Harvest High Income Shares™ have been a tremendous success, raising over $2.5 billion in just one year since its launch. Canadian investors have embraced this innovative product suite with enthusiasm. Harvest ETFs remains committed to meeting the strong and growing demand for High Income Shares™.

Today, we are excited to add to this innovative suite with the launch of the Harvest High Income Equity Shares ETF (HHIH:TSX). This ETF provides unlevered access to the growth potential of a portfolio of the same leading and trending US stocks held in the underlying ETFs within the Harvest Diversified High Income Shares ETF (HHIS:TSX). It overlays an active covered call strategy designed to generate high monthly income.

HHIH | The Harvest High Income Equity Shares ETF

HHIH is our all-in-one solution that invests directly in the equities that are represented in our Harvest single stock ETF suite. It offers monthly cash distributions while providing the opportunity for capital appreciation. HHIH provides exposure to the same top US stocks as HHIS. Unlike HHIS, HHIH does not use or have exposure to leverage.

Access the growth of leading US stocks

The underlying U.S. securities and the investment themes to which investors are expose when they access HHIH and HHIS are compelling and attractive.

GLP-1/Weight Loss Drugs | Eli Lilly

It is hard to miss the story that GLP-1s/weight loss drugs have become in recent years. The rise of GLP-1s like Ozempic, and their revolutionary results in delivering weight loss, has consumers and investors excited.

Eli Lilly, in its recent earnings report, reported revenue growth of 38% to US$15.56 billion. That was driven by volume growth from GLP-1s Zepbound and Mounjaro.

The Global Anti-Obesity Medication Market May Touch $120 Billion by 2035

Source: Goldman Sachs Research, 2025.

Next-Gen Currencies/Bitcoin | MicroStrategy & Coinbase

PricewaterhouseCoopers (PwC) recently projected that the cryptocurrency and blockchain space “has the potential to boost global economic output by US$1.76 trillion by 2030.”

The rise of digital currencies like Bitcoin and Ethereum has spread far beyond retail investors, with spot crypto ETFs launching and institutional investors jumping in.

MicroStrategy, now rebranded as “Strategy”, has quickly developed into a Bitcoin treasury proxy, with over US$70 billion in total Bitcoin holdings among its vast hoard.

Coinbase is the largest Bitcoin custodian on the planet, and the largest US based cryptocurrency exchange. It currently boasts over 100 million users at the time of this writing.

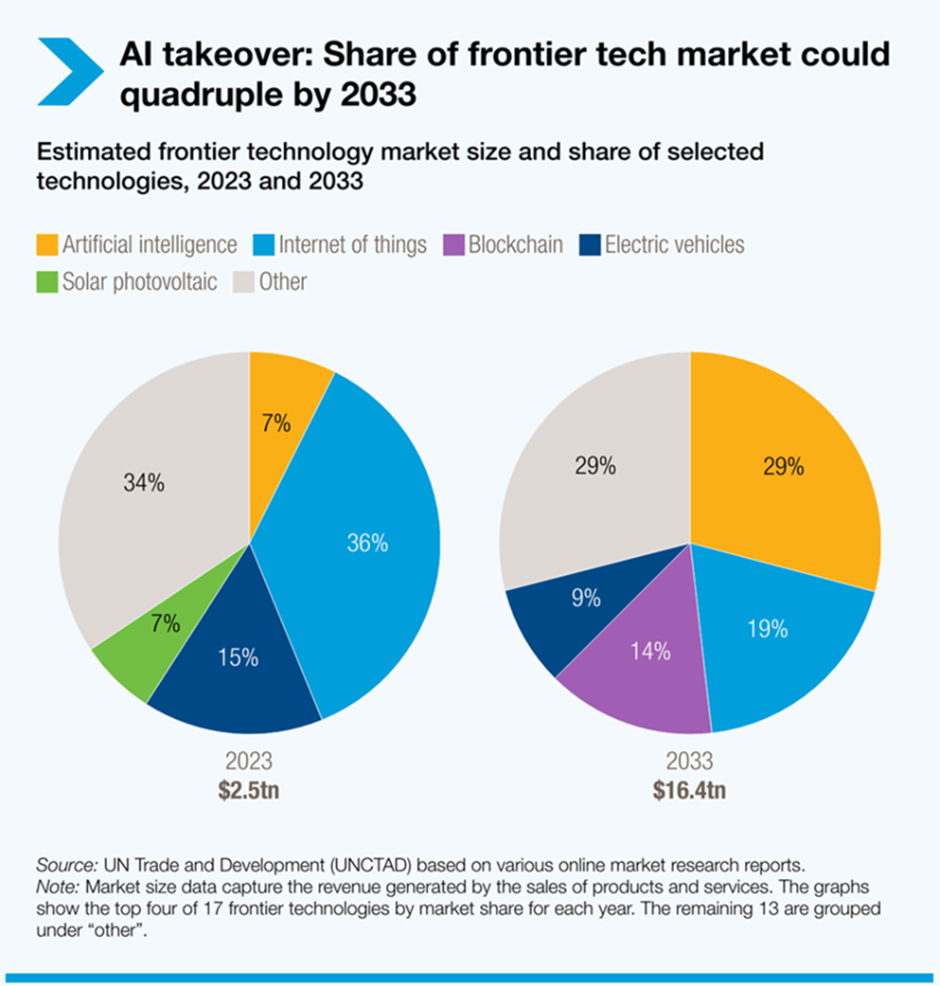

Artificial Intelligence Development | Palantir, Microsoft, & Apple

The development of artificial intelligence in the form of large language models (LLMs), generative models, deep learning models, and more, has applications in a broad array of industries. Going forward, AI could have a transformative impact on how we work, dramatically improving efficiencies and challenging old processes.

Palantir’s AI platform works to incorporate generative AI and other AI technologies into the operations of the companies and governmental organizations they work with.

Microsoft developed Copilot, an AI companion that hopes to rival other LLMs like ChatGPT.

Apple has jumped feet first into the AI revolution. CEO Tim Cook recently said that Apple sees AI as “One of the most profound technologies of our Lifetime”. The company is “embedding it across our devices and platforms . . . significantly growing our investments,” according to Cook.

Chipmakers & Manufacturers | NVIDIA, AMD & Broadcom

In a recent piece, we’d discussed some of the sub-sectors in technology with strong growth potential. Semiconductors, often referred to as “chips”, are experiencing tremendous sales growth due to the demand spurred by AI and software development. Deloitte recently predicted that “generative AI chips will be over US$150 billion in 2025”.

NVIDIA built a reputation as one of the leading manufacturers and sellers of graphics processing units (GPUs) over its history. However, their crucial role in powering generative AI made NVIDIA one of the most exciting growth stories of the 2020s.

AMD and Broadcom are two of the leading semiconductor manufacturers on the planet.

Monthly income from a well-established strategy

Harvest ETFs has an experienced investment management team that oversees and implements its well-established active and flexible covered call strategy. Since 2016, Harvest ETFs paid out nearly $1.5 billion in total monthly cash distributions, supported by its covered call strategy, to unitholders of Havert investment products.

HHIH will employ this active covered call writing strategy to deliver high monthly cashflows to its unitholders.

*On August 19th, HHIH announced an initial distribution per unit of $0.185 payable on October 9th to unitholders on record as at September 29th, 2025.

Source: Harvest Portfolios Group, Inc. August 2025.

How to add HHIH to your portfolio

HIHH is the timely unlevered version of HHIS, which provides a compelling way to invest in top industry leaders. It’s design to pay high monthly cash distributions supported by a proven covered call writing strategy.

Investors can access HHIH through their online brokerage, or by asking their investment advisor.

Disclaimer

The content of this article is meant to provide general information for educational purposes and should not be construed as investment advice. Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into available class units of the Fund. If the Fund earns less than the amounts distributed, the difference is a return of capital. Tax investment and all other decisions should be made with guidance from a qualified professional.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.