Understanding Registered Retirement Income Funds (RRIFs) in 2024 starts with Registered Retirement Savings Plans (RRSPs). Registered Retirement Savings Plans (RRSPs) are Canada’s most popular retirement savings vehicle for good reason. You get a tax deduction for the contributions you make, plus the amount saved which grows in a tax-sheltered account.

But in the end the government wants the tax to be paid. So, in the year you turn 71 an RRSP must be converted into a Registered Retirement Income Fund. (RRIF). Thereafter you must draw down the fund each year by amounts according to tables set out by Ottawa.

Any changes to withdrawal rates are made by Parliament. No changes have been legislated for 2024. However, there are still key details about RRIFs that retirees and pre-retirees should be aware of.

1. What is a RRIF?

A RRIF is a vehicle that allows Ottawa to get the tax refunds it paid for your RRSP contributions back. Unlike an RRSP which was designed to get Canadians to save for retirement, a RRIF is an income plan. It is a structured way to cash out your RRSP.

2. How does a RRIF work?

The amount you must withdraw increases each year after age 71 according to the tables. Your bank or investment advisor will have them. You can start earlier than 71, but not later.

Withdrawals have been the subject of some controversy lately, as mandatory withdrawals can mean a retiree has to sell some of their assets. This could compound a loss or reduce their exposure to future growth opportunity. As retirees live longer, RRIFs in 2024 have become increasingly challenging.

The minimum withdrawals were relaxed in the 2015 federal budget to recognize that we’re living longer and rates of return on investments are lower than they were. In March 2020, the federal government reduced the minimum withdrawal rate by 25% for the year as a one-time response to COVID-19. In 2021 they reverted back to pre-pandemic levels.

3. A sample calculation

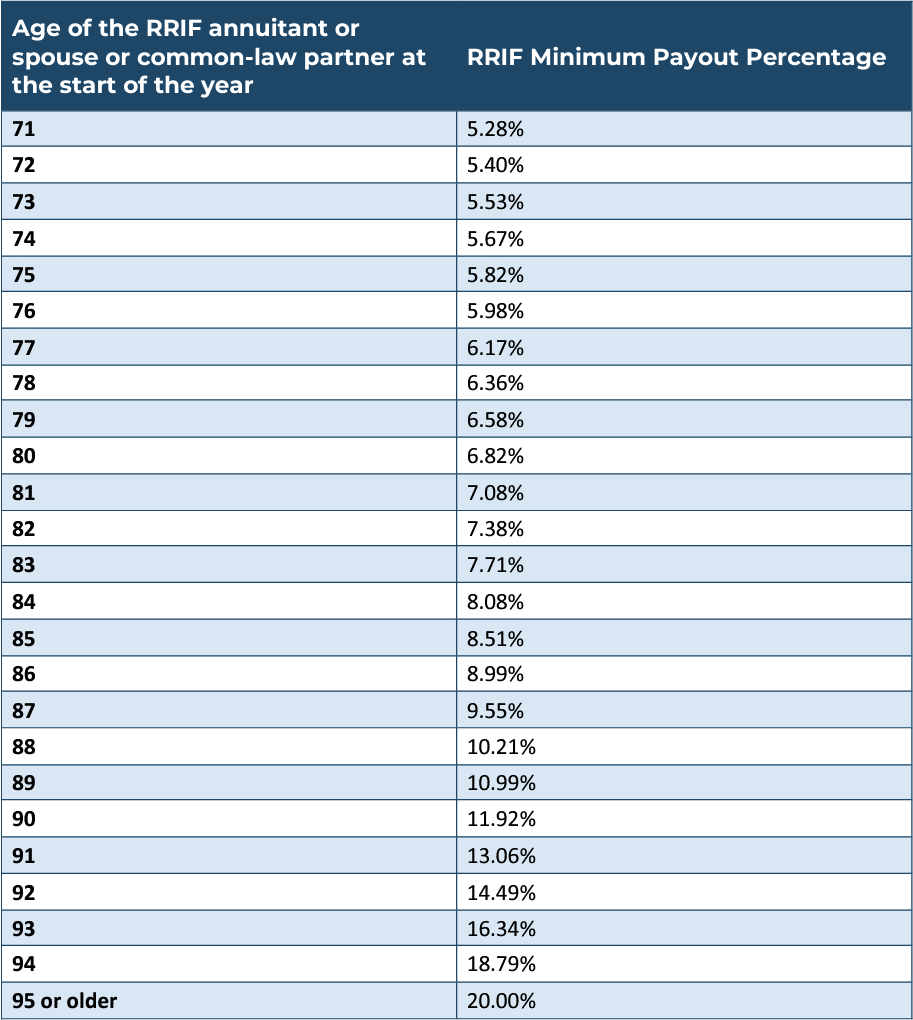

Suppose you were 71 on Jan. 1, 2024 and converted a $100,000 RRSP to a RRIF. You must withdraw 5.28% of the opening balance for the year as per the tables, or $5,280. Withdrawal rates rise each year until 95 when they peak at 20% a year.

Depending on your cash flow needs you can take out all the money on Jan. 1 or all on Dec. 31, or at any combination in between. You can also withdraw more than the minimum, but never less.

RRIF Minimum Withdrawal Table

Source: Canada Revenue Agency, the above data applies to RRIFs set up on or after Jan. 1 1993. Refer to source data for RRIFs with earlier start dates. Prescribed factors may have certain qualifications. Consult your investment dealer to understand RRIF minimum withdrawals and tax implications.

4. How do I set up a RRIF?

You can set up a RRIF through a bank, investment dealer, credit union, trust or insurance company. They will advise you on the types of RRIFs available to you and the investments they can hold. Your advisor can help.

Broadly speaking, you can convert your RRSP as a lump sum, you can keep the same investments and sell them bit by bit, or you can convert your RRSP into an annuity that pays a monthly amount for life.

Each of these strategies has a tax liability.

5. Can I have more than one RRIF?

Yes. You can have more than one RRIF and you can have self-directed RRIFs. You may want to set up a self-directed RRIF if you prefer to manage your investments yourself.

Once the RRIF is established, you cannot contribute any more too it. And the plan cannot be terminated except by death.

6. Is it only RRSPs that must be converted?

No. A Pooled Registered Pension Plan (PRPP) RPP or unmatured RRSP, including a direct transfer of a commutation payment from your RRSP annuity an unmatured RRSP under which your current or former spouse, or common-law partner is the annuitant.

7. What can I hold in a RRIF?

There are no restrictions on the type of investment you can hold in a RRIF. You can keep the RRSP holdings as is and sell the appropriate amounts. You can hold any combination of stocks, bonds, GICs, mutual funds or Exchange Traded Funds (ETFs).

Each retiree must decide the right mix for their circumstances.

8. What happens to a RRIF when I die?

If you are the beneficiary of the deceased – often a spouse – the amounts received from a RRIF can be transferred to your RRSP, RRIF or PRPP.

How Harvest ETFs can help?

RRIFs can be problematic for retirees who want to preserve their capital and plan for longer lifespans. Mandatory withdrawals on an investment account can cement losses and result in a severe depreciation of the principal.

In addition to maintaining their own lifestyles, many retirees want to leave a legacy to future generations of their families. The savings they hold in a RRIF account can be an important part of that legacy, and drawdowns can adversely impact their goal.

Harvest ETFs offers equity growth-focused, equity income, and enhanced equity income Exchange Traded Funds (ETFs) that can be part of a retirement plan. The Harvest philosophy is to offer simple, transparent, fee competitive ETFs that own successful dividend-paying global businesses which grow over time.

Harvest offers a suite of ETFs which are divided among eight equity income-oriented ETFs, Enhanced Equity Income ETFs, and Equity Growth-Focused ETFs. The equity growth-focused ETFs generally offer more opportunity for capital appreciation. They focus on emerging or mega investing themes which over time can generate powerful returns.

All Harvest ETFs are RRSP and RRIF eligible.

The income generated by any of the equity income & enhanced equity income Harvest ETFs, if held in RRIF accounts, can help generate cashflow to meet some or all of the mandatory withdrawal amount without having to sell investments or unduly depreciate principal savings.

The Harvest covered call option strategy

Harvest is the third largest option writing ETF firm in Canada and its equity income ETFs use a covered call strategy to generate additional cash flow.

The strategy creates tax advantaged income where the tax advantage comes from the premium income created by the call writing. It is treated as capital gains.

To find out how your clients can benefit from these equity income solutions call 1.866.998.8298.

For more on Harvest Equity Income ETFs please visit