By Ambrose O’Callaghan

Coming into the midway point of the 2020s, the industrials sector looked poised to benefit from a resurgent U.S. manufacturing space. A year later, and that case looks as strong as it did in the spring of 2024. Harvest ETFs’ investment management team recognized this trend, leading to the launch of the Harvest Industrial Leaders Income ETF (HIND:TSX).

Today, I want to explore how this story has evolved since then, and why this industrials ETF offers an opportunity to plug into America’s manufacturing revival.

A Historic Opportunity in Industrials

The industrial sector is made up of industries that are involved in the production and processing of raw materials, goods, or services. In terms of HIND, this includes a range of sub-sectors:

- Aerospace & Defence

- Trading Companies & Distributors

- Electrical Components & Equipment

- Rail Transportation

- Industrial Machinery & Supplies & Components

Industrials are no longer a slow-growth, legacy sector. The sector stands as a key engine of economic transformation in the U.S. An economic transformation that we characterized as the “Rs”: Recovery, Rebuild and Repatriation. The myriads of economic benefits to be captured by industrials are rooted in developments like the post-pandemic reshoring trend, significant infrastructure stimulus through key pieces of legislation, as well as a manufacturing tech boom.

U.S. Manufacturing | The Recovery

Coming into the 2020s, there was an ironclad economic case for jump-starting America’s manufacturing rebound. In May 2024, the American Society of Civil Engineers released a report; Bridging the Gap: Economic Impacts of National Infrastructure Investment. “From 2024-2033, $7.4 trillion in infrastructure needs are projected . . . Approximately $4.5 trillion in investment is anticipated which covered approximately 60% of the total needs, leaving a gap of $2.9 trillion.”

Source: Bridging the Gap, ASCE. May 2024.

The report also estimates that this $2.9 trillion gap will cost the economy nearly $4 trillion in lost GDP by 2033.

Fortunately, through key pieces of legislation like the CHIPS and Science Act (2022) and the Infrastructure Investment and Jobs Act (IIJA), hundreds of billions have been earmarked for revitalizing America’s infrastructure and energy/utilities sectors.

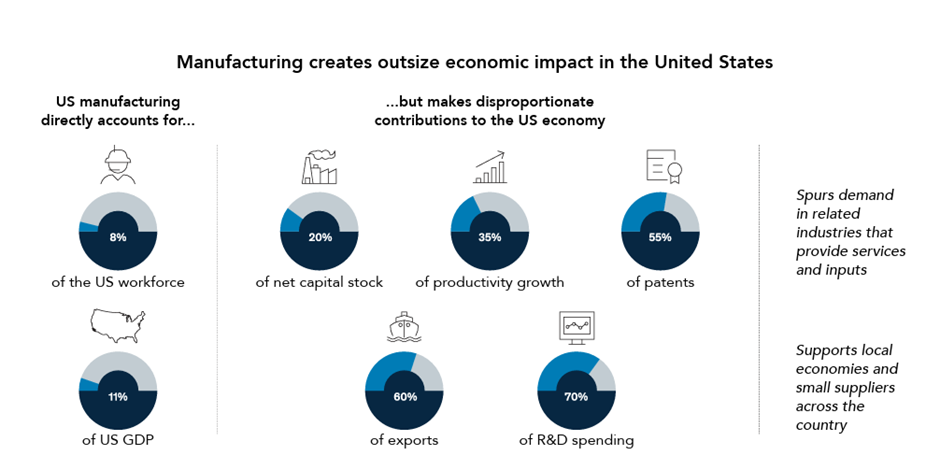

Source: US Bureau of Economic Analysis; US Bureau of Labor Statistics, McKinsey Global Institute analysis.

There are several holdings within HIND that are well-positioned to take advantage of this massive investment:

Caterpillar Inc, a holding in HIND, manufactures and sells construction and mining equipment, diesel and natural gas engines, turbines, and diesel-electric locomotives in the United States and worldwide. While tariffs have emerged as a headwind in recent months, Caterpillar’s long-term outlook remains strong on the back of the country’s manufacturing push.

Canadian Pacific Kansas City Limited provides massive rail service and network reach to North American markets. The IIJA earmarked $102 billion in total rail funding.

Infrastructure Investment | The Rebuild

A bipartisan consensus exists in the U.S. that infrastructure spending is a priority for the future. This serves to reduce policy risk for the industrials sector in the medium-to-long term. The $1.2 trillion IIJA may just be the beginning for this space, with new legislation and private capital compounding this trend.

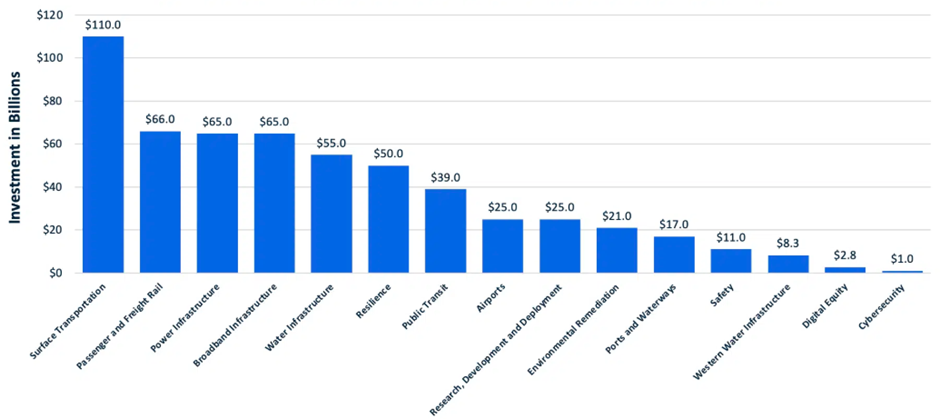

The IIJA allocates $550 billion in new federal investments. That infrastructure has been divided among various segments. It includes earmarks for projects like electric school and transit buses, electric vehicle (EV) charging stations, and more.

Source: Gordian, June 22, 2023. https://www.gordian.com/resources/unveiling-iija-an-overview-of-federal-infrastructure-funding/

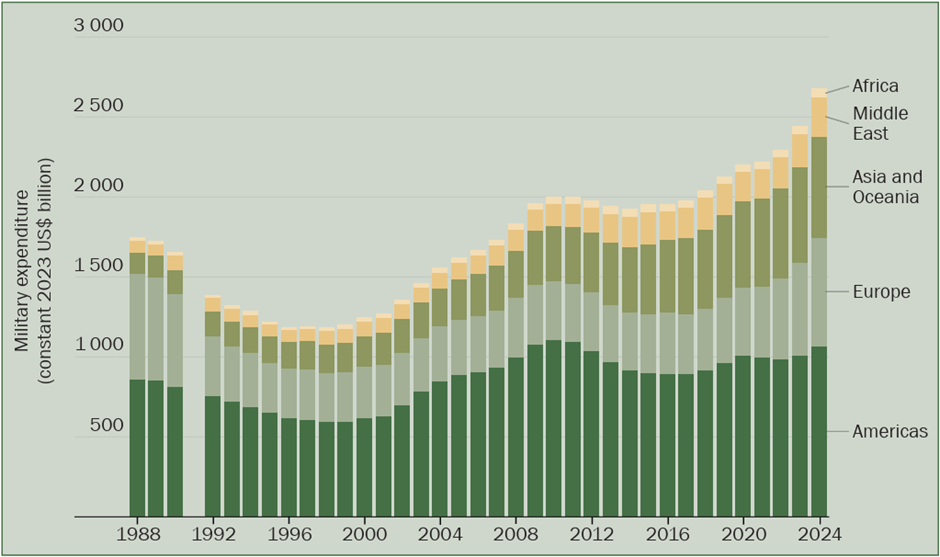

Bi-partisan consensus, at least when it comes to defence spending, still exists in the United States. According to the Stockholm International Peace Research Institute, military spending by the US rose by 5.7% to reach US$997 billion in 2024. That represented 66% of total NATO spending of 37% of total world military spending. The US has continued to allocate a large portion of its military budget to modernizing military capabilities and the US nuclear arsenal to maintain its strategic advantage over Russia and China.

Source: Stockholm International Peace Research Institute, 2024.

Aerospace and defence companies like Lockheed Martin and RTX Corporation are well-positioned to benefit in this environment. These are two other holdings that HIND provides exposure.

American Advantage | Repatriation

Both Republican and Democratic administration have sought to revamp US manufacturing. In 2022, the Biden White House claimed that the U.S. manufactured just 12% of the world’s chips – down from 37% in 1990. Through legislation like CHIPS, it sought to reverse that trend.

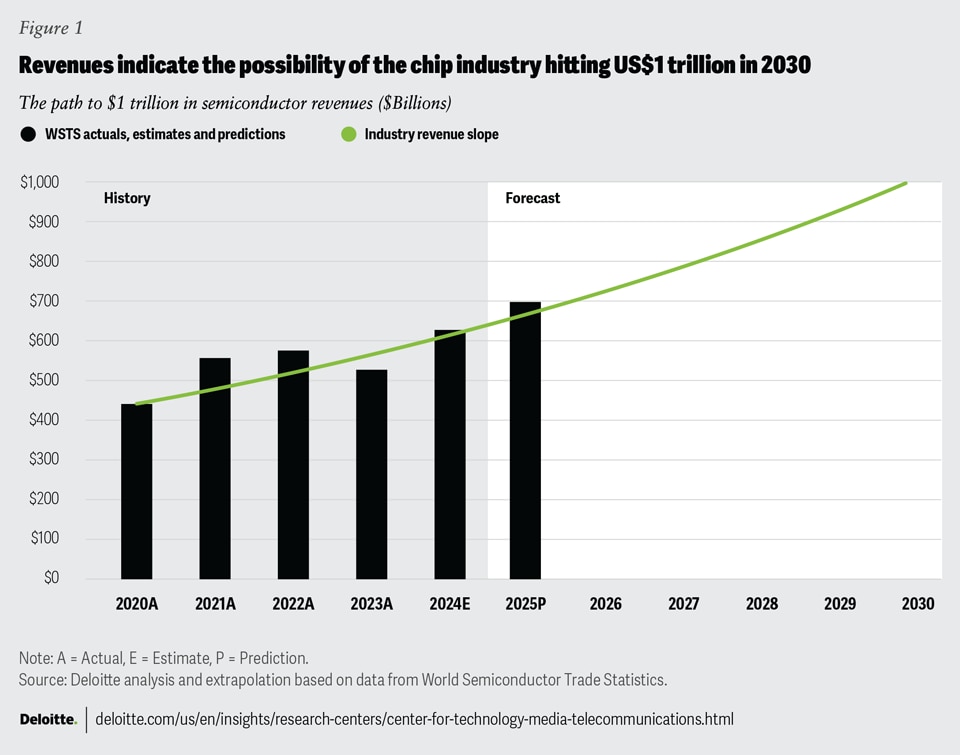

Deloitte writes that chip sales are poised to soar in the middle of this decade, on the back of generative AI and data centre build outs. A February 2025 report projected that the semiconductor industry could reach US$2 trillion by 2040. Semiconductor sales reached US$627 billion in 2024, and were projected to hit US$697 billion in 2025, which would represent an all-time high.

Source: Deloitte, February 2025.

Beneficiaries in HIND:

- AMETEK: a holding in HIND. A global manufacturer with a strong presence in the semiconductor industry. CAMECA, a subsidiary of AMETEK, uses Secondary Ion Mass Spectrometry (SIMS) and Atom Probe Tomography (APT) instruments in the research and design of semiconductor devices.

- Eaton Corporation: another HIND holding. Also active in this space. Won a contract to help power semiconductor research at the NY CREATES’ facility in New York. The project, which features a 50,000 square foot cleanroom, is expected to be completed in 2026. It is partially funded by the CHIPS & Science Act.

Summary

There is a triple opportunity in the industrials space right now that investors may want to take hold of. The US pathway towards recovery, rebuilding, and repatriation offers opportunities in areas like construction and heavy machinery, aerospace and defence, electrical components and equipment, and others.

The Harvest Industrials Leaders Income ETF (HIND:TSX) has 20 equal weight industrials securities. It offers exposure to these leading industrial companies and the emerging trends that are powering their growth. Moreover, it offers up sector diversification within the industrials space to reduce portfolio volatility.

HIND | Harvest Industrial Leaders Income ETF

Benefits:

- Access to leading industrial companies and leading trends

- Sector diversification within industrials

- Covered calls to generate income and lower volatility

- $0.07 monthly cash distribution per unit

- 7.29% Current Yield (as at June 20, 2025)

- Tax efficient income

Annual Performance

As at November 30, 2025

| Ticker | 1M | 3M | 6M | YTD | 1Y | SI |

|---|---|---|---|---|---|---|

| HIND | (0.03) | 2.98 | 9.92 | 10.47 | 1.80 | 8.31 |

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.