By Ambrose O’Callaghan

The spotlight was on the technology sector in 2024 as the artificial intelligence (AI) boom jumpstarted another strong year for the space. By the end of the year, investors were left wondering whether tech could continue its remarkable run. The first half of 2025 has introduced new challenges, but the positive story for tech remains.

The Harvest Tech Achievers Growth & Income ETF (HTA:TSX) offers the best of two worlds by providing access to a burgeoning sector blended with monthly income and downside protection with its covered call option strategy. There is also a levered option, the Harvest Tech Achievers Enhanced Income ETF (HTAE:TSX) that aims to generate higher levels of monthly income through the application of modest leverage.

Technology stocks in the first half of 2025

The S&P Tech climbed 8.05% year-to-date as at June 30, 2025. This translates to it still being ahead of the broader S&P 500 – which was up 6.20% – over the same period.

Since the early mid 2020s, Tech has powered the performance of the broader market. In fact, it stands apart as the only sector that is delivering significant growth to the US economy and the stock market. Currently and looking ahead, Tech remains the beneficiary of artificial intelligence, software development, and the emergence of quantum.

Tech sub-sectors to watch

The AI space continues to soak up much of the attention in the tech sector.

Semiconductors

According to a February report from Deloitte, chip sales are well-positioned to deliver strong growth going forward. While demand from PC and mobile markets has remained muted, the sub-sectors’ growth is bolstered by the emergence of generative AI and data centre build outs.

Deloitte predicts that “gen AI chips will be over US$150 billion in 2025”. Meanwhile, Lisa Su, chief executive officer at Advanced Micro Devices (AMD), “moved her estimate for the total addressable market for AI accelerator chips up to US$500 billion in 2028.” That is larger than the sales totals for the entire chip industry in 2023.

Earlier this year Harvest launched the single stock ETF the Harvest AMD Enhanced High Income Shares ETF (AMDY:TSX). AMDY invests all its assets, directly or indirectly, in shares of AMD. It aims to generate high monthly cash distributions through covered calls while capturing the potential upside of AMD. These are enhanced with the application of modest leverage at approximately 25%. AMDY gives investors a unique opportunity to gain exposure to this US giant while enjoying monthly cash distributions.

Artificial Intelligence

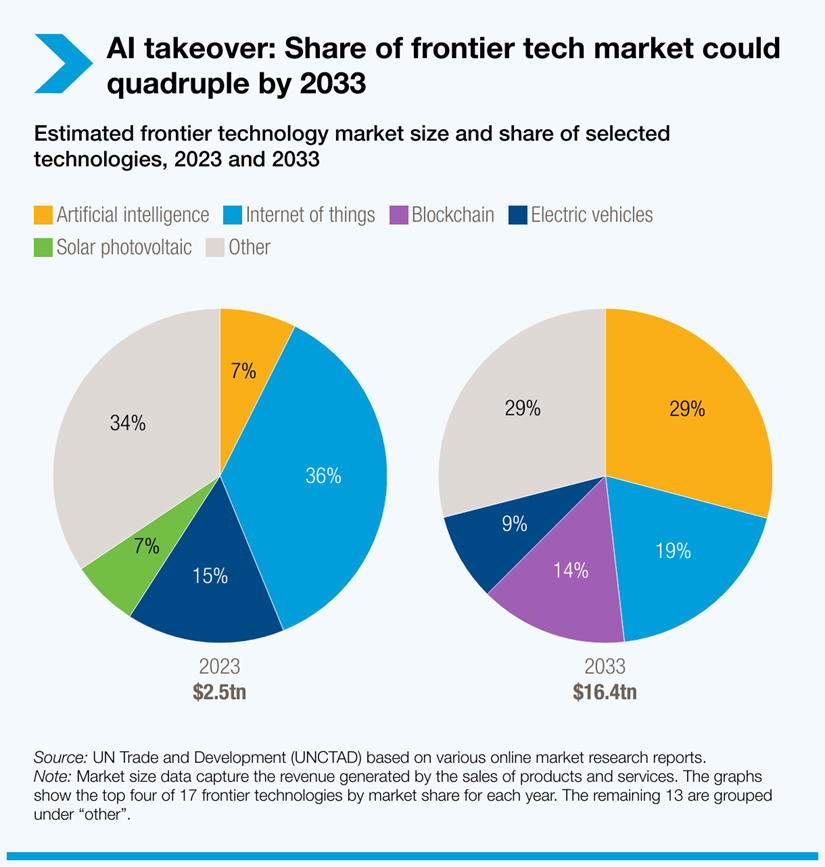

The AI revolution is being felt across many sectors of the economy beyond technology. Indeed, generative AI use is changing the very nature of work, education, and our social lives. A recent UN Trade and Development (UNCTAD) report projects that the global AI market will grow from US$189 billion in 2023 to US$4.8 trillion by 2033. That would represent a 25-fold rise in just 10 years.

Key beneficiaries of the AI boom, particularly in generative AI, include household names and HTA holdings like Microsoft, Meta, and Alphabet (Google).

- Microsoft | The company has developed many AI tools and services, including Copilot, a personal AI assistant, and Azure AI, a platform for building and deploying AI solutions

- Meta | Also offers a personal AI assistant through the Meta AI app, in addition to image and video creation tools and innovations like the Ray-Ban Meta glasses

- Alphabet | Focus on AI includes integration into various products and core businesses like Search and Cloud, development of AI models like Gemini

Software

Unlike the previous two sub-sectors, software has lagged. This is in large part because these areas remain in the research and development phase for their AI solutions. Software companies are eager to monetize generative AI enhancements, but this has proven to be a challenge in the early stages. That reality has weighed on the software space.

Technology: Unknowns and opportunities

Unknowns

Tensions between the U.S. and China have fortunately cooled in the late spring and early summer of 2025. However, it has become apparent that the U.S. government does not want China to have access to the most advanced semiconductors. The U.S. wants to establish itself as a leader in AI from a commercial and defence perspective, and countering China’s rise remains an integral part of executing on that strategy.

Because of this geopolitical reality, there is always the potential for more export restrictions to be enacted. The latest trade dispute between the two economic superpowers saw China restricting the export of rare earth minerals.

As it stands, investors should expect that trade disputes will be ongoing as a long-term resolution appears remote at this stage. On the other hand, the emergence of DeepSeek AI was an example of innovations emerging in this environment. China found a way to develop a chatbot that rivalled ChatGPT while lacking the high-performance chips of their American counterparts.

Opportunities

Piggybacking off that message, AI is still far and away the largest area of investment over the intermediate to long term. However, there are other areas that have received less attention in comparison.

Cryptocurrency and blockchain technologies

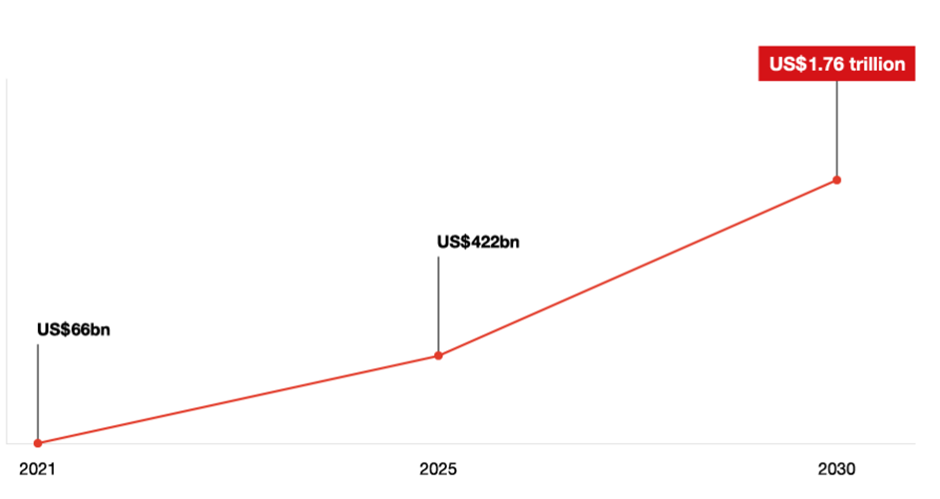

These technologies have spread into other areas. According to a report from PricewaterhouseCoopers (PwC), cryptocurrencies and blockchain “has the potential to boost global economic output by US$1.76 trillion by 2030 . . . experts anticipate that the technology will be used by the majority of companies around the world in the next five years.”

Source: PwC “Global Blockchain Report 2020”

Quantum

Quantum is a little bit of a “wild west” as this space remains very early in its development. It is unclear, at least at this stage, who the winners and losers will be in this space. Moreover, quantum computing companies worth mentioning remain at the smaller-to-midcap end of the spectrum.

Regardless, this remains an area that will be worth watching for investors going forward. A report from McKinsey & Co recently projected that new investments and innovation could propel the quantum market to a US$100 billion valuation in a decade’s time. McKinsey’s research focused on the three core pillars of QT: quantum computing, quantum communication, and quantum sensing. Together, McKinsey predicts that these three could generate up to US$97 billion in revenue worldwide by 2035, with quantum computing leading the way with as much as US$72 billion in revenue generated in 10 years time.

Applying the Harvest Way to tech

Harvest technology ETFs aim to provide growth opportunities and offer high monthly distributions that income seekers will find attractive. They provide access to this top performing growth sector and focused on investing in the sector’s leading companies. The ETFs trade on the TSX with tickers HTA and HTAE. HTAE uses leverage while HTA is unlevered and is available in classes A (CAD-hedged), B (unhedged) and U (USD denominated).

HTA | Harvest Tech Achievers Growth & Income ETF

HTA covers a core US large cap portfolio of dominant technology leaders, including names like Microsoft, NVIDIA, and Apple. It applies an active covered call strategy to enhance portfolio income potential and lower portfolio volatility. HTA has raised its monthly distribution payout five times since its inception. It last paid out a monthly cash distribution of $0.14 per unit, representing a current yield of 9.09% as at July 2, 2025.

Annual Performance

As at January 31, 2026

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 4Y | 5Y | 7Y | 8Y | 10Y | SI |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HTA | 0.39 | (1.41) | 7.04 | 0.39 | 10.91 | 15.55 | 24.71 | 12.27 | 15.65 | 18.85 | 16.21 | 18.31 | 15.42 |

| HTA.B | (0.23) | (3.71) | 6.31 | (0.23) | 6.14 | 18.05 | 27.24 | 15.74 | 18.41 | - | - | - | 20.87 |

| HTA.U | 0.57 | (0.81) | 8.18 | 0.57 | 13.30 | 17.31 | 26.27 | 13.76 | 16.94 | 20.36 | 17.59 | - | 18.67 |

HTAE | Harvest Tech Achievers Enhanced Income ETF

For investors who desire even higher levels of monthly income, there is HTAE. This ETF applies modest leverage to an investment in HTA, offering access to a levered investment in the same portfolio of large-cap tech companies. HTAE has raised its monthly distribution three times since its inception in 2022. It last paid out a monthly cash distribution of $0.16 per unit. That represents a current yield of 11.67% as at July 2, 2025.

Annual Performance

As at January 31, 2026

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.