By Ambrose O’Callaghan

On January 16th, Harvest ETFs unveiled five new single-stock ETFs which are now trading on the TSX. This round of single stock ETFs covers MicroStrategy, Coinbase, Palantir, Tesla, and Meta. These are added to the Harvest High Income Shares ETFs lineup that already covers Eli Lilly, Amazon, Microsoft, and NVIDIA. Moreover, Harvest has launched an all-in-one solution that will provide exposure to the 7 Harvest Enhanced High Income Shares ETFs and the Harvest MicroStrategy High Income Shares ETF and Harvest Coinbase High Income Shares ETF.

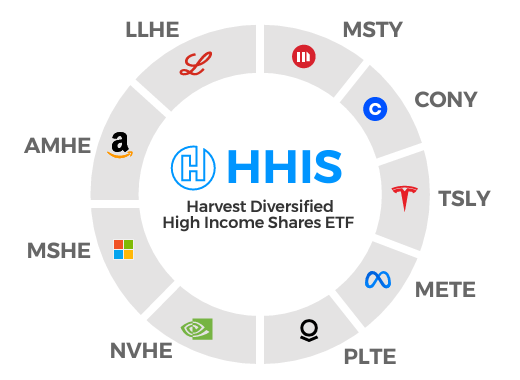

The Harvest Diversified High Income Shares ETF

The Harvest Diversified High Income Shares ETF (HHIS:TSX) – our all-in-one solution for investors that want to invest in all of the Harvest Single Stock ETFs – is designed to provide unitholders with high monthly cash distributions and the opportunity for capital appreciation, on a levered basis. HHIS holds Harvest Single stock ETFs that (i) invest in single equity securities, and (ii) engage in covered call strategies. In using leverage, HHIS can do so directly, or indirectly by investing in Harvest Singlet Stock ETFs that use leverage.

The initial leverage ratio will therefore be in the range of 20 – 25% of the net asset value of HHIS. HHIS has a risk rating of high and is designed to provide the benefits of diversification and the convivence gain exposure at lower price point to top and well-favoured stocks by investors, while enjoying monthly cash distributions. The chart below shows the initial composition of HHIS.

As the chart below illustrates, the Harvest Diversified High Income Shares ETF will have an initial distribution per unit of $0.25.

All-In-One Solution: Basket of Single Stock ETFs

**Announced distribution payable on March 7, 2025 with record date as of February 28, 2025.

Source: Harvest Portfolios Group, Inc. January 2025.

Harvest High Income Shares ETFs invest in single top US stocks. These are overlayed with an active and flexible covered call writing strategy on the portfolio of holdings up to 50%.

Investors will now have nine top US stocks to choose from, available in levered and non-levered varieties.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest High Income Shares ETFs (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this article is to inform and educate and therefore should not be taken as investment, tax, or financial advice. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A and Class U units of the Fund. If the Fund earns less than the amounts distributed, the difference is a return of capital.