By Ambrose O’Callaghan

Bitcoin, the world’s premier digital currency, has benefited from renewed momentum in 2025. The largest cryptocurrency crossed back above the USD$100,000 mark in the first half of the year, climbing toward fresh highs. Bitcoin continued to draw institutional interest and significant ETF flows. This followed the launch of the first spot Bitcoin ETFs in the previous year.

A halving event in April 2024 tightened supply pressure and reinforced the scarcity narrative that has powered Bitcoin demand. Meanwhile, Bitcoin has behaved more in concert with broad financial markets. It has shown strong correlations with equities, becoming a mainstay in many institutional portfolio strategies.

The price of Bitcoin shot up through the USD$120,000 point in the second half of 2025. However, the premier cryptocurrency and its peers have faced challenges due to macro headwinds. These have come in the form of trade tensions as well as profit-taking pressures. Meanwhile, the domestic regulatory environment has struck a warmer tone towards the crypto space with the GOP in power, providing a boost to digital assets.

So far, 2025 has been a year of maturation and consolidation for the world’s top cryptocurrency. Bitcoin continues to benefit from strong bullish forces, underpinned by institutional and macro tailwinds. It looks promising, and the ecosystem around Bitcoin is also strengthening. The Harvest Bitcoin Leaders Enhanced Income ETF (CBOE: HBTE) is designed to capitalize on these positive developments. HBTE invests in companies within the Bitcoin ecosystem and provides exposure to the price of Bitcoin.

The ETF’s main goal is to generate monthly income through covered calls and the application of leverage, while capturing the potential upside of its investments.

What makes up the Bitcoin ecosystem?

Due to its evolution as an asset, a Bitcoin ecosystem has emerged in recent years. Companies that exist within this ecosystem include Bitcoin Treasury holders, Digital Asset Management & Institutional Services, Bitcoin miners, and Trading & Wallets platforms.

Bitcoin Treasury

One of the most notable progressions in Bitcoin’s role in recent years has been its growing adoption on corporate balance sheets as a “treasury reserve” asset. Not satisfied to hold excess cash, or park it in low-yield government securities, some companies are now treating Bitcoin as a long-term store of value to hedge against inflation, monetary debasement, or fiat currency risks. Meanwhile, the evolution of legal and regulatory frameworks has led capital markets to begin tolerating and, in some cases, facilitating firms that raise equity or debt to acquire crypto assets.

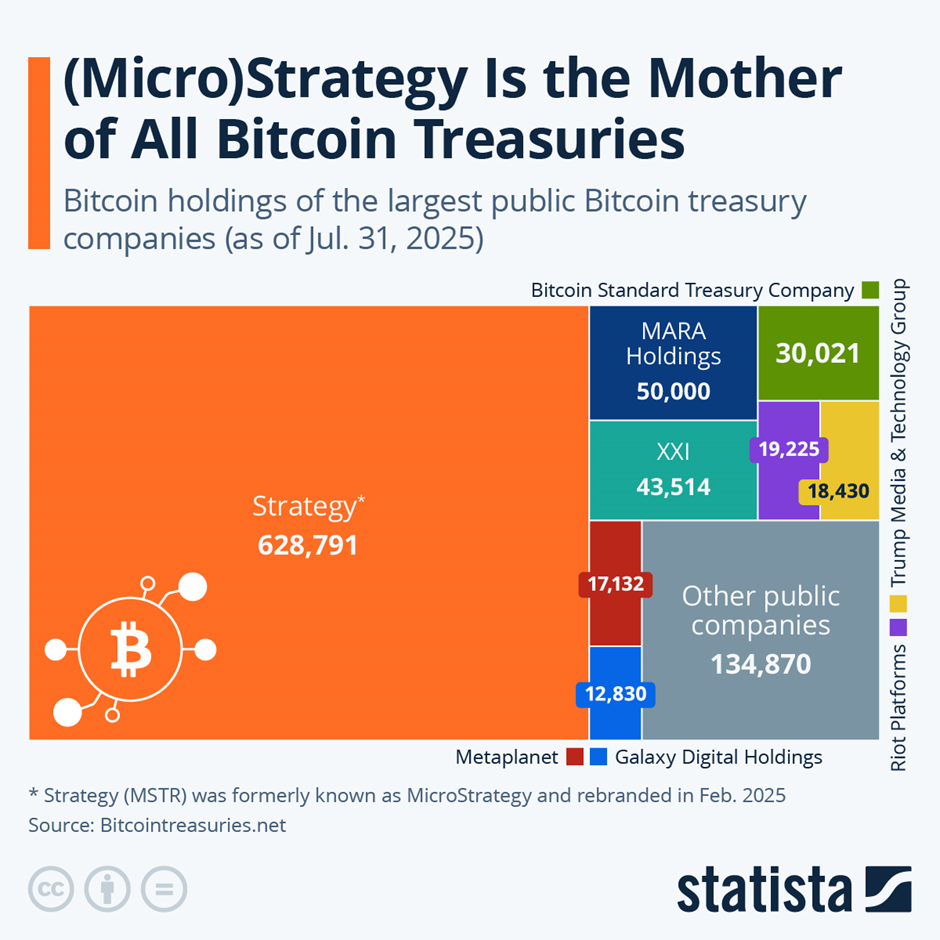

MicroStrategy, which recently rebranded as “Strategy”, is the flagship example of this model. Strategy made its first major Bitcoin acquisitions in 2020. Since then, it has steadily increased its holdings, rebranding as Strategy to emphasize its identity as a “Bitcoin treasury company” or “Bitcoin proxy”.

At the time of this publication – October 23, 2025 – Strategy ownings just over 640,000 bitcoins. Those holdings are valued at over USD$68 billion.

Digital Asset Management & Institutional Services

Several key players are building out full-stack offerings: custody, staking, trading, lending, and structuring investment products that appeal to regulated money managers. This trend has seen regulators open the door for spot Bitcoin ETFs in 2024. Moreover, traditional banks are re-entering or expanding in digital asset custody.

This expansion has included growth in institutional-grade staking, validator operation, and other Bitcoin services. Institutions are exploring ways to generate yield while working to observe security and regulatory requirements. Asset and wealth management firms have launched dedicated funds, many with more familiar investment structures like funds or exchange-trade-funds (ETFs).

Galaxy Digital has been active and strategic in expanding its institutional services. This includes integrating with major custodial infrastructure providers like Fireblocks and BitGo. The company is working with partners to provide additional infrastructure like validation services, lending, custodial support, and trading. Galaxy also boasts an asset management affiliate, where it has rolled out funds and ETFs, sometimes with outside wealth management partnership.

Bitcoin Miners

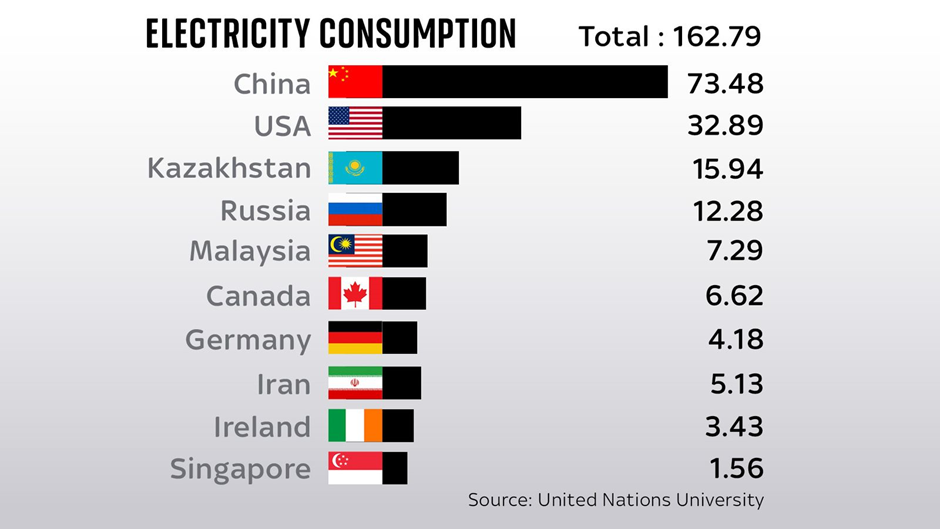

Bitcoin mining is notable for being capital-intensive and energy sensitive. Because of these factors, the margins of miners are often under pressure due to rising network difficulty, upward power and infrastructure costs, and the need to refresh or deploy more efficient ASICs – specialized hardware for efficiently mining cryptocurrencies. Recent reports have revealed that bitcoin mining consumes more electricity than most nations.

Countries Ranked by Electricity Consumption from Bitcoin Mining Operations in 2020-2021

Another key theme for Bitcoin miners is consolidation, scale, and vertical integration. Smaller or more inefficient miners are under pressure. Meanwhile, stronger and larger miners can scale profitably. This has contributed to a greater degree of consolidation in the sector.

Some of the notable miners include companies like Riot Platforms, BitDeer, and Hut 8 Mining. The latter is notable in that is has taken a somewhat different path than its peers. Hut 8 has emphasized its infrastructure, power, and digital infrastructure portfolio. In 2025, the company announced a partnership with Eric Trump and Donald Trump Jr. to launch a new entity, American Bitcoin. Hut 8 will hold an 80% stake and act as the infrastructure and operating partner. The firm will focus on large-scale Bitcoin mining and accumulation.

Trading & Wallets

The regulatory environment has shifted in a positive direction for crypto trading and wallets platforms. Clearer norms have been established in recent years. However, tokenized securities, derivatives, and payment-wallet overlaps will continue to draw some degree of regulatory scrutiny. Meanwhile, wallets are becoming more integrated, and the onboarding process is modernizing. Moreover, the ability to use Bitcoin as payments is improving.

Coinbase is the largest US based cryptocurrency exchange, and the largest Bitcoin custodian on the planet. The company has consolidated its regulatory gains through 2025. On the product side, the company recently acquired Deribit – a major derivatives platform – for approximately USD$2.9 billion. This provides Coinbase a solid footprint in options and futures markets.

Block, Inc. is progressing to blur the line between trading, wallets, and payment infrastructure. They recently announced that Square will enable Bitcoin payments via its Point of Sale hardware. This means merchants will be able to accept BTC payments and be able to choose whether to keep the BTC they receive or automatically convert it to fiat in real time. This Bitcoin payments rollout is expected to begin in the latter half of 2025 and become eligible for a wider rollout in 2026.

HBTE | Leading Companies with the Harvest strategy

HBTE offers investors access to the rapidly evolving Bitcoin ecosystem. Beyond the companies we have already covered here today, HBTE also holds equities like IREN Limited, MARA Holdings, Core Scientific, and offers exposure to the iShares Bitcoin Trust ETF. This essentially provides access to the spot price of Bitcoin.

This ETF combines access to companies within the Bitcoin ecosystem with Harvest ETFs’ proven covered call option writing strategy. HBTE also employs modest leverage at approximately 25%, aiming to generate even higher levels of income and growth potential.

Disclaimer

The information is meant to provide general information for educational purposes. This material is not intended to be relied upon as research, investment, or tax advice and is not an implied or express recommendation, offer or solicitation to buy or sell any security or to adopt any particular investment or portfolio strategy.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether because of new information, future events or other such factors which affect this information, except as required by law.