A Vital Sector in Constant Demand

Steady Income and Growth Opportunities in Canada’s Largest Healthcare Income ETF

Healthcare ETFs from Harvest provide exposure to leading US healthcare companies.

These companies deliver growth and innovation in a vital sector. Global trends are driving long-term growth in the healthcare space. Harvest Healthcare ETFs offer diversified exposure to 20 large-cap US healthcare stocks.

Why Healthcare?

Healthcare focuses on preventing disease and improving our quality of life. It is a ‘superior good’, something we demand no matter what the economy is doing. That provides the healthcare sector with consistent earnings potential in good times and bad.

Permanent and Non-Cyclical Long-Term Drivers

Medical and Scientific Advancement

Gene editing. 3D Printing. Nanotech. GLP-1s.

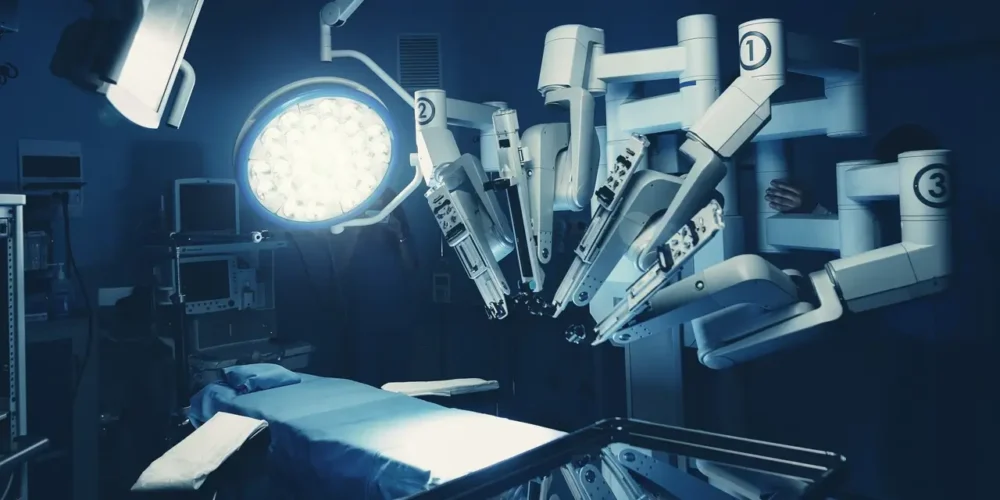

Technological Innovation

Robot-assisted surgeries. New Medical Devices.

Aging Populations

Global population 65+ to increase from 10% in 2022 to 16% in 2050.

Emerging Markets

Expansion and growth opportunities for healthcare companies.

China & India Healthcare Expenditure in $USbn

China and India’s healthcare expenditures have delivered a compound annual growth rate (CAGR) at about 14% since 2000.

Source: WHO Global Health Expenditure Database, Harvest Portfolios Group Inc., as of March 2023

Why Harvest ETFs?

The healthcare sector combines innovation with consistent demand over the long term, which fits with Harvest’s belief in wealth creation through the ownership of leading businesses.

Harvest employs an active call option strategy to generate a premium on a portion of the portfolio, delivering monthly income for investors.

NAVs and Distributions Since Inception

This table shows the growth of $100,000 since inception as at October 31, 2024. HHL would have delivered cumulative distributions of $71,474 since inception.

Disclaimer: The chart above is based on a hypothetical and historical initial $100,000 CAD investment in the ETF and shows the ETF’s market value using the daily market close price of the ETF on the TSX. The chart also shows the monthly cash distributions paid by the ETF on a cumulative basis. The starting point of the data is day the ETF was launched or commenced trading on the TSX. The cash distributions are not compounded or treated as reinvested, and the chart does not account for sales, redemption, distribution or optional charges or income taxes payable by any unitholder. The chart is not a performance chart and is not indicative of future market values of the ETF or returns on investment in the ETF, which will vary.

HHL: A Storied Track Record

As at October 31, 2024

in AUM

distribution since inception

%

current yield

Healthcare Themes

Capturing value from innovative leaders.

AI / Robotics

Elderly Care

GLP-1s

Biopharmaceuticals

Telemedicine 2.0

Medical Devices

Investing in Large-Cap Healthcare Leaders

HHL & HHLE provide exposure to a portfolio of 20 large-cap healthcare leaders delivering value from new drugs, treatments, and technologies.

As at October 31, 2024

Healthcare Strategy

(Growth – Innovation – Income)

The Harvest Healthcare Leaders Income ETF (HHL) and the Harvest Healthcare Leaders Enhanced Income ETF (HHLE) deliver consistent income through covered calls, which offers the following benefits:

High annualized yields paid as monthly distributions

Downside protection via options premiums

Volatility monetization

The Harvest Healthcare Leaders Enhanced Income ETF (HHLE) adds roughly 25% leverage to its investment in HHL. That allows HHLE to deliver higher cash-flow at a slightly higher risk rating.

Key Facts

As at 2024/11/22

TICKER

HHL

TSX

CURRENCY

CAD

Hedged

NAV

$8.10

Updated Daily

MKT PRICE CLOSE

$8.12

Updated Daily

NET AUM*

$1531.67M

Updated Daily

MGMT STYLE

Active

With Covered Calls

CASH DISTRIBUTION***

Monthly

Frequency

LAST DISTRIBUTION

$0.0600

Cash, Per Unit

CURRENT YIELD

8.87%

Updated Daily

DISTRIBUTION

$6.8862

Total, Since Inception**

Key Facts

As at 2024/11/22

TICKER

HHLE

TSX

CURRENCY

CAD

Hedged

Underlying ETF

NAV

$10.13

Updated Daily

MKT PRICE CLOSE

$10.12

Updated Daily

NET AUM*

$46.33M

Updated Daily

MGMT STYLE

Active

With Covered Calls

Underlying ETF

CASH DISTRIBUTION***

Monthly

Frequency

LAST DISTRIBUTION

$0.0934

Cash, Per Unit

CURRENT YIELD

11.08%

Updated Daily

HOLDING

HHL

Underlying ETF

Key Facts

As at 2024/11/22

HHL

CAD

$8.10

$8.12

$1531.67M

Active

Monthly

$0.0600

8.87%

$6.8862

Key Facts

As at 2024/11/22

TICKER

HHLE

TSX

CURRENCY

CAD

Hedged

Underlying ETF

NAV

$10.00

Updated Daily

MKT PRICE CLOSE

$10.00

Updated Daily

NET AUM*

$46.33M

Updated Daily

MGMT STYLE

Active

With Covered Calls

Underlying ETF

CASH DISTRIBUTION***

Monthly

Frequency

LAST DISTRIBUTION

$0.0934

Cash, Per Unit

CURRENT YIELD

11.08%

Updated Daily

HOLDING

HHL

Underlying ETF

Meet the Manager

Paul MacDonald, CFA

Paul MacDonald is the Chief Investment Officer (CIO) at Harvest ETFs and the lead manager for HHL and HHLE. Paul brings over 20 years of experience in the investment business, with 15 years as a Portfolio Manager. Paul covers select Healthcare companies globally and is the lead Portfolio Manager on the Harvest Healthcare Leaders Income ETF, one of Canada’s largest Healthcare ETFs. Paul also covers select Real Estate companies and plays a key role in formulating Harvest’s overall investment strategy.

Harvest Healthcare Insights

Disclaimer

Harvest Healthcare Leaders Income ETF (HHL) originally commenced operations as a TSX listed closed-end fund on December 18, 2014 and converted into an exchange-traded fund on October 24, 2016.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently and past performance may not be repeated.

Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into the Class of units that you own of the Fund. If the Fund earns less than the amounts distributed, the difference is a return of capital. Tax, investment and all other decisions should be made with guidance from a qualified professional.

The current yield represents an annualized amount that is comprised of 12 unchanged monthly distributions (using the most recent month’s distribution figure multiplied by 12) as a percentage of the closing market price of the Fund. The current yield does not represent historical returns of the ETF but represents the distribution an investor would receive if the most recent distribution stayed the same going forward.

* Represents aggregate AUM of all classes denominated in Canadian dollars.

** Inception Date: HHL Class A is 2014/12/18; HHL Class B is 2020/03/12; HHL Class U is 2017/02/09; HHLE is 2022/10/25.

*** In addition to cash distributions, the Fund could have notional non-cash distributions which are paid annually (if any). There is no impact on net asset value per unit. The notional distribution is added to the cost base of the ETF and is taxable if not held in a registered account (RRSP/RRIF/TFSA, FHSA and RESP).