Getty Images

Technology stocks with even the subtlest hint of an edge in artificial intelligence (AI) have received intense attention among investors of late. But while AI holds vast potential for the broad technology sector, health care is another industry that stands to gain comparable rewards from this emerging theme.

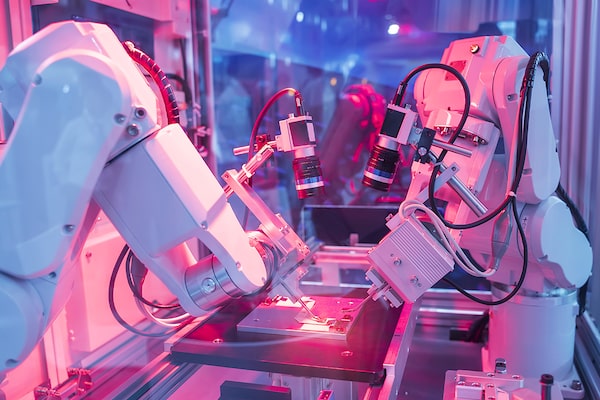

AI-fuelled advances in areas such as robotics and personalized therapies are expected to reshape the global health care industry.

“Few sectors will benefit as much from AI as health care will, once it’s really embedded,” says Craig Baun, senior wealth advisor and portfolio manager with Baun & Pate Investment Group at Wellington-Altus Private Wealth Inc. in Calgary.

The technology and health care spaces are entwined in an “innovation wave,” says Paul MacDonald, chief investment officer and portfolio manager at Harvest ETFs in Oakville, Ont. He anticipates a tailwind that’s poised to deliver elevated returns for at least the next five to 10 years. “We’re talking about huge advancements in science that are driving growth over the medium and longer term.”

Harvest sees another connection between the health care and technology sectors. If investors want to build a portfolio around two pillars, these ones are solid bets. These core sectors have different growth profiles, so they balance each other out during times of volatility and strength.

With health care, Mr. MacDonald points to non-cyclical factors such as aging populations and gross domestic product growth in developing markets that are driving a disproportionate amount of spending to health care. The sector can perform well during difficult periods, but also offers exposure to innovation.

Meanwhile, technology tends to do better in a growth environment, but various large-cap players offer stability during down times.

Low exposure among Canadian investors

For Canadian investors, the challenge is gaining access to those sectors. About 40 per cent of the total market cap across U.S. equity indexes comes from technology or health care. Yet, many Canadian investors remain overweighted in Canadian investments and hold little to no exposure to either sector.

“From a Canadian perspective, they’re both areas outside our borders that are dominant in the broader economic system, yet domestic investors have relatively low exposure,” Mr. MacDonald says.

Delivering efficient, diversified and cost-effective access to those sectors is the central investment objective of Harvest Healthcare Leaders Income ETF HHL-T and Harvest Tech Achievers Growth & Income ETF HTA-T.

These two exchange-traded funds (ETFs) hold a relatively concentrated exposure to high-quality names across their respective fields.

Alphabet Inc., ServiceNow, Inc., Adobe Inc., Accenture PLC, and Micron Technology, Inc. comprised the top five holdings, in no particular order, in Harvest Tech Achievers Growth & Income ETF as of Sept. 29. This ETF includes 20 stocks of relatively equal weighting. Software represented the biggest subsector with a weighting of 34.3 per cent.

The top five holdings in the Harvest Healthcare Leaders Income ETF are Amgen Inc., Boston Scientific Corporation, UnitedHealth Group Inc., AbbVie Inc., and Novartis AG, in no particular order. Like Harvest Tech Achievers Growth & Income ETF, this fund offers relatively equal weighting across 20 names. Pharmaceuticals possesses the largest subindex exposure at 34.8 per cent as of Sept. 29.

“Canada’s health care sector really is non-existent in terms of the broader array of stocks,” says Andrew Pyle, senior investment advisor and senior portfolio manager with The Pyle Group at CIBC Wood Gundy in Peterborough, Ont. “Canada is mainly long-term care, which is fine. But you’re not getting a diversified play into all health care investments can offer.”

Mr. Pyle points to health care as one of the best recession-proofing tools an investor can use in the equity side of their portfolio. His preferred method for investing in the space is through ETFs.

Advertising feature produced by Globe Content Studio with Harvest Portfolios Group. The Globe’s editorial department was not involved.