By Harvest ETFs

A sustained period of high inflation, market instability, geopolitical tension, two quarters of negative growth in the United States—technically a recession—this year should have been disastrous for the travel industry. Yet, somehow, the industry has continued to recover from COVID-19 pandemic induced downturn.

US total airline passenger numbers are near their pre-pandemic levels. Average fares for US travelers are already above 2019 levels. Hotel occupancy in the U.S. is above 2019, and on par with 2019 globally. Short term rental bookings have been growing faster than ever, and even casino revenues from the Las Vegas strip are up vs. 2019.

This is not to say that travel hasn’t been challenged by 2022’s various crises. Bookings in Europe were hit by the onset of war in Ukraine. Casinos with exposure to Macau have struggled due to China’s ‘Zero-COVID’ policy. While fuel prices have largely been passed on to consumers, the increased costs have had slight impact on demand. Nevertheless, key companies are reporting and forecasting profits.

“Despite higher cost pressures, people are still travelling,” said Kushal Agarwal, portfolio manager at Harvest ETFs responsible for the Harvest Travel & Leisure Index ETF (TRVL:TSX). “We are seeing the long-term trend of older people in North America retiring and spending their time travelling. That’s combined with a millennial generation that prefers to spend on experiences, a shift to remote-work and the shorter-term tailwinds of post-covid demand resiliency for travel.”

Corporate travel offsetting inflation and recession

One of the key surprises of the travel industry’s relative strength this year has been the resumption of corporate travel. The rapid transition to remote work across so many industries in 2020 prompted many analysts to declare the death of the corporate traveler. 2022 has shown that this typically higher-margin customer is alive and well.

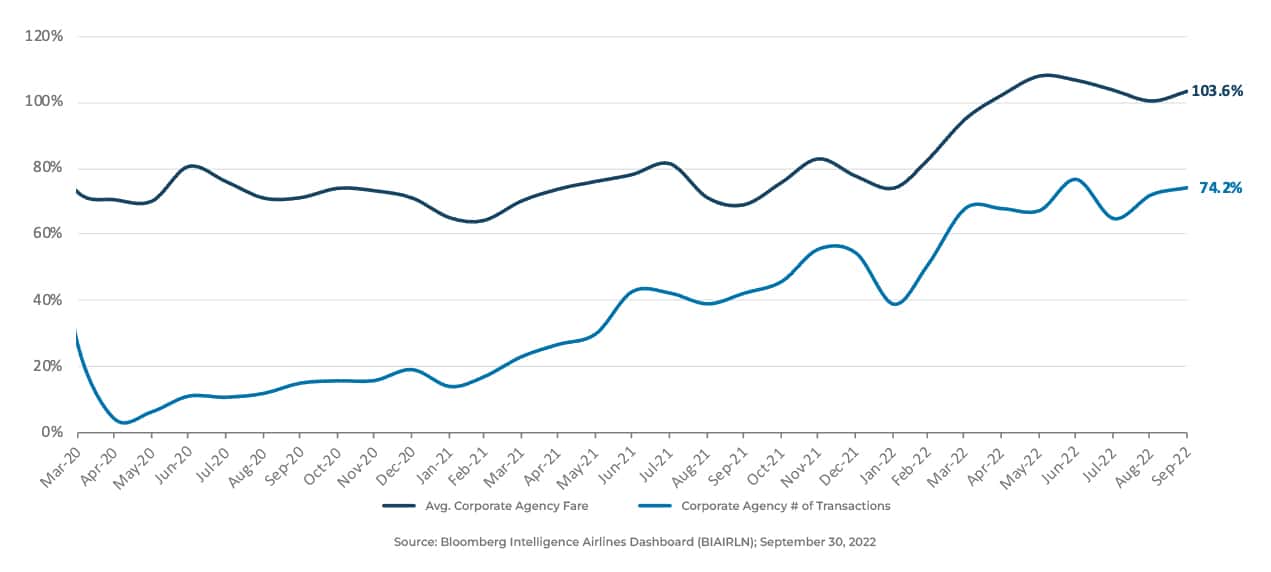

Agarwal notes that corporate trips are hard to parse out from overall travel data, but the rate of corporate travel agency bookings has risen back up to 75% of pre-pandemic levels. And that is despite average fares from corporate agencies surging above 2019 levels. This points to higher profitability for travel companies when demand rises above pre-pandemic levels – as corporate travelers usually form the higher margin accounts for airlines and hotels.

Corporate agency avg. fares & # of transactions as a % of 2019

Agarwal attributes this rapid resumption to the simple principle of competition. Once one business resumes in-person meetings with clients, its competitors will do the same so they can offer a more personable client approach and don’t lose out on another avenue of business. While uncertainties still persist on the macro side, Agarwal believes the recovery of business travel is likely to continue thanks to the inherent social nature of mankind.

Capturing the travel & leisure industry in an ETF

Agarwal noted that the TRVL ETF holds many of the most forward-looking names in the travel space, including travel technology companies like Airbnb and Booking.com. These companies have been instrumental in the lowering of overall travel costs and opening up a wider range of experiences and locations to travelers, especially those experience-driven younger people. Notably, Airbnb has seen a larger share of their bookings come from longer-term stays of 7+ to 28+ nights. Many travelers, for business or pleasure, are using these companies to secure a longer-term stay. At the same time, traditional hotel bookings have recovered most of their 2019 volume and we are seeing an ecosystem where hotels and online bookings websites can coexist.

Those travel innovators sit within a 30-stock diversified basket held by TRVL. The ETF gives investors broad-basket access to the travel industry and other leisure sectors. By holding 30 of the largest airlines, cruise lines, hotels, resorts and casino companies listed in North America, TRVL offers diversified exposure to the ongoing recovery of the travel industry and its long-term tailwinds.

“There is still uncertainty, on the macro level and the travel industry is not immune to that,” said Agarwal. “But when we launched this ETF in 2021, we predicted that long-term demand tailwinds would bring back the long-term growth prospects of the travel & leisure industries. We are now seeing that recovery play out.”

Quoted in this article

|

Kushal Agarwal, CFAPortfolio Manager |