By Ambrose O’Callaghan

Last month, we released a piece that explored a barbell strategy utilizing Harvest Income ETFs. This strategy aimed to take advantage of opposite sides of the investing “barbell”, maximizing growth and defensive exposure to deliver a balanced result. One of the ETFs we’d targeted on the defensive side was the Harvest Low Volatility Canadian Equity Income ETF (TSX: HVOI). Today, I want to zero-in on why a low volatility strategy could add significant value in the present market. Let’s dive in.

Market conditions in November 2025

The S&P 500 has hit multiple all-time highs through 2025. After hitting yet another peak last week, investors may be wondering whether the market is too frothy at this juncture. Of course, previous bull markets have shown impressive staying power.

Mike Gitlin, the chief executive officer of investment manager Capital Group, recently lauded strong corporate earnings but added “what’s challenging are valuations”. “[Most people] would say we’re somewhere between fair and full,” he continued. “But I don’t think a lot of people would say we’re between cheap and fair.”

Ray Dalio, the prominent hedge fund manager and co-chief investment officer of Bridgewater Associates, has also sounded warnings for a frothy market. “This time the [monetary] easing will be into a bubble rather than into a bust,” Dalio stated. He went on to claim that AI stocks already register as overvalued according to Bridgewater’s proprietary indicators.

Are we at a market top? As always, there is no way to be certain. This bull market has reached a period of maturation. In this environment, a low volatility strategy is one some investors may want to consider.

Why a low volatility strategy could add value

The low volatility investing approach aims to achieve the benefits of equity investing while mitigating the inherent risk within equities. Through this, an effectively structured low volatility exchange-traded fund (ETF) can achieve this by overweighting defensive stocks as well as traditionally defensive sectors. Some examples of defensive sectors include Consumer Staples and Utilities. Meanwhile, the strategy underweights more aggressive sectors like Energy and Materials.

A low volatility strategy seeks to add value in negative markets, and through market cycles. It charts out two objectives to achieve this broader goal:

Low Volatility Strategies | Winning by not losing

Source: Bloomberg, Harvest ETFs. 30 years returns from Feb 28, 1995 to Feb 28, 2025.

The chart above illustrates the the low vol index performed vs the non-low vol index in past market corrections. For example, the dotcom bubble correction in 2001, which saw growth-oriented technology stocks fall from all-time highs. This period stood out as the S&P 500 Low Vol Index finished in the black – up 25% – compared to declines of over 40% for the baseline S&P 500 over that same stretch.

Meanwhile, the 2008 Financial Crisis and 2022 Rates Correction illustrate how low index were able to mitigate losses during periods of heavy market turbulence.

Upside returns & a smoother ride: Lesson from history

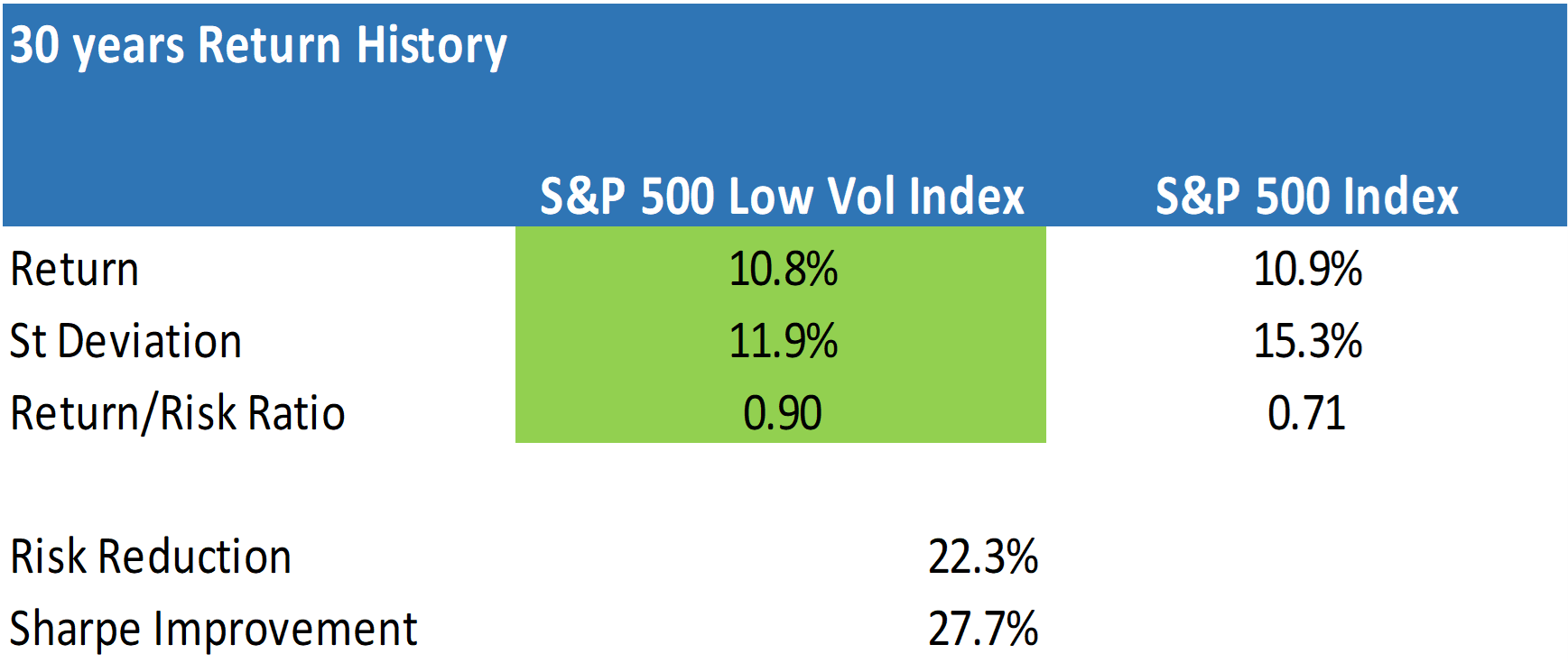

Source: Bloomberg, Harvest ETFs. 30 years returns from Feb 28, 1995, to Feb 28, 2025.

Conventional wisdom may dismiss low volatility strategies for their inability to generate total return over the long term. However, the 30-years return history shows that the S&P 500 Low Volatility Index has delivered comparable returns to the base S&P 500 Index.

The Return/Risk Ratio, or Sharpe Ratio, measures an investment’s risk-adjusted return, (return per unit of risk). It aims to show whether a portfolio’s excess returns are the result of a winning strategy, or simply taking more risk. The chart above shows that the Low Vol index delivered risk reduction of 22% and a Sharpe improvement of 27%.

Two low volatility strategies: Pure low vol and monthly income low vol

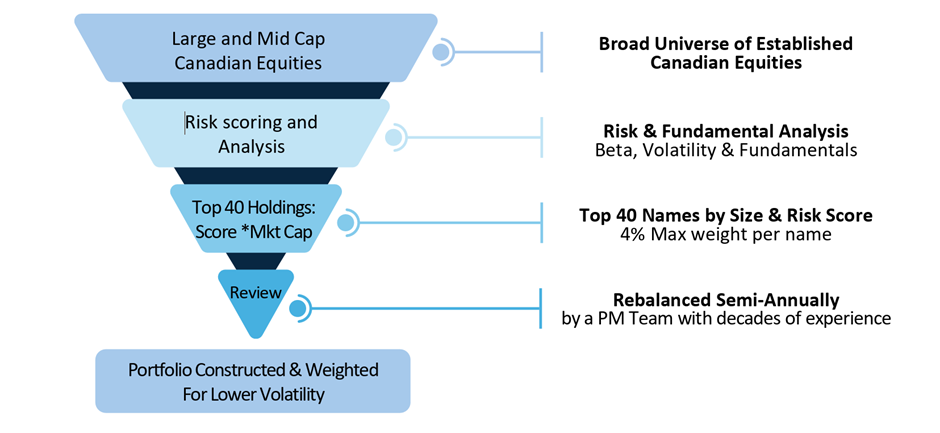

The Harvest Low Volatility Canadian Equity ETF (TSX: HVOL)holds 40 top Canadian equities. These equities are ranked and weighted by their risk score and market cap weight, with a 4% maximum weight per name. The portfolio’s equities are scored according to risk and fundamental metrics. These include risk analysis, Beta – a risk metric that measures an investment’s sensitivity to fluctuations in the broader market, volatility, and implied volatility – a measure derived from options pricing that represents expected future volatility.

H4 Low Volatility | Portfolio Construction

The Harvest Low Volatility Canadian Equity Income ETF (TSX: HVOI) builds on HVOL’s low volatility strategy, while offering monthly cashflow. It seeks to achieve through an active covered call option overlay. This also works to further reduce volatility, while generating monthly cash distributions.

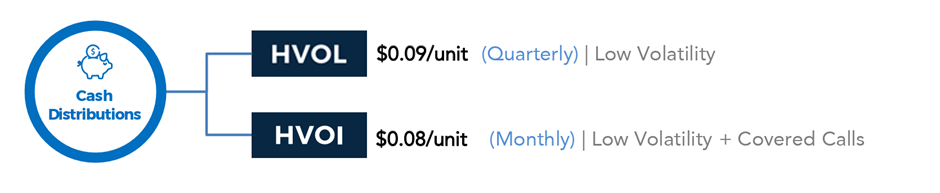

Below are the cash distributions that have been paid out from these respective low volatility ETFs. HVOL seeks to pay a quarterly distribution, last delivering a payout of $0.09 per unit to those holding the ETF. HVOI has delivered a monthly cash distribution of $0.08 per unit since its inception.

Disclaimer

The content of this article should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or use to engage in personal investment strategies. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into available Class units of the Fund you own. If a Fund earns less than the amounts distributed, the difference is a return of capital.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.