By Ambrose O’Callaghan

The Harvest Diversified High Income Shares ETF (HHIS:TSX) offers exposure to a multi-sector portfolio that captures a diverse selection of trending companies that are positioned for strong growth. HHIS aims to deliver consistent, high monthly income alongside growth opportunities. The ETF holds a portfolio of Harvest single-stock ETFs. These ETFs utilize modest leverage, combined with the benefits of income generation and exposure to leading businesses across various sectors.

As of April 30, 2025, HHIS’ portfolio was broken down as follows:

|

HHIS Holdings |

TSX Ticker |

Weight % |

|

PLTE |

9.1% |

|

|

MSTE |

8.4% |

|

|

LLHE |

7.6% |

|

|

NFLY |

7.6% |

|

|

CNYE |

7.4% |

|

|

MSHE |

7.3% |

|

|

AVGY |

7.1% |

|

|

TSLY |

7.0% |

|

|

COSY |

6.8% |

|

|

NVHE |

6.8% |

|

|

AMHE |

6.5% |

|

|

METE |

6.3% |

|

|

GOGY |

6.2% |

|

|

AMDY |

5.5% |

Source: Harvest Portfolios Group, Inc. May 2025.

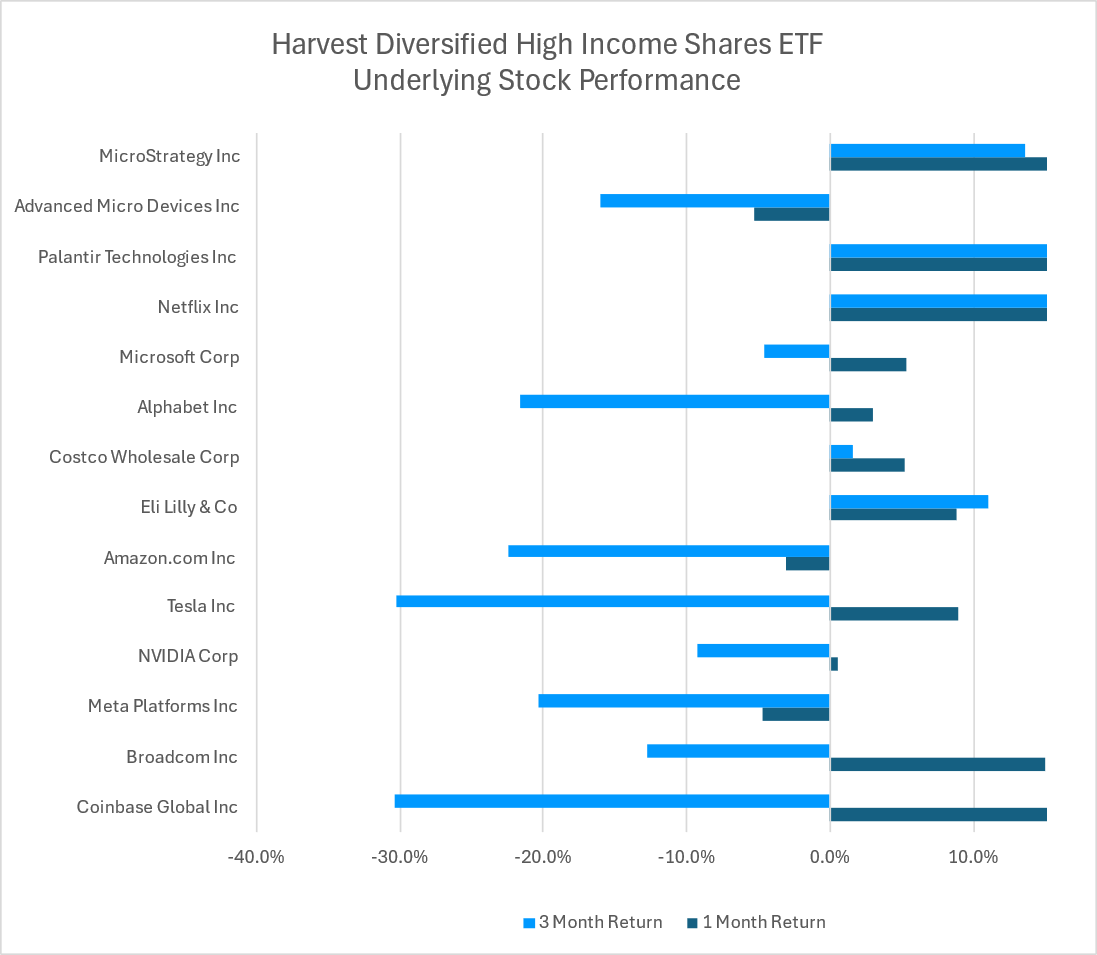

The US markets were roiled by volatility in April 2025. US President Donald Trump’s “Liberation Day” tariffs resulted in violent convulsions for domestic and global markets. However, the next week his administration announced a 90-day pause on “reciprocal” tariffs. In that timeframe, his administration vowed to re-negotiate trade deals. The pivot from protectionism to new free trade deals injected positive sentiment back into the market. Many top stocks in HHIS rebounded on the news. Others are looking to claw back losses from the late winter and early spring.

Source: Bloomberg, Harvest, as of April 30, 2025.

Recapping a tumultuous April

The Harvest suite of High Income Shares outperformed the broader market in April 2025. It delivered this outperformance despite significant market volatility that occurred early in the month. As mentioned, this was spurred on due to harsh US tariffs announced. The rest of April saw a strong rebound in equities. Growth equities performed particularly well during this period. That benefitted several names in the High Income Shares lineup as well as HHIS.

Leading exposures in HHIS included the Harvest Palantir Enhanced High Income Shares ETF (PLTE:TSX). PLTE saw its market price go from $14.80 to $19.17 – up 29% in the month-over-month period. Palantir benefitted from market expectations of higher defence and spyware software spending. The Harvest MicroStrategy Enhanced High Income Shares ETF (MSTE:TSX) saw its market price go from $13.71 to $16.92 – up 23% in the year-to-date period. MicroStrategy was bolstered due to a resilient Bitcoin. The Harvest Netflix Enhanced High Income Shares ETF (NFLY:TSX) saw its price market go from $11.01 to $12.76. That was up 15% in the year-to-date period. Netflix was powered by a solid earnings report with greater-than-expected subscriber growth.

Meanwhile, other High Income Shares were negatively impacted by the bout of turbulence experienced in April. The Harvest Meta High Income Shares ETF (METE:TSX) fell from $11.18 to $9.81 per unit. That represented a 12% decline. Meanwhile, the Harvest AMD Enhanced High Income Shares ETF (AMDY:TSX) saw its market price go from $12.17 to $10.66 – also down 12% over the course of the month of April. This can be attributed to the pressure that chipmakers were under in the same period.

The Harvest Diversified High Income Shares ETF (HHIS:TSX) saw its market price increase from $10.25 to $10.50 – up 2.4% over the course of April 2025. That outpaced the S&P 500, which was down 4.6% in CAD terms.

April 2025 HHIS updates

There were no significant changes to the composition of HHIS throughout the month of April. However, outperforming components drifted higher in weight over the course of April, while underperforming components drifted lower. Premiums were elevated and rich during the previous month. This was due to increased uncertainty and relatively high volatility, driving elevated option premiums.

Write levels, meanwhile, have generally remained on target. A modest range around 33% has been set across the High Income Shares suite, and that was achieved in April 2025. Microsoft, Netflix, and Meta posted strong earnings, while Eli Lilly disappointed in its most recent quarter. Overall, earnings continue to be resilient across HHIS’ core components.

Looking ahead, market sentiment has improved as the Trump administration moves to secure further trade deals after moving ahead with its 90-day pause on tariffs. In May, the Trump administration is trying to push through its “Big Beautiful Bill”, a sprawling domestic policy bill that is centred on a multi-trillion-dollar suite of tax cuts. The Trump Tax Cuts of 2017, which dropped the corporate rate to 21%, would become permanent.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest High Income Shares ETFs managed by Harvest Portfolios Group Inc. (the “Funds” or a “Fund”). Please read the relevant prospectus before investing. The Funds’ returns are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.