The Harvest Diversified High Income Shares ETF (HHIS:TSX) has accumulated over $600 million in total assets under management (AUM) since its inception in January 2025. It provides exposure to a diversified portfolio of Harvest single stock ETFs that invest in trending companies with strong growth potential.

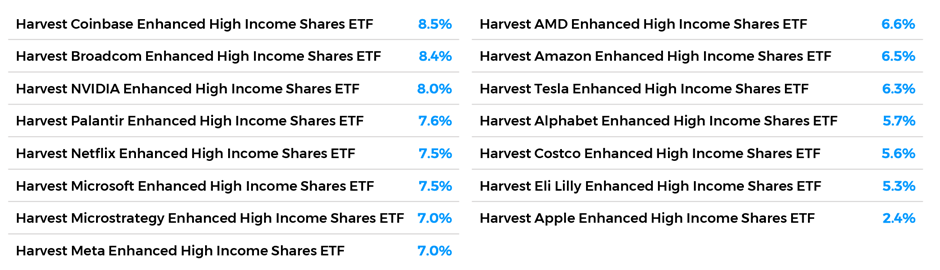

As of June 30, 2025, HHIS’ portfolio was broken down as follows:

Source: Harvest Portfolios Group, Inc. June 30, 2025.

The United States stock market climbed to record highs in the month of June. Different market sectors took turns leading the pack, which illustrated the broad strength we are experiencing right now. Those rotations in market leadership started in April after the “Liberation Day” tariffs were announced and then pulled back due to the 90-day pause. Technology and industrials stocks have led the pack. Meanwhile, defensive areas like healthcare have lagged.

A hot start for stocks to kick off the summer

The S&P 500 Index rose 5% in June to close out at a record high. That extended a two-and-a-half month rally that began after the 90-day tariff pause was announced in April. Meanwhile, the NASDAQ was up 6.1% in the same month, below last month’s strong gains but still putting out a good month.

HHIS benefited from strong performances across the boarder in the month of June. As the chart below illustrates, tech names led the pack. However, far and away the strongest gains belonged the Coinbase Global. The second Trump administration has been very friendly to the broader cryptocurrency markets, which has led to a flight of capital into the digital asset space. The Harvest Coinbase Enhanced High Income Shares ETF (CNYE:TSX) was a big beneficiary of this momentum. It paid out a meaty monthly distribution of $0.40 in June.

Source: Blomberg Finance L.P., Harvest, as of June 30, 2025.

Equities in the artificial intelligence space also gained momentum in June. AMD, a top semiconductor stock, jumped over 25% in the month of June, while Broadcom rose nearly 15%. The Harvest AMD Enhanced High Income Shares ETF (AMDY:TSX) and the Harvest Broadcom Enhanced High Income Shares ETF (AVGY:TSX)benefited in June. AMDY and AVGY last paid out monthly distributions of $0.24 and $0.22 per unit, respectively.

There were other AI-linked stocks like NVIDIA, Meta Platforms, and Palantir that were in the black for the month. Palantir and NVIDIA have been two of the best performers over a three-month period. That has bolstered the Harvest NVIDIA Enhanced High Income Shares ETF (NVHE:TSX), the Harvest Meta Enhanced High Income Shares ETF (METE:TSX), and the Harvest Palantir Enhanced High Income Shares ETF (PLTE:TSX).

Despite continued lower volatility stretching into the late spring and early summer, option premiums stayed high. That supports income generation through covered calls written at about 33% across the High Income Shares suite.

Summary

The HHIS ETF soared passed a half billion in total AUM in the month of June. This rise reflects significant investor interest in this one ticket single stock solution.

HHIS benefited from U.S. equity markets sustained momentum, powered by broader growth and AI themes. The top contributors include CNYE, which was bolstered by optimism in the crypto space, and AMDY and NVHE, which gained from enthusiasm with regards to AI development. Meanwhile, the Harvest Tesla Enhanced High Income Shares ETF (TSLY:TSX)and the Harvest Costco Enhanced High Income Shares ETF (COSY:TSX) dipped, with Tesla continuing to battle turbulence due to lingering political controversies.

Keep an eye out for the Harvest Apple Enhanced High Income Shares ETF (APLE:TSX) in our next report, the newest addition to the High Income Shares lineup.

Coming Soon | HHIH

The HHIS ETF and the High Income Shares suite has generated considerable enthusiasm among investors and advisors alike. In response to that enthusiasm, Harvest ETFs recently announced the filing of a preliminary prospectus for the Harvest High Income Equity Shares ETF, ticker HHIH.

HHIH will provide un-levered access to the growth potential of a portfolio of leading and trending US stocks that are generally similar to the underlying stocks held in the ETFs within HHIS, with an active covered call strategy overlay designed to generate high monthly cash distributions.

“Harvest is pleased to add this new offering to compliment the success of HHIS on an unlevered basis,” said Michael Kovacs, President and CEO of Harvest ETFs. “HHIH is designed to capture a diverse selection of companies that are positioned for strong growth, and through our covered call option strategy, can deliver high levels of monthly income for investors. For over 15 years, Harvest has been committed to bringing innovative growth and high-income investment opportunities to the Canadian market.”

Disclaimer

The Harvest Single Stock ETFs in which HHIS invests all use modest leverage of 25% of their net asset values. The use of leverage will amplify both the upside and downside outcomes and may lead to higher return volatility. With the use of leverage HHIS and its underlying ETFs are regarded as alternative exchange traded funds.

Commissions, management fees and expenses all may be associated with investing in Harvest High Income Shares ETFs (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. This article is meant to provide general information for educational purposes. Any security mentioned herein is for illustration purposes and should not be taken as an invitation to purchase or sell such security.