By Ambrose O’Callaghan

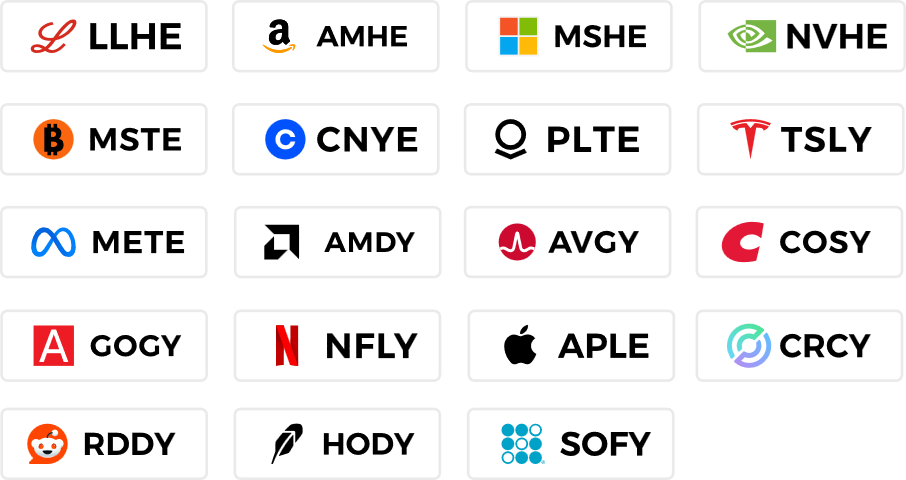

The Harvest High Income Shares ETFs™ suite turned a year old this past August. Since the summer of 2024, Harvest has launched single stock ETFs covering 19 US companies. This includes healthcare giants like Eli Lilly, tech titans like Nvidia, Microsoft, and Meta, and other stalwarts like Netflix and Palantir.

Harvest recently announced a preliminary prospectus for an additional six new single stocks of US companies including Block Inc., CrowdStrike Holdings, Johnson & Johnson, JPMorgan Chase & Co., Novo Nordisk, and Oracle. That will bring the U.S.-focused Harvest High Income Shares suite to 25.

In January 2025, Harvest launched the Harvest Diversified High Income Shares ETF (TSX: HHIS). HHIS provides unitholders diversified exposure to top US companies by investing in a portfolio of Harvest Single Stock ETFs. These underlying ETFs are overlayed with an active covered call writing strategy and employ modest leverage at approximately 25% to generate high levels of monthly income and capture more growth. HHIS is focused and concentrated on the top 19 stocks, with weightings that are targeted based on growth potential, diversification and importantly, income generation capabilities from the option strategy.

Now, as we approach the first anniversary of HHIS’s debut, we are going to look back on the year that was. How HHIS has been managed, how it balances its growth and income factors, and its approach going forward.

How HHIS is managed

The HHIS ETF is a one ticket solution that offers exposure top US companies via the Harvest Single Stock ETFs at a lower purchase price in Canadian dollars.

HHIS Holdings

Harvest ETFs engages an active covered call writing strategy to generate cashflows for unitholders. It’s overlayed on each individual single stock holding, with write-level capped at 50%, though typically falling in the 30-35% range for each to maintain growth exposure.

Harvest’s covered call option writing aims to strike the right balance between income and growth exposure. The stocks held by the Harvest Single Stock ETFs trade in highly liquid option markets. In executing its option strategy, Harvest can generate steady income from the option premiums.

Investors also get access to most of the upside within HHIS’ portfolio, as call option writing in the Underlying ETF holdings is typically below the 50% cap. Moreover, the Underlying ETFs in HHIS employ modest leverage at roughly 25%, with the aim to enhance monthly income and capital appreciation.

Balancing HHIS: A growth and income story

There are three intersecting factors to consider for HHIS at this stage in late 2025.

Size versus volatility

First, the size of its underlying holdings versus volatility. Indeed, HHIS’ combined market cap is one of the elements that make it an attractive target for Canadian investors.

Implied volatility continues to determine the course when it comes to generating option premiums and the monthly income from the ETF. Option premiums remained robust coming into the month of December. We continued to execute covered call writing around a 33% level for the underlying holdings. The chart below shows the most recent write-level that we published.

High Income Shares Metrics

Source: Bloomberg Finance L.P. Harvest ETFs, as of November 28, 2025.

Consistent Rebalancing

Consistent rebalancing on the part of the Harvest investment management team has also been an important part of navigating HHIS through 2025. Through the month of November, positive contributors to HHIS’ momentum included the Harvest Eli Lilly Enhanced High Income Shares ETF (TSX: LLHE), the Harvest Alphabet Enhanced High Income Shares ETF (TSX: GOGY), and the Harvest Broadcom Enhanced High Income Shares ETF (TSX: AVGY). Eli Lilly became the first health care company with a $1 trillion market valuation, as it continued to lead in weight-loss and diabetes drug performance.

The Harvest investment team was active during the pullback for LLHE in August. In response, the team added a significant amount of LLHE units to HHIS and trimmed select names that have doubled.

Option premiums were well supported through the month of November. As noted, earlier income generation through covered call writing remained at around a 33% write level across the HHIS suite. Meanwhile, option coverage was increased on the Harvest MicroStrategy Enhanced High Income Shares ETF (TSX: MSTE) to help support its distribution.

In October, the investment management team added new positions in HHIS that included the Harvest Reddit Enhanced High Income Shares ETF (TSX: RDDY), the Harvest Robinhood Enhanced High Income Shares ETF (TSX: HODY), the Harvest Circle Enhanced High Income Shares ETF (TSX: CRCY), and the Harvest SoFi Enhanced High Income Shares ETF (TSX: SOFY). It is worth noting that relatively small weightings were added and the team added to the names over the course of two months and brought the weights up to their target amounts as the underlying stocks pulled back meaningfully through November.

Through this consistent and constant tactical rebalancing, HHIS is positioned to continue to deliver diversified, enhanced income from high-growth US companies.

Turbulence in 2025

US markets have encountered turbulence in the month of November, as concerns over tech valuations continue to weight on investors. Meanwhile, worsening economic indicators have also contributed to increasingly bearish sentiment. A covered call option strategy works to monetize market volatility and generate higher levels of income in a turbulence market.

The November pullback has contributed to more more volatility in the underlying stocks. This has commensurately meant that option premiums have increased. Moreover, the leverage applied in the underlying ETFs can enhance both monthly income and the total returns in the portfolio in both directions. The investment team ensures that the leverage ratios remain intact each day. It is notable that leverage works to enhance both upside and downside potential.

The HHIS Approach | Opportunistic, not systematic

HHIS brings together exposure to the top US companies via its portfolio of Harvest single stock ETFs with weightings that are adjusted frequently to capture growth potential, ensure optimal diversification, and income generation capabilities from the option strategy. The covered call writing approach has provided ample opportunities to generate income amidst higher volatility in the final quarter of the year.

The underlying Harvest Single Stock ETFs generally target writing options at approximately 33% with flexibility to go up to 50%. If the amount needs to be a bit more or a bit less each month, then the levels are adjusted to keep the distributions consistent. However, they are subject to change based on volatility and market prices. While several of the holdings in HHIS have had distributions lowered in the past year, several have also had meaningful increases. That has flowed through on a net basis for HHIS holders to consistent distributions during the year and more recently two distribution increases.

For investors that are interested in holding the same HHIS portfolio in US dollars, the company recently unveiled HHIS.U.

For investors who want to further reduce volatility, and avoid exposure to leverage, there is the Harvest High Income Equity Shares ETF (TSX: HHIH). This ETF provides access to a basket of companies that mirrors those covered in HHIS. However, investors get direct exposure to the underlying stocks, and a covered call strategy is then overlayed on that portfolio of equity securities.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds and Harvest High Income Shares ETFs managed by Harvest Portfolios Group Inc. (The “Funds” or “ETFs”). Please read the relevant prospectus before investing. The ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

The Funds that use modest leverage of 25% do so to enhance exposure, directly or indirectly, to the underlying stocks. This places them within the category of liquid alternative ETFs. The use of leverage increases the return volatility, meaning it will amplify both gains and losses.

The Funds pay you distributions in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into available Class units/shares of the Fund that you own. If the Funds earn less than the amounts distributed, the difference is a return of capital.