By Ambrose O’Callaghan

Interest rates and inflation expectations have shifted in the latter half of 2025. Central banks in the United States and Canada have pursued interest rate cuts, while actions on trade have impacted bond markets. Investors may be looking for opportunities in the fixed income space in this uncertain environment.

Monetary policy and yield curve positioning

Back in September, we looked at the history and purpose of the United States Federal Reserve.

Where do things stand for the Fed in late 2025?

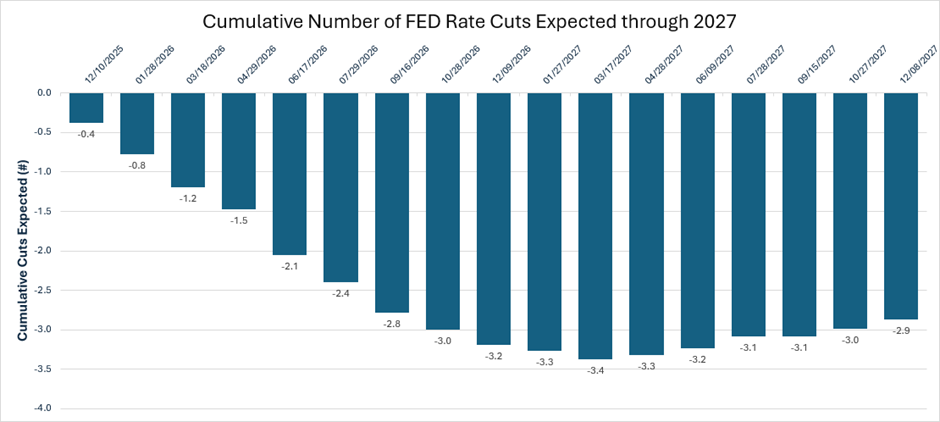

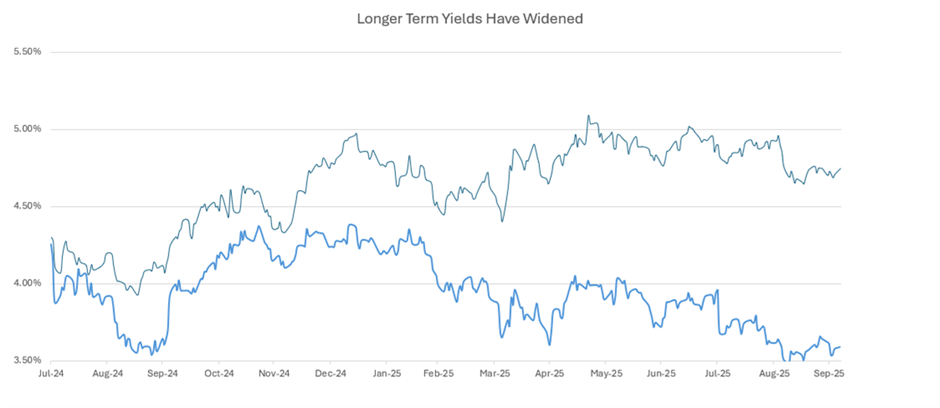

The US Federal Reserve Bank (Fed)and the Bank of Canada (BoC) delivered another round of 25-basis point cuts during the month of October. Despite easing by the Fed, long yields have remained sticky. Policy and inflation uncertainty has lingered in the current climate. Still, the yield curve is normalizing, with inverted overnight rates having pushed back down below long-term rates (i.e. short-term rates were higher than long term rates, that has normalized). In the U.S., the market is currently expecting a pause in short term rates for a few months, before another potential 3 full cuts in 2026 – taking overnight rates to 3.25% and resembling a normal shaped curve with overnight rates below the 2 year and 5-year rates. Meanwhile, in Canada the overnight rate is now 2.25% where it should remain based on current market expectations – with the curve looking more normal.

Source: Harvest ETFs, November 17, 2025.

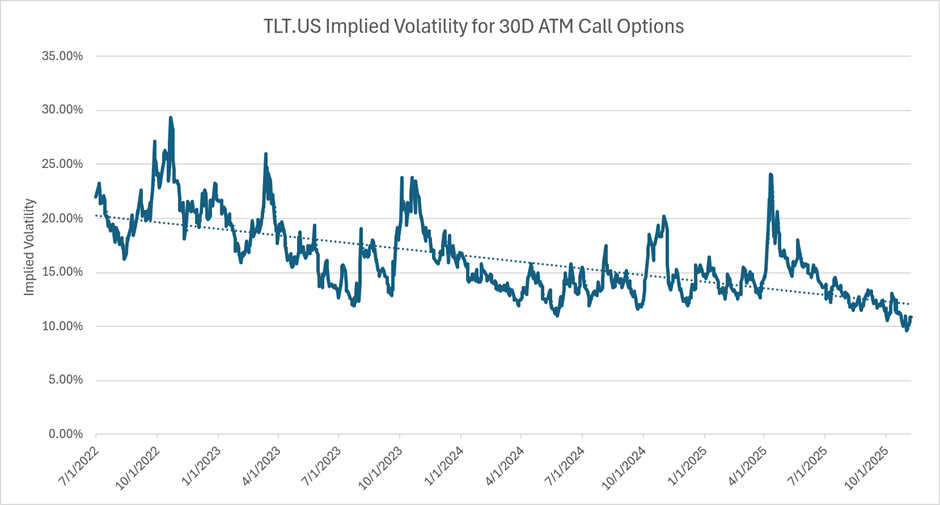

Bond ETFs both on the long-end and medium part of the yield curve eased off from the volatility that they witnessed in the second half of 2024 and early part of 2025, with the choppiness around the US election, and the bumpiness of a new combative US administration pushing headlines and bond volatility, especially around tariff policy announcements.

With the tempering of bond price movements, we’ve also witnessed a compression in implied volatility, which is a key driver of option premiums are priced on, down close to five-year lows.

Source: Harvest ETFs, November 17, 2025.

This is an unusual backdrop given the macroeconomic noise and has made for a challenging environment holding long-duration bond ETFs given the relatively lower option premiums yet continued sensitivity to unexpected headlines.

HPYM & HPYT | Intermediate and long-duration bond ETFs

The Harvest Premium Yield Treasury ETF (TSX: HPYT) holds a portfolio of longer dated US treasury bond ETFs, overlayed with a covered call strategy to generate high levels of monthly income. Longer-duration bonds tend to be more sensitive to any unexpected headlines, which have become a staple of the current US administration.

Source: Harvest ETFs, November 17, 2025.

Implied volatility has moved lower, making the environment more challenging for generating option premiums. HPYT last paid out a monthly cash distribution of $0.11 per unit. This represents a current yield of 15.05% as at November 14, 2025.

Annual Performance

As at January 31, 2026

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | SI |

|---|---|---|---|---|---|---|---|

| HPYT | 0.06 | (1.94) | 2.49 | 0.06 | 4.04 | (0.18) | 1.27 |

| HPYT.B | (0.62) | (4.42) | 1.61 | (0.62) | (0.92) | - | 2.20 |

| HPYT.U | 0.18 | (1.55) | 3.40 | 0.18 | 5.75 | 1.11 | 0.98 |

The Harvest Premium Yield 7-10 Year Treasury ETF (TSX: HPYM) is a portfolio of intermediate duration US Treasury bond ETFs, also with covered calls to generate monthly cashflow. Mid duration bonds are not subject to the same volatility as longer duration bonds. Meanwhile, premiums tend to be lower in the mid duration, and this has continued to be the case in 2025.

Annual Performance

As at January 31, 2026

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | SI |

|---|---|---|---|---|---|---|---|

| HPYM | (0.21) | (0.05) | 2.59 | (0.21) | 5.79 | 2.14 | 2.10 |

| HPYM.U | (0.08) | 0.46 | 3.47 | (0.08) | 7.63 | 3.58 | 3.46 |

TBIL | A dependable cash proxy

Cash alternatives remain a valuable target in a bond barbell for those holding cash. These vehicles can help to rebalance portfolios in an uncertain climate. Because of this, the Harvest Canadian T-Bill ETF (TSX: TBIL) is a high-quality parking spot for cash. TBIL pays competitive interest income that comes from investing in Treasury Bills issued by the Government of Canada.

Disclaimer

The content of this article should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or use to engage in personal investment strategies. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds”). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into available Class units of the Fund you own. If a Fund earns less than the amounts distributed, the difference is a return of capital.

The current yield represents an annualized amount that is comprised of 12 unchanged monthly distributions (using the most recent month’s distribution figure multiplied by 12) as a percentage of the closing market price of the Fund. The current yield does not represent historical returns of the ETF.