Canadian do-it-yourself (DIY) investors have more options than ever to fine tune their portfolios.

Single stock ETFs are the latest innovation, making it easier than ever to tap into global markets and invest in big-name stocks. These investment vehicles now represent another part of the investor toolkit, alongside direct stock ownership and Canadian Depository Receipts (CDRs).

Let’s break down these investment vehicles to give you a better understanding.

Direct stock ownership | Acquiring shares in a specific company. When you purchase Apple or Microsoft stock, you become a fractional owner of that corporation with voting rights and direct claim to dividends.

Single stock ETF | Full exposure to specific company shares through an exchange-traded fund (ETF). Issuers like Harvest ETFs are listed on the TSX, and invest in the shares of a single, often high-growth, stock (ex. NVIDIA, Amazon, or Tesla). In Canada, these ETFs have additional features such as covered call strategies to generate cashflow, and modest leverage to enhance income and growth potential.

CDR | Offer access, in Canadian dollars, to foreign companies that are not directly listed on a Canadian exchange. They come with built-in currency hedging to CAD. Typically, CDRs underlying shares are of U.S. corporations, such as Tesla and Microsoft.

The following table captures some additional key differences of the three product structures:

Key Differences

|

Feature |

Direct Stock Ownership |

Single-Stock ETFs |

CDRs |

|

Key Feature |

Direct ownership, voting rights, potential for dividends. |

High monthly income, exposure to performance, tempered risk profile. |

Access to U.S. stocks with built-in currency hedging. |

|

Income Potential |

Depends on company dividends. |

Enhanced via covered call premiums. |

Depends on underlying company dividends. |

|

Leveraged Exposure |

None, or responsibility of investor |

None or built-in 25% modest leverage. |

None or responsibility of investor |

|

Volatility |

Exposed to full price swings. |

May have reduced volatility due to option overlay, though leverage may increase |

Mirrors underlying stock. |

|

Fractional Shares |

Depends on broker. |

Depends on broker, generally lower price per share as well |

Limited availability |

|

Currency Exposure |

Direct exposure to the currency of the stock’s listing (e.g., USD for U.S. stocks). |

Exposure to the underlying stock’s currency, with potential for currency-hedged versions. |

Currency-hedged to the Canadian dollar. |

|

Foreign Property Considerations |

Canadian property, structured as a mutual fund trust. |

Foreign property, may require additional reporting. |

Access to U.S. stocks with built-in currency hedging. |

|

Typical Cost Profile |

Per trade commissions, depending on the brokerage firm. Currency conversion fees for U.S. stocks. |

Management Expense Ratio (MER) & per trade commissions, depending on brokerage firm. |

No direct management fee, but an embedded currency hedging cost. Trading commissions depending on brokerage. |

|

A potential fit for |

Long-term investors with high conviction in a specific company and a tolerance for volatility. |

Yield-focused investors who are looking to participate in the long-term growth of market leading companies. |

Investors seeking exposure to specific U.S. companies without the hassle of currency conversion. |

Built-In Income. Built-In Growth. Built for You?

Since 2024, Harvest High Income Shares have expanded the income investing landscape. These single stock ETFs offer investors more opportunities for high monthly income through exposure to global industry leaders. The ETF suite harnesses the power of growth focused investing in top companies, while also providing enhanced, tax efficient distributions supported by an active covered call strategy. High Income Shares seek to provide high monthly income with capital appreciation opportunities from a single stock.

Through this suite, investors can access sectors and companies that are largely absent from domestic indexes. High Income Shares target growth themes in technology, artificial intelligence (AI), media, healthcare, and consumer services. The ETF suite currently has 15 U.S. stocks in its lineup, including names like Apple, NVIDIA, Microsoft, Amazon, and Eli Lilly.

“Harvest High Income Shares are designed to give investors access to world-class businesses with long-term upside potential with attractive monthly distributions. With High Income Shares, investors can tap into the strength of sectors like healthcare, technology, financials, and consumer goods – all while unlocking attractive monthly cash flows from premium global enterprises.”

Chris Heakes, CFA

Portfolio Manager and co-manager on Single Stock ETFs

The aggregate market capitalization of the underlying stocks held by the Harvest High Income Shares ETFs represents over USD$20 trillion. That is several times larger than the size of the entire S&P/TSX Composite Index. This dramatic difference illustrates how the global reach of companies in the Harvest High Income Shares suite portfolio dwarfs the Canadian market.

Market Capitalization of HHIS Underlying Stocks VS S&P/TSX Composite

Source: Harvest ETFs, Bloomberg as at June 30, 2025. Illustration of the total consolidated market capitalization of the stocks that are represented within the Harvest Diversified High Income Shares ETF versus the total index value of the S&P/TSX Composite Index.

Key Benefits of Harvest High Income Shares

- Monthly Income | Enhance monthly cash distributions from large-cap companies with strong earnings potential

- Access Growth Potential | Participate in the capital appreciation of leaders like Apple Inc, Strategy, Eli Lilly, or NVIDIA – companies driving long-term global growth

- Accessibility | More affordable entry points with lower unit prices relative to the individual equity securities. This enables portfolio diversification with lower capital requirements.

- Risk Mitigation | An actively managed covered call strategy providing a measure of downside protection through monthly cashflow that can also reduce market volatility

- Currency Flexibility | Canadian trust unit trading on the TSX, available in CAD or USD (on select tickers)

- Tax Efficient | The strategy is designed to optimize tax treatment of monthly income

- Enhanced Series Available | Enhanced High Income Shares with 25% leverage to generate higher levels of income and growth potential

An Innovation in Income ETFs: HHIS

The Harvest Diversified High Income Shares ETF (HHIS:TSX) offers investors a one-ticket solution to participate in the performance of dominant global powerhouses, while collecting monthly income. HHIS utilizes a fund-of-fund structure, holding a diverse mix of the underlying Harvest High Income Shares ETFs. The overall mix of company exposure is selected for their market leadership and relevance to long-term investment themes, such as technology, healthcare, and consumer services.

HHIS generates monthly cashflows through the covered call strategy. It employs modest leverage at approximately 25% to enhance income and growth potential.

“HHIS represents the natural evolution of conventional income investing by combining income generation with upside opportunity capture. We’re moving beyond the traditional product lens to offer investors a new way of thinking about building diversified, income-focused portfolios– it’s architecting a framework to wealth building that acknowledges today’s complex market dynamics.”

Avinash D’Souza, CAIA, FRM

Vice President, Product Strategy

Portfolio Uses for HHIS

Harvest High Income Shares ETFs offer a powerful blend of income generation, risk reduction, and tax efficiency. This innovation brings institutional-grade strategies to the portfolios of everyday Canadians.

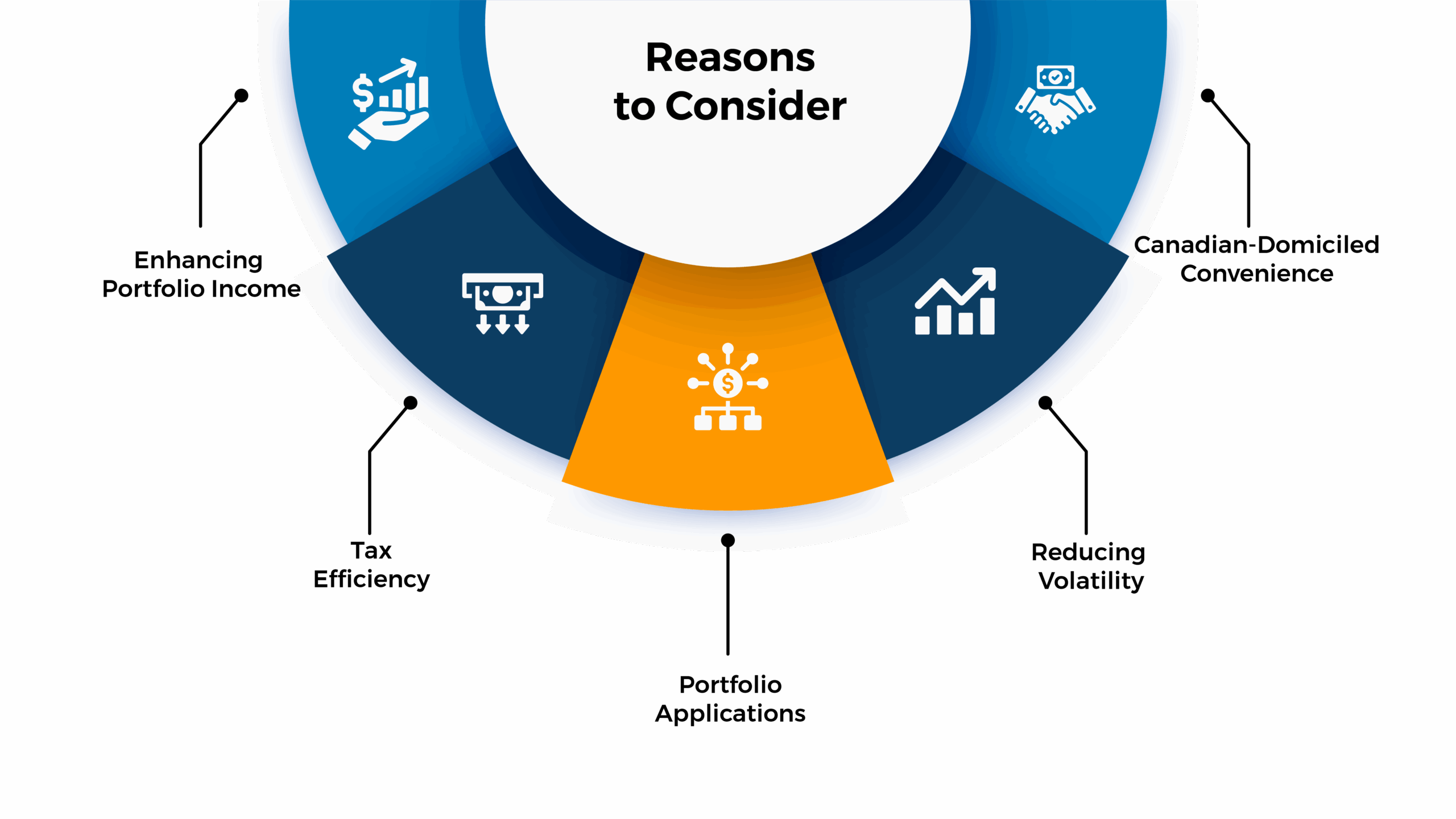

Enhancing Portfolio Income

The covered call strategy aims to monetize the volatility of these stocks, providing cash flows even in sideways markets. This is attractive to investors seeking a high income stream, in addition to growth exposure. High Income Shares can be used to diversify income streams beyond traditional fixed income, which may offer lower yields or higher interest rate sensitivity.

Reducing Volatility

The premium generated from selling covered calls acts as a buffer against moderate price declines in the underlying stock. This can help to smooth out returns and reduce portfolio volatility, relative to holding the individual equities directly. By generating income while retaining exposure to growth, these ETFs can potentially offer better risk-adjusted returns compared to simply holding the volatile underlying stock.

Canadian-Domiciled Convenience

Harvest High Income Shares ETFS are Canadian-domiciled ETFs. That means they are readily available for Canadian investors to integrate into their portfolios. They are eligible in registered accounts (RRSPs, TFSAs, etc.). Moreover, while they invest in US companies, High Income Shares are priced in Canadian dollars. This has the effect of simplifying currency management for investors.

Tax Efficiency

For Canadian investors, income from covered calls is typically treated as capital gains. Capital gains are more tax efficient than interest income or eligible dividends in non-registered accounts. This provides an advantage for strategic tax planning to optimize portfolios and improve after-tax returns. Harvest High Income Shares ETFs are income-oriented and potentially less volatile alternatives to direct stock ownership for tax-advantaged accounts.

Portfolio Applications

Harvest High Income Shares ETFs are not only limited to a core long-term holding approach but may also be used as a part of tactical trading strategies. For investors who want concentrated exposure to a specific growth stock but also require income, these ETFS bridge a unique gap that traditional growth stocks or broad-market ETFs cannot.

Institutional-Quality Strategies for Retail Investors

Single stock ETFs bring options-based income and risk management strategies, typically used by institutions, to everyday investors in a transparent, easy-to-access format.

Conclusion

Each investment vehicle can play a role in a diversified portfolio.

Individual stock ownership offers a straightforward approach, but involves extensive company research as well as foreign markets. It also often lacks income desired by investors. CDRs, meanwhile, simplify access to U.S. giants with built-in currency hedging. However, they offer limited strategy flexibility. There is significant debate around the efficacy of currency hedging for equity.

Single stock ETFs stand out as the most versatile and accessible tool for today’s DIY investor.

Harvest ETFs offers a comprehensive range of single stock ETFs in Canada in the form of Harvest High Income Shares. They offer:

- Exposure to high-performance, industry-leading companies

- Consistent monthly income through covered calls

- Built-in leverage (in select ETFs) to enhance income and growth

- The convenience of a single TSX-listed product

For investors who want more than just market exposure, Harvest High Income Shares offer a compelling way to invest in industry leaders. These ETFs focus on growth potential and enhanced income generation. The advantages of monthly cash flows and potential to boost total return has pushed them into the spotlight. High Income Shares are quickly becoming the go-to choice for DIY investors looking to churn out steady monthly income and stay ahead of the curve.

Disclaimer

The content of this article is meant to provide general information for educational purposes. Commissions, management fees and expenses all may be associated with investing in Harvest High Income Shares ETFs managed by Harvest Portfolios Group Inc. (the “Funds” or a “Fund”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.