By Caroline Grimont

Last month, we talked about Annie Duke’s “Thinking in Bets,” which was written by a professional poker player back in 2018. Today, I wanted to go a little further back, and by a little, I mean all the way back to 1000 BC, and ancient Babylon. The book I wanted to talk about is the 1926 must-read by George S. Clason, titled, “The Richest Man in Babylon.”

Source: “The Richest Man in Bablyon”, by George S, Clason, as seen on Amazon.ca.

This book has been recommended to me more times than I can remember, mainly because of its parable-based structure, and foundational wisdom, all of which can be applied today. The book imparts personal finance basics through bite-size stories, many of which feature Arkad, a poor scribe who ended up becoming the eponymous richest man in Babylon.

I remember it being a breeze, and I finished it in one sitting. As I re-read it last week, though, I realized that some of the language is quite dated. It fails to address things like asset allocation, inflation, and cryptocurrencies. Granted, predicting the rise of Bitcoin in 1926 would have been a tall order. I would still recommend it for its descriptions of human behavior, stress on the need for financial discipline, and the use of psychology to understand the mechanics of wealth remain relevant. I would suggest that, for a more modern toolkit, one should pair this book with Duke’s, and others which we will cover in future editions of this column.

Today, I decided to try and be Clason and write my review through a parable. Here goes.

The Investor and the Seven Lessons

Once upon a time, let’s say 2025, in a land relatively near us, somewhere in the Greater Toronto Area, lived an investor. This investor was young, brave, and smart. She knew that one day, she would live in a beautiful house and gain her heart’s desire. But the road to get there was long, and complicated, and she didn’t know the way.

She spoke to her mother, but her mother didn’t know either. She asked her father, but her father’s advice was to buy shares in Nortel – as I have said, she was smart, so she smiled, thanked him, and moved along without paying his advice any heed.

As is the case with many young investors of her age, in her time, she turned to the repository of all knowledge, the Weird Wise Web, but like her father’s advice, a lot of what she saw seemed too good to be true. There were cloaked figures hawking obscure cryptocurrencies, charlatans espousing the glittering world of NFTs, carnival sideshow-style creepers declaring that they and only they knew where to find hidden gold.

Our investor knew to not trust all that she saw, knew to recognize the smoke and mirror tactics of these online magicians. But she didn’t know how to look beyond and behind the curtain, to find the kernels of truth to make her money grow. So, day after day, she travelled to her job in Downtown Toronto, staring out the window of the TTC as she thought about her predicament, getting no closer to her beautiful house, and gaining her heart’s desire.

And then one day, as she sat in the subway hurtling west, a dark cloaked figure materialized on the two-person seat beside her. He had a book in his hand but was not reading it. Instead, he was listening to voices in his head, loud enough that she could hear the bass thumping out of his ears. She was annoyed – she wanted the space to herself – but before she could say anything, the subway car lurched, and with a screech, stopped in the middle of nowhere.

With a pop, the lights went out, and in the dark, the voice box in the sky came on. “Your attention please. We are experiencing a delay westbound between our Spadina and Sherbourne stations due to a trespasser on the tracks. Response personnel are on the way.”

The investor and her fellow travelers gave a collective groan. Emergency lights came on, and in the warm glow, the investor saw that her cloaked neighbour had vanished but had left his book behind. Scrupulously honest, she looked around to see if she could find him to return his property, but it was almost as he had never been. Curious, she picked up the book, and read the cover, which said “The Richest Man in Babylon.” Intrigued, she began to read. And as she read, her knowledge grew. From the book, she gleaned seven keys of wealth, or seven lessons. She applied these lessons to her own life, and in time, she acquired her beautiful house and gained her heart’s desire.

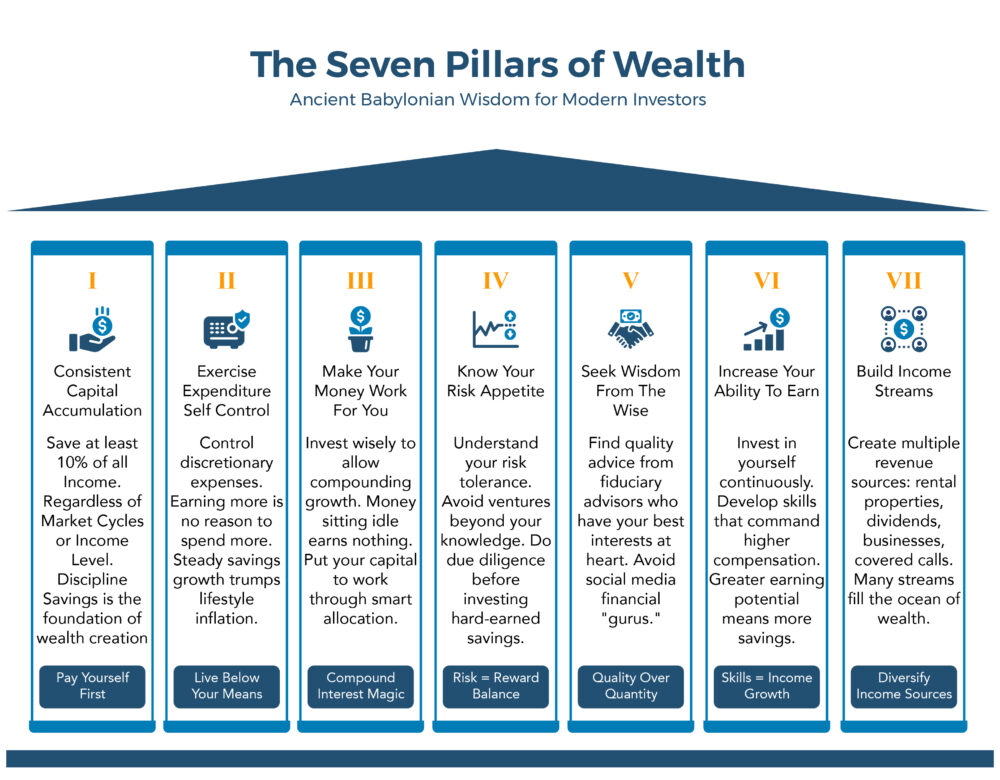

Source: Illustration based on the lessons mentioned in “The Richest Man in Babylon”.

Do you seek her seven lessons? Here is what she learnt:

Lesson One: Consistent Capital Accumulation

The investor learnt what in her heart she always knew. Savings are key to long-term wealth creation. One of the core tenets of the book is that everyone, regardless of market cycles or income level, should save at least 10% of all income. Without disciplined saving, even the best investment strategy is doomed to failure.

Lesson Two: Exercise Expenditure Self Control

The investor rued her empty bank balance, even as she celebrated her full shopping cart. This was her tragedy. Just because you earn more, that no reason to spend more. If you can steadily increase your savings and cut down on expenses, your nest egg will grow. Your discretionary expenses are within your control. So, control them.

Lesson Three: Make Your Money Work for You, And You Can Stop Working for Money

If your savings sit in a cash account, or under your mattress, you earn nothing. Put your money to work by investing it wisely, allowing compound growth to take effect. This is the essence of capital allocation.

Lesson Four: Know Your Risk Appetite

The parables in “The Richest Man in Babylon” repeatedly warn against risky ventures, or of trusting unskilled people with your hard-earned savings. It is critical to do your own due diligence, understand how much risk you can take, and know where you’re investing.

Lesson Five: Seek Wisdom from the Wise

The investor sought wisdom from the Weird Wise Web – Instagram, Reddit, TikTok, X. But she couldn’t tell what was factual, what was fiction, and what was a scam. There is real value in seeking out good, quality advice, from people who have your best interests at heart. To find such advisors, look for people to whom you would pay for advice. In most cases, fee-based financial planners are fiduciaries, which means that they are dutifully bound to do what is best for you, not what is best for themselves.

Lesson Six: Increase Your Ability to Earn

In her first job, the investor worked as a lifeguard at Wasaga Beach. Then, she moved away to college. After that, she got a job in a large warehouse, where artists from all over the country came to sell their wares. As she learnt more, her skills grew, as did her ability to command more coin for her expertise. Invest in yourself. This will help your earnings grow and will increase your savings. That will grow your nest egg, making you more financially secure.

Lesson Seven: Build Income Streams

Many, many streams feed the mighty river, and many, many rivers fill the great ocean. Similarly, the ocean of wealth needs many small streams to fill it up, not just one water flow. This means that you need to find multiple sources of income. This could be a rental property, or dividends, or an income generating business.

Another avenue for investors to consider is covered call ETFs – and Harvest’s portfolio of funds offers products that could satisfy a wide range of investors. As my colleague Ambrose O’Callaghan wrote, “Covered call ETFs generate cash flows for unitholders from a portfolio of securities with a covered call option writing strategy. Harvest launched its first ETFs in 2016. Since then, it has established itself as one of the top covered call option writing firms in Canada. Harvest utilizes an active and flexible call option strategy to build high yield ETFs that pay monthly distributions and still capture the opportunity for market growth.”

Disclaimer

The content in this article should not be construed as investment advice. Please read the relevant prospectus before investing. Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds or Harvest High Income Shares ETFs, managed by Harvest Portfolios Group Inc. (the “Funds” or a “Fund”). The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.