By Ambrose O’Callaghan

The industrials sector typically refers to companies that manufacture machinery, handheld tools, and other industrial products. This sector also includes aerospace and defence firms, as well as companies that are engaged in transportation and logistics services. Industrials are the beating heart of a modern economy. As such, some of the largest companies on the planet are found in this sector. Indeed, the Dow Jones Industrial Index has historically maintained a heavy weighting in this crucial space.

In 2024, the industrials space is drawing significant attention. United States leadership has spurred significant private investment in the manufacturing space. That action is exciting as we consider the three “Rs” – Recovery, Rebuilding, and Repatriation. The burgeoning industrials space offers huge secular growth opportunities at this stage, which is why investors may want to take notice.

Today, I want to explore the three “Rs” and look at a new industrials ETF that offers investors exposure to this sector and acts as a reliable passive income vehicle.

How industrials are fueling an American Recovery

Three key pieces of legislation were enacted by the Biden administration in 2021 and 2022 that are already having a huge impact on the industrials sector.

The Infrastructure Investment and Jobs Act (IIJA) was enacted by the 117th United States Congress and signed into law by President Joe Biden on November 15, 2021. An amended version of the IIJA included approximately US$1.2 trillion in spending. The IIJA included provisions related to federal highway aid, transit, hazardous materials, rail programs of the Department of Transportation, and others. The amended IIJA included funding for broadband access, clean water and electric grid renewal, and additional transportation and road proposals.

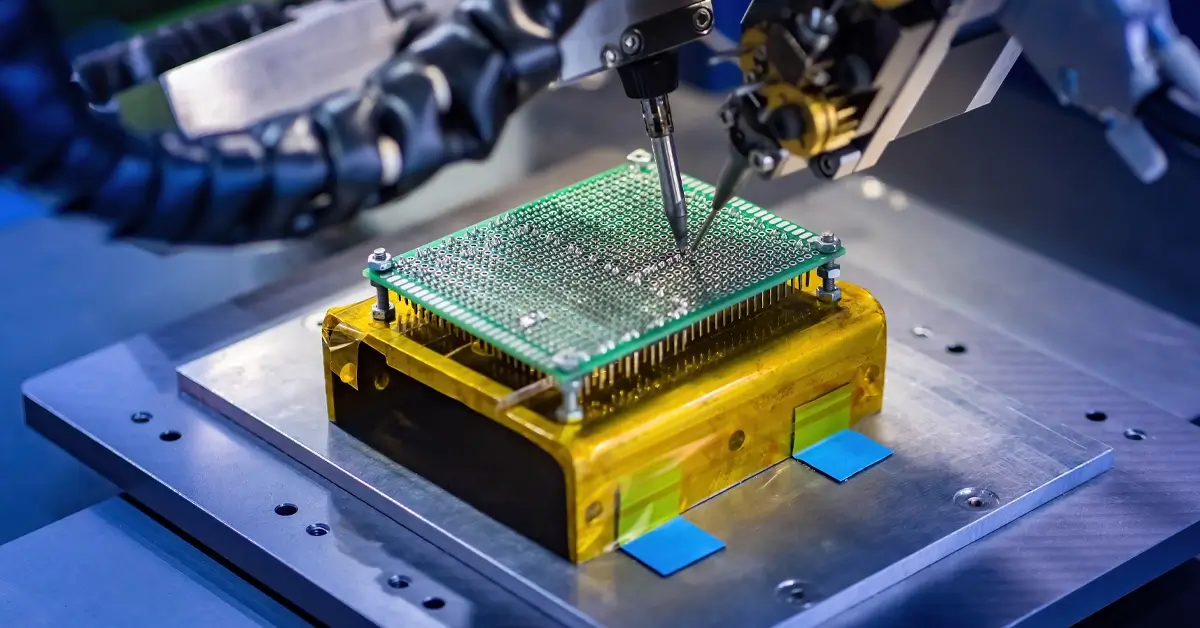

The CHIPS and Science Act was signed into law by President Joe Biden on August 9, 2022. It authorized approximately US$280 billion in new funding aimed at bolstering domestic research and manufacturing of semiconductors in the US.

Finally, on August 16, 2022, the Inflation Reduction Act (IRA) was passed into law. The IRA aimed to curb inflation by reducing the federal budget deficit, lowering prescription drug prices, and investing in domestic energy production.

The Rebuilding of America

The aforementioned acts provide funding for projects that can drive economic growth and prepare the US economy for the transition to net-zero emissions. Moreover, these pieces of legislation make it easier to greenlight projects that will fuel growth.

The renewable energy sector could benefit from supporting infrastructure investment. IIJA includes plans to increase grid resilience, reduce red tape on the approval of transmission, and provide necessary infrastructure around storage and end-of-life recycling for grid-level batteries. The IIJA also earmarked US$7.5 billion for electric vehicles (EVs).

The IIJA dedicates an entire section to the right to own and operate ‘surface transportation’ assets. That includes highways, rail, and intermodal facilities.

Repatriation – American manufacturing is back

US leadership has made a concerted effort to bring domestic manufacturing back strong. To that end, the legislative push will also have the added impact of repatriation. US manufacturing will be a larger player in the semiconductor space, while innovations like automation could reinvigorate the US manufacturing base in the 2020s and beyond.

According to a statement from the Biden White House in 2022, the United States manufactures just 12% of the world’s chips – down from 37% in 1990. The CHIPS and Science Act aims to reverse that trend. Semiconductor projects are already underway in the US. McKinsey & Company recently estimated that the value of domestic semiconductor projects under consideration totalled US$223 billion to over US$260 billion through 2030. Of the up to US$260 billion investment in new US fabs, about US$183 billion is attributed to projects that are ongoing or announced.

Industrials are also primed to benefit from automation. Another report from McKinsey & Co projects that automation in the industrials space will have a huge impact due to the pace of change that has resulted from technological disruptions, macrotrends like reshoring, as well as environmental, social, and political factors.

An industrials ETF with an income advantage

Harvest ETFs’ leadership has identified these exciting trends in the industrials space. With that, it is proud to announce the launch of the Harvest Industrial Leaders Income ETF (HIND:TSX).

HIND will seek to provide unitholders with an opportunity for capital appreciation through exposure to leading industrial companies and emerging trends. Moreover, HIND will be overlayed with an active covered call option writing strategy. HIND will write up to 33% covered calls to generate high monthly cash distributions.

Industrials are bolstered by diverse growth drivers at this stage. Investors now have the opportunity to take advantage of this sector’s growth potential, while also generating consistent monthly income. HIND offers exposure to industrial giants and delivers steady monthly cashflow with its covered call strategy.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this article is to inform and educate and therefore should not be taken as investment, tax, or financial advice.