By Ambrose O’Callaghan

Harvest is happy to announce the launch of five new single-stock Harvest High Income Shares ETFs, and a diversified High Income Shares ETF that we will cover in a second piece.

“These are exciting, widely held companies,” said Michael Kovacs, President and CEO of Harvest. “Through our underlying covered call options strategies, [we] can deliver high levels of monthly income for investors.”

Five NEW US Stocks

MicroStrategy. The company was known for providing business intelligence, mobile software, and cloud-based services, developing into a Bitcoin-proxy due to its substantial holdings in the world’s premier digital currency.

Coinbase. Operating one of the largest cryptocurrency exchange platforms on the planet, and the largest in the United States in terms of volume. It is consistently ranked as the safest crypto exchange.

Palantir. This company specializes in software platforms for big data analytics, with customers that include the US Intelligence Community and US Department of Defense.

Tesla. A multinational automotive and clean energy company that designs, manufactures, and sells battery electric vehicles (BEVs), as well as other related products and services.

Meta. An Information Technology company that owns and operates Facebook, Instagram, Threads, WhatsApp, and other products and services.

These five stocks are well known and sought after by North American investors. They possess very deep and liquid option markets, which makes them ideal to pair with Harvest’s active covered call writing strategy. Further, the level of volatility that accompanies the share prices is high. That makes these stocks a fantastic target for Harvest’s covered call writing strategy.

The Harvest Approach – Strong and Consistent Income Every Month

Harvest has established a proven track record of income generation. Indeed, the company celebrated 15 years of business in 2024.

Over that period, Harvest has pursued an active covered call writing strategy that is focused on generating high income, every month, for investors in its Income ETFs. Harvest has generated over $1 billion in total monthly cash distributions since launching its stable of Income ETFs in 2016.

In 2024, Harvest first launched Harvest High Income Shares. This innovative product line is focused on investing in shares of a single company, targeting the largest, widely held US stocks. An additional five single stock ETFs have debuted in 2025, as well as a one ticket diversified solution; The Harvest Diversified High Income Shares ETF (HHIS:TSX). For more on this innovative new product, check out our second insights piece on the January 2025 launch. Harvest covered call ETFs offer distinct advantages to investors who are hungry for income-oriented investment products. The premium from covered call writing can be treated as capital gains. This means the high income that Harvest High Income Shares ETFs seek to provide can be regarded as tax efficient income.

In addition,Harvest High Income Shares ETFs are organized as Canadian Trust Units. As open-end mutual funds listed on the TSX, they provide trading and reporting flexibility for Canadian investors.

Harvest High Income Shares: Innovation and Higher Monthly Income

The covered call strategy used for the Harvest High Income Shares ETFs will operate with up to a 50% write level. Harvest’s portfolio management team has stress tested these equities with an average 2-year implied volatility. The team found that they can produce high levels of income at much lower write levels. Therefore, a 50% write level, in their view, provides a conservative floor to ensure unitholders will be able to have reliable high-income generation every month.

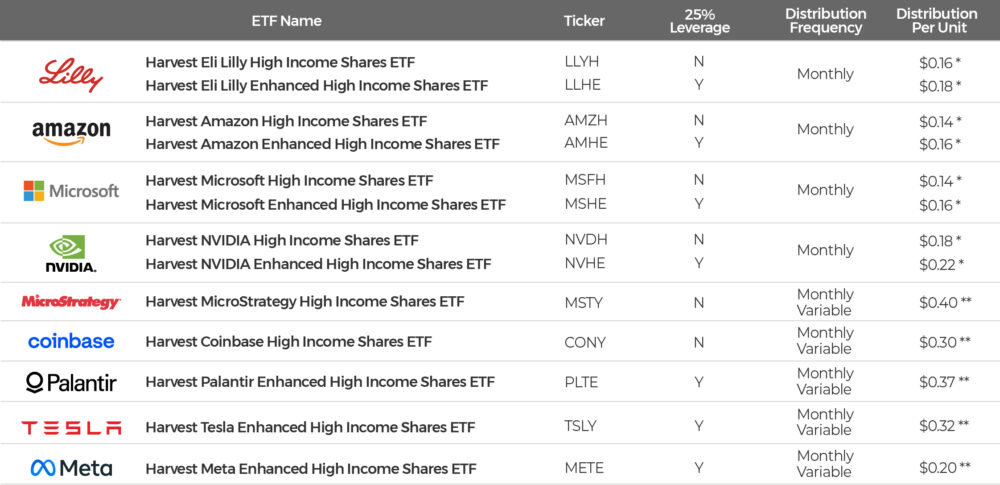

Harvest now offers single-stock ETFs representing nine US-listed companies. The monthly cash distributions for the five new ETFs are even more impressive. All five ETFs have been assigned risk rating of high.

The Harvest MicroStrategy High Income Shares ETF (MTSY:TSX) and the Harvest Coinbase High Income Shares ETF (CONY:TSX) will not utilize leverage. MSTY and CONY will pay a variable monthly distribution of $0.40 and $0.30, respectively.

The remaining three new single-stock ETFs aim to offer even higher levels of income and growth potential by employing modest leverage on top of a covered call strategy. The Harvest Palantir Enhanced High Income Shares ETF (PLTE:TSX), the Harvest Tesla Enhanced High Income Shares ETF (TSLY:TSX), and the Harvest Meta Enhanced High Income Shares ETF (METE:TSX) have announced a variable monthly cash distribution of $0.37, $0.32, and $0.20 per unit.

Harvest Single Stock ETFs

*Most recent distribution and USD series are available. For each fund offered in USD the distribution per unit is in USD.

**Announced distribution payable on March 7, 2025 with record date as of February 28, 2025.

Source: Harvest Portfolios Group, Inc., January 2025.

For investors looking for an all-in-one solution, Harvest now has the Harvest Diversified High Income Shares. It invests in all the single stock ETFs with a biased towards those the use leverage to enhanced monthly income and potential growth. HISS risk rating is also high.

Summary

Each Harvest High Income Shares ETF invests in a top US stock and overlays an active and flexible covered call strategy on the portfolio holding up to 50%. Investors now have nine widely held stocks from which they can get exposure at a lower price point relative to owning the stocks directly, namely Eli Lilly, Amazon, Microsoft, NVIDIA, MicroStrategy, Coinbase, Palantir, Tesla, and Meta.

These ETFs are focused on generating high monthly income that is tax efficient, while providing exposure to the upside of the individual stock. These are Canadian securities,.

Harvest ETFS is happy to bring these products to market. These will offer investors the opportunity to hold an exciting stock like Microsoft in Canadian dollars, taking advantage of a more friendly price point.

Learn more about these new innovative products and get crucial market insights by subscribing to our newsletter.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest High Income Shares ETFs (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this article is to inform and educate and therefore should not be taken as investment, tax, or financial advice. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A and Class U units of the Fund. If the Fund earns less than the amounts distributed, the difference is a return of capital.