By Ambrose O’Callaghan

The year 2024 started in a similar fashion as 2023. The mega-cap concentrated technology sector fuelled positive upward momentum.

Economic data slowed in the first quarter of 2024. Meanwhile, relatively defensive areas benefited through the spring months and again through the end of the summer season as recession concerns resurfaced ahead of the first interest rate cut in August.

How a “soft landing” has impacted the market

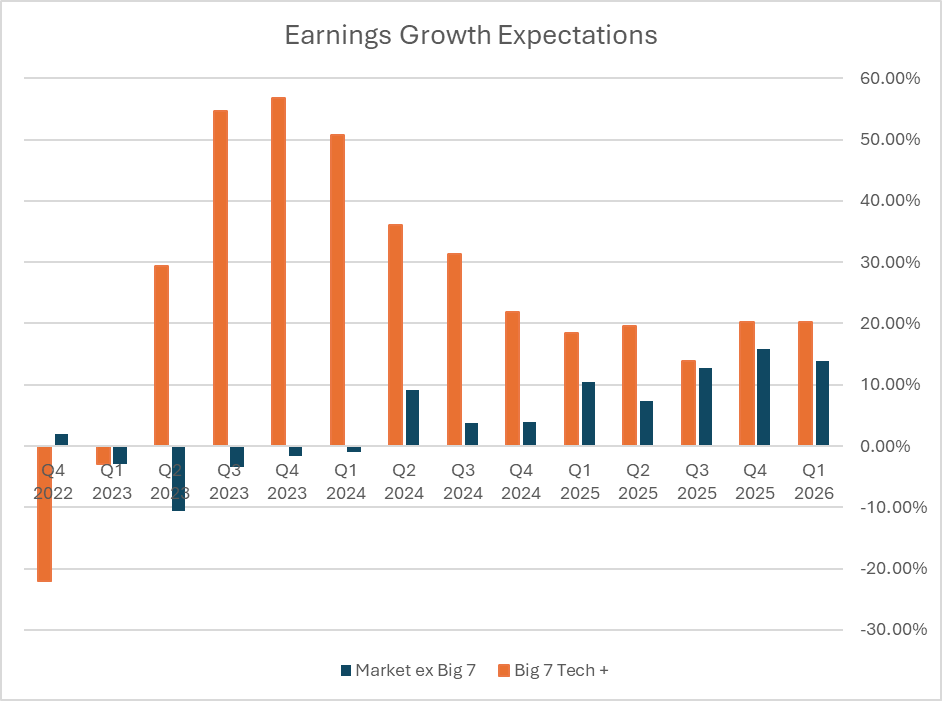

Equities and bonds continued to be very sensitive to the day-over-day economic data points. In another period these data points might have less impact on the behaviour of individual stocks and bonds. The chart below illustrates the dramatic shift in earnings growth expectations from 2022 through to the first quarter of 2026. Market and investor sentiment has improved as the US Federal Reserve has seemingly been able to orchestrate a “soft landing”.

Source: Bloomberg, January 10, 2025.

The ability of the Fed to produce a “soft landing” in 2024 was reflected in the meaningful uptick in earnings expectations for the entire market. Previously, the Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta, and Tesla) has been the driving force, outshining the broader market.

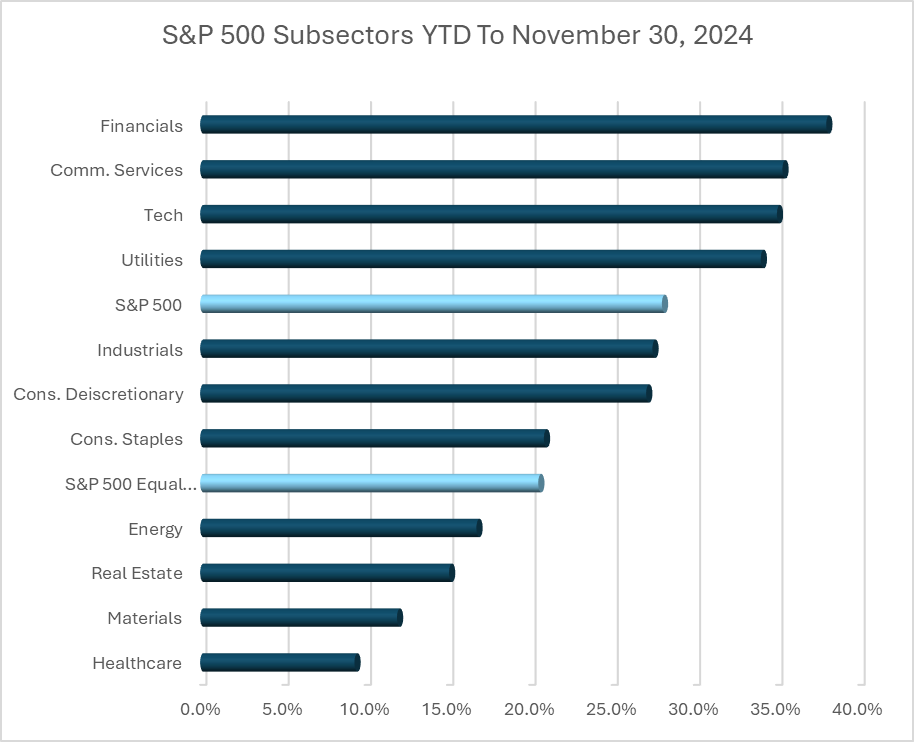

Through November 2024, the stock market rejoiced the certainty of the coming Republican administration. It continued to rally hard through to the end of November with nearly every sub-sector up over 10%.

Source: Harvest Portfolios Group, Inc. January 2025.

Transitioning from 2024 to 2025

The month of December 2024 closed as only the third negative month of that calendar year. Factors like tax loss selling, volume voids, and policy rhetoric compounded to contribute to the decline in the final month of the previous year. Regardless, the broader markets finished in the black for the second year in a row with a 20% upward movement. That rate of increase is a rarity over the past 40 years. That said, the strong move upward does not mean a correction is more likely to occur in 2025.

Coming into December, many Harvest Equity Income ETFs hit 52-week highs on the back of said momentum. The Harvest Diversified Monthly Income ETF (HDIF:TSX), which holds a portfolio of Harvest Equity Income ETFs including the Harvest Healthcare Leaders Income ETF (HHL:TSX) and the Harvest Tech Achievers Growth & Income ETF (HTA:TSX), finished the year up 18.98% as at December 31, 2024.

Annualized Performance

As at January 31, 2026

| Symbol | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | SI | |

|---|---|---|---|---|---|---|---|---|---|

| HDIF | 0.46 | 3.78 | 10.63 | 0.46 | 11.71 | 16.62 | 13.33 | 7.60 |

One of the bigger unknowns heading into 2025 remains policy risk. Recent history has demonstrated that political rhetoric can have a material impact on economic activity, and on the ebbs and flows of the domestic and international markets. Moreover, geopolitical relations surrounding tariffs have the capacity to stir volatility in the near term.

In our January product commentary, we highlighted that we are able to measure the uncertainty in policy. The present level of uncertainty is the third highest after the COVID-19 pandemic and the Financial Crisis/Great Recession. That said, the first Trump administration was no stranger to uncertainty and speculation surrounding policy. In the end, it was an event that was separate from politics (COVID-19) that provided the black swan event in the first Trump administration.

Policy and geopolitical questions are macroeconomic clouds that investors will want to pay close attention to in the year ahead.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.