By Ambrose O’Callaghan

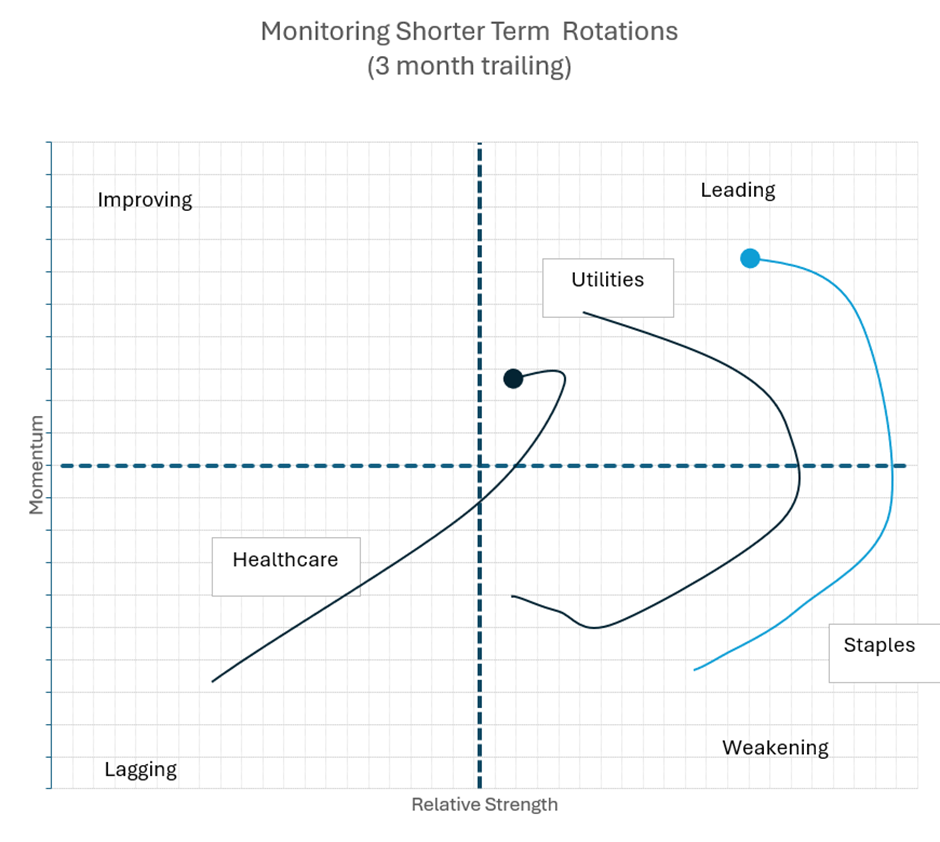

Earlier this month, we explored the market rotations in which sectors like technology, industrials, and even more diverse sectors like consumer discretionary were the major beneficiaries. Indeed, sectors with high-growth potential and higher volatility have thrived since the 90-day pause was announced following “Liberation Day” in the United States. Although economists and analysts continue to point to uncertainty as it relates to tariffs, markets have thrived on a perceived easing of economic anxieties. The “big question” we will explore in this piece is “What has become of more defensive sectors during that stretch?”

Source: Harvest Portfolios Group Inc. For illustration only. June 30, 2025.

The past three months has seen defensive sectors lagged in comparison to more volatile and high-growth sectors like those mentioned above (investors were in what is commonly referred to as “risk-on” mode as they reallocate capital to the high-growth and high-volatility sectors). Other areas like value versus growth indexes and investment factors like size and momentum compared to dividends and quality have reiterated ongoing market dynamics. Yes, the market has hit all-time highs, but there are divergences under the surface.

As we explore the big question, we will look at utilities, healthcare, and take a broader view that will encompass the consumer staples sector. Let’s dive in.

Global utilities | Dominating during summer doldrums

In late June, we provided a review of the utilities space and the Harvest Equal Weight Global Utilities Income ETF (HUTL:TSX). A kick-off statement in that piece was “utilities keep the lights on”. But can they do the same thing for your portfolio? So far in 2025, HUTL – a global utilities portfolio, and the broader utilities space have performed well making their case for a place in a diversified portfolio. Investors that are exposed are currently reaping the benefits.

Annual Performance

As at November 30, 2025

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 4Y | 5Y | 6Y | SI |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HUTL | 0.66 | 2.79 | 5.84 | 16.42 | 11.48 | 15.75 | 10.02 | 8.22 | 8.70 | 5.30 | 6.67 |

When we look at the year-over-year performance, HUTL has nicely outperformed both the S&P/TSX Capped Utilities Index – up 16.58% 1YR as at July 29, 2025 – and the S&P 500 Utilities Index – up 18.47% 1YR as at July 29, 2025. In the previous piece, we focused on the advantages offered by a global utilities portfolio that also utilizes an active covered call writing strategy. To that end we highlighted these key advantages of HUTL

- Global Diversification | Exposure toglobal holdings reduce geographic risk, including catastrophic weather events and regulatory variance

- AI Power Demand Growth | The AI revolution has increased the demand for electricity

- Harvest Covered Call Strategy | The use of atime-tested option strategy to generate monthly income and reduce volatility

- Consistent Income | A portfolio thatprovides consistent monthly cash distributions

There is also a high yield option in the form of the Harvest Equal Weight Global Utilities Enhanced Income ETF (HUTE:TSX). This ETF applies modest leverage to an investment in HUTL, offering access to the same globally diversified portfolio of utilities companies with enhanced monthly cashflow.

Annual Performance

As at November 30, 2025

Healthcare | A storm of headline and policy risk

Previously, we reviewed the challenges faced by the healthcare sector in late 2024 and in the first half of 2025. Headline and policy risks have contributed to turbulence for healthcare stocks throughout 2025, particularly following the “Liberation Day” tariff announcement.

The S&P 500 Healthcare Index has dropped 2.50% in the year-to-date period as of July 29, 2025. Those losses have extended to 10.47% in the year-over-year period for the same index. Unsurprisingly, valuation multiples have compressed significantly across the healthcare sector due to these conditions.

While healthcare combats headwinds in the near term, we continue to see strong long-term fundamentals in the healthcare space. At these valuation levels, healthcare could be an attractive target for investors.

The Harvest Healthcare Leaders Income ETF (HHL:TSX) offers exposure to a portfolio of large-cap US healthcare leaders. This includes Eli Lilly, which is at the forefront of the explosive GLP-1/weight loss drug revolution. HHL is overlaid with an active covered call writing strategy, aiming to generate consistent monthly cash distributions. This ETF last paid out a monthly cash distribution of $0.06 per unit.

Investors looking for access to healthcare with higher growth and income potential may want to consider the Harvest Healthcare Leaders Enhanced Income ETF (HHLE:TSX). This ETF employs modest leverage of approximately 25% on an investment in HHL. HHLE last paid out a monthly cash distribution of $0.0934.

Diversification | Still the only “free lunch”

“Diversification is the only free lunch” in investing. This quote has been attributed to Harry Markowitz, the US Nobel Prize-winning economist. Markowitz’ work on modern portfolio theory emphasized diversification in investor portfolios to reduce risk and enhance returns over the long term.

The Harvest Diversified Monthly Income ETF (HDIF:TSX) holds a portfolio primarily of Harvest equity income ETFs. HDIF captures a large and diverse set of high-quality companies. It provides exposure to sectors like technology, healthcare, global utilities, financials, industrials, and others.

HDIF employs modest leverage at approximately 25% to enhance cashflow and bolster growth potential. The ETF last paid out a monthly cash distribution of $0.0741 per unit.

Annual Performance

As at November 30, 2025

| Symbol | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | SI | |

|---|---|---|---|---|---|---|---|---|---|

| HDIF | 2.23 | 5.31 | 15.21 | 14.24 | 7.94 | 19.98 | 12.98 | 7.52 |

Summary

Defensive sectors have lagged those that are more growth-oriented in the late spring and summer periods in 2025. Still, investors should not ignore the attractive valuations that exist in healthcare, the advantages offered by exposure to global utilities, and the power of diversification in the face of uncertainty. These portfolios provide access to these spaces, while delivering consistent monthly income through Harvest’s active covered call writing strategy.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional. The content of this article is to inform and educate and therefore should not be taken as investment, tax, or financial advice.