Amid Apple’s steady performance trajectory, the Harvest Apple Enhanced High Income Shares ETF (APLE:TSX) presents a unique convergence of growth potential and high-income generation, tailored for investors to generate meaningful monthly income while maintaining exposure to one of technology’s most reliable performers. Current market conditions and Apple’s specific metrics create an especially favorable environment for this innovative structure that combines single-stock ownership with an active covered call strategy and modest leverage that aim to deliver enhanced returns and monthly cash flows.

Key Features of APLE

APLE combines three core elements to deliver enhanced monthly distributions:

Direct Exposure to Apple Inc

One of the FAANG (Facebook, Amazon, Apple, Netflix, and Google) stocks, Apple Inc. is a globally dominant technology leader with robust financials, innovation pipelines, and a $100B+ services segment.

Active Covered Call Strategy

Writing options on up to 50% of the portfolio to generate high yields, boosting tax-efficient monthly income while retaining partial upside.

Modest Leverage

Amplifies both income and capital appreciation potential, calibrated to balance risk and reward.

With a management fee of 0.40% and CAD-denominated distributions within a Canadian trust structure, APLE could appeal to income-focused investors amid elevated interest rates and market volatility.

Fundamentals Behind the APLE ETF

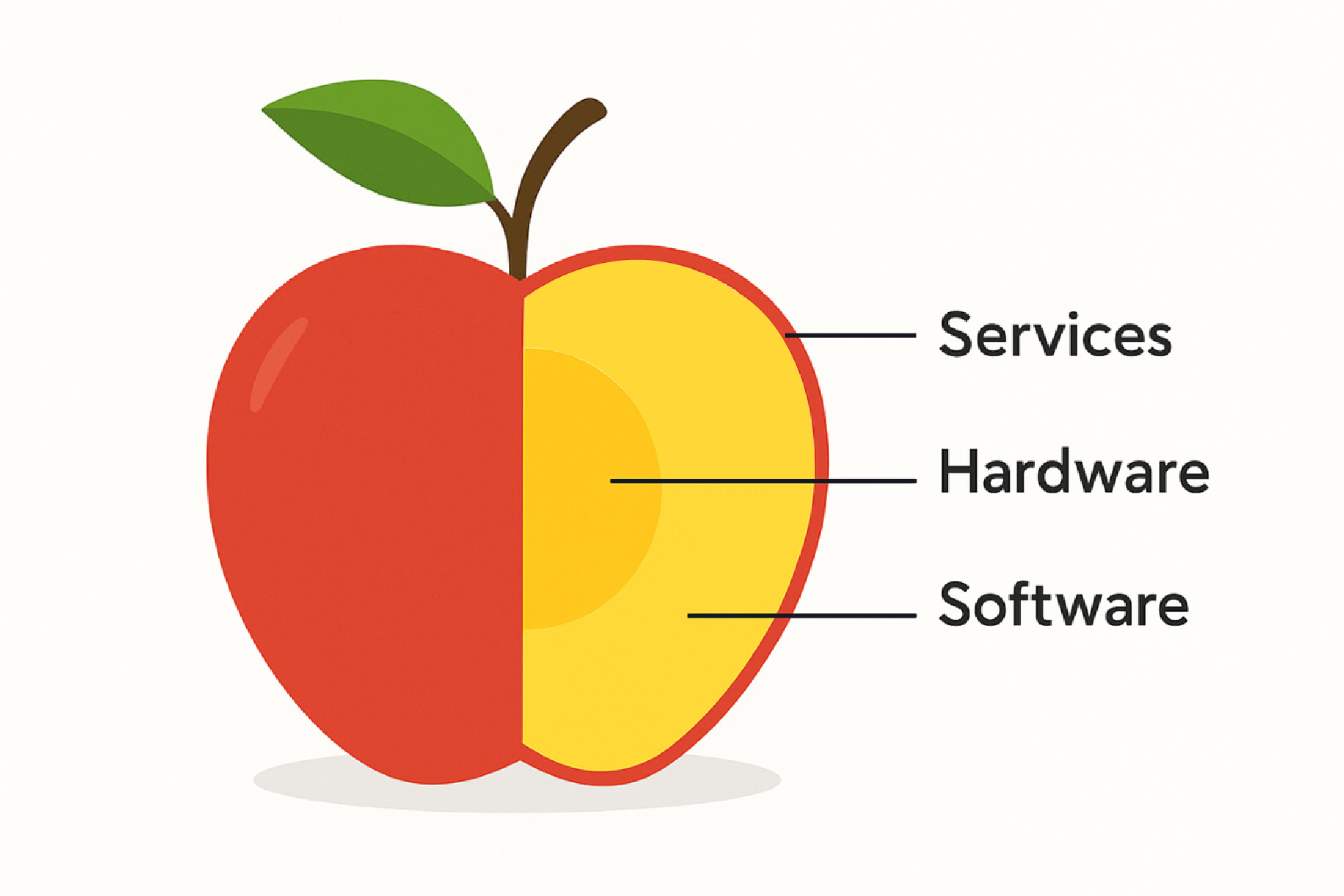

Apple’s $3tn market capitalization reflects its entrenched ecosystem of hardware, software, and services.

The key pillars for Apple’s growth and success include:

iPhone Growth

Despite macroeconomic headwinds, iPhone revenue grew 5% YoY in Q2 2025 to USD $46.8Bn, outperforming expectations with record install base and upgraders.

Services Growth

The ~USD $100B/year services segment hit an all-time revenue record with 12% growth YoY to $26.6Bn, momentum across all categories, and ongoing global expansion, providing stability amid hardware cycles.

Global Production Diversification

Recent strategic shifts of iPhone assembly to India and non-iPhone manufacturing to Vietnam as well as the domestic sourcing of 19bn chips in 2025 mitigate tariff risks under U.S.-China trade tensions.

Apple’s balance sheet remains a fortress, with USD$24Bn in operating cash flow (Q2 2025) funding $29B in shareholder returns via dividends and buybacks.

Enhancing Apple’s Modest Dividend Yield

Apple’s trailing dividend yield of approximately 0.50% ranks relatively low compared to broader market averages. This modest yield, while growing consecutively for 14 years, could leave income-oriented investors wanting more. The recent 4% dividend increase to $0.26 per share continues Apple’s pattern of steady dividend growth.

Through a covered call strategy such as APLE, investors can potentially multiply their effective yield several times over, while enjoying monthly cash distributions.

Additionally, Apple delivered 2.6% of equity share buybacks in the 12 months ended March 31, 2025, compounding total shareholder yield further.

This approach aims to transform Apple from a growth-focused holding with minimal income into a potentially substantial yield-generating asset while maintaining exposure to the company to capture potential growth.

APLE’s Income-Generation Mechanics

APLE writes call options on up to 50% of its Apple holdings, targeting:

Monthly Premiums

Harvest ETFs’ expert options management team dynamically selects strike prices to balance income and participation in the potential upside.

Volatility Capture

Apple’s 30-day volatility is at 27%, which is good for generating high option premiums.

APLE employs 25% leverage to:

- Boost Distributions: Leverage amplifies dividend income and option premiums

- Enhance Total Returns: The use of modest leverage to achieve higher total return, albeit at slightly higher risk

Further, Apple’s options market currently presents an exceptional opportunity for covered call writers such as Harvest ETFs. An average implied volatility of 26% over the past 3 years, combined with relatively strong option liquidity creates a fertile ground for option income generation. This implied volatility environment creates a particularly advantageous entry point for covered call strategies, as premium income is directly correlated with volatility expectations.

A Strategic Fit for Investor Portfolios

APLE is an ETF for:

- Income-Focused Investors: Seeking tax-efficient, monthly income to replace bond coupons in a “higher for longer” rate environment.

- Growth-Income Balancers: Willing to accept medium-high risk for high monthly income coupled with Apple’s innovative growth potential.

- Canadian Taxpayers: Distributions optimize after-tax returns vs. U.S.-listed ETFs.

Your Dual-Engine Investment

APLE offers a synthesis of growth and income, by combining Apple’s entrenched ecosystem and Harvest’s income generation approach. For investors prioritizing monthly cash flows without sacrificing tech exposure, APLE’s income and growth approach is compelling. Further, the benefits of the active management of APLE and the fundamental strength of its investment holding (i.e. Apple stock), are catalysts for APLE to potentially do well in both volatile and sideways markets, allowing it to achieve its investment objectives of providing monthly income and growth participation.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.