TFSAs rival RRSPs as a retirement vehicle

Published by Harvest Portfolios Group

Introduced in 2009, the Tax Free Savings Account (TFSA) enable Canadians who are 18 years of age or older to save and invest money tax-free during their lifetime – either for retirement or for any other purpose.

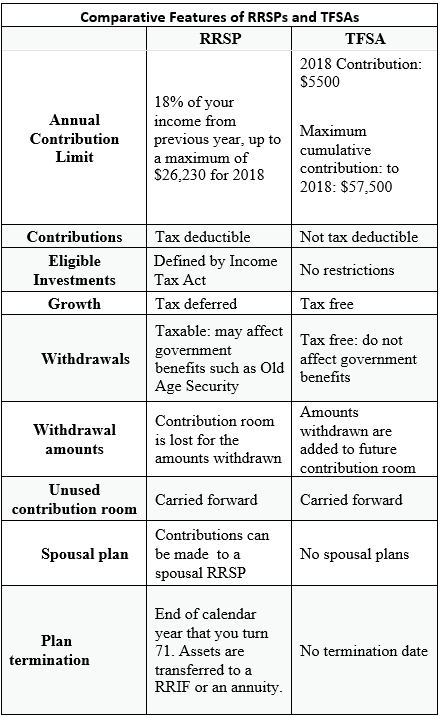

Contributions to a TFSA are not deductible for income tax purposes. However, any amount contributed as well as any income or capital gains generated in the account are tax-free, even when withdrawn.

An individual can contribute up to their TFSA contribution room. Unused TFSA contribution room can be carried forward to later years. The total amount of TFSA withdrawals in a calendar year is added to the TFSA contribution room for the next calendar year. The chart below shows the cumulative contribution limits of TFSAs since 2009.

Year TFSA Annual Limit TFSA Cumulative Limit

While TFSAs are not specifically designed to save for retirement, they have now become an important retirement tool because of their flexibility as a savings and investment vehicle, as well as the potential tax savings they offer.

Deciding whether you should invest in an RRSP or a TFSA should be based on your personal investment objectives. Your advisor can help you decide which option is best.

For more information on Harvest Portfolios ETFs:

– Harvest Brand Leaders Plus Income ETF

– Harvest Global REIT Leaders Income ETF

– Harvest Banks & Buildings Income ETF

– Harvest European Leaders Income ETF

– Harvest Energy Leaders Plus Income ETF

– Harvest Global Resource Leaders ETF

– Harvest Healthcare Leaders Income ETF