-advises for Horizons. Harvest’s Global REIT Leaders Income ETF (TSX: HGR) also holds the stock.

Digital Realty has about 21 per cent of the global market share for data centres. Its properties include two Toronto area facilities in Markham and Vaughan. It recently acquired Netherlands-based InterXion to become the second largest European data provider.

The shares are up 14 per cent year-to-date on strong earnings and it raised its dividend in March for the 15th consecutive year. The annual rate yields 3.24% at the current price of US $138.

“It’s not just Amazon and Google who need these facilities,” Mr. MacDonald says. “Every company has to store data somewhere.” CoreSite Realty Corp. (NYSE:COR) is another REIT both hold. CoreSite is U.S. focused and much smaller than Digital realty with a market capitalization of US $9 billion versus $36 billion. Its customers include Walt Disney, Apple, Comcast, Microsoft and Verizon.

Other specialty REIT players include Crown Castle International Corp. (NYSE:CCI) and American Tower Corp. (NYSE:AMT). They capture the Internet of Things (IoT) which is the inter connectivity of devices with phones and computers via the Internet.

Houston-based Crown Castle is one of the largest U.S. wireless tower companies with over 40,000 towers and approximately 80,000 route miles of fiber optic cable. Boston-based American Tower is the largest global owner and operator of wireless and broadcast communications towers.

“If data is the new oil, they are the pipeline,” Mr Iyer says. A second growth area is so-called last mile warehouses, which are where goods ordered online or shipped between factories are stored prior to delivery. In Canada, the exclusive public players have been acquired or taken private.

Mr. Iyer likes Stag Industrial Inc. (NYSE:STAG) whose model is single tenant properties. Customers include Fedex, UPS and online retailers like Amazon and WalMart. Stag operates across the U.S., but has many properties in middle America. The company will benefit from the repatriation of industry from China and other parts of Asia, he says. The dividend yields 5.7% at current prices and has been raised in each of the past 10 years.

A global player is Prologis Inc. (NYSE: PLD) which has been in business for 30 years, operates in 19 countries and has a $64 billion market cap. The dividend yields 2.65% at current prices.

When it comes to how to invest, both say diversity is best.

“If you’re looking for a one-stop solution, I recommend buying a basket,” says Mr. MacDonald. Mr. Iyer favours actively managed ETFs, though agrees some investors may prefer individual stocks.

This article appeared in the Globe Advisor section of the Globe & Mail’s Report on Business on June 1, 2020.