By David Wysocki

Canadian investors need income and returns from their ETF investments. The trouble is, they’re hard to find. High inflation since 2022 has exceeded rates available through most fixed income tools, prompting some Canadians to reconsider financial goals like retirement. At the same time, rate hikes intended to cool inflation have prompted higher market volatility and dampened some aspects of the market recovery we’ve seen so far in 2023.

One sector that has been a stronger performer, despite the wider market environment, is large capitalization (large-cap) technology. The tech sector, and specifically the biggest companies in tech, have been a significant contributor to total market returns. While investing in tech stocks can help Canadians find returns, tech stocks alone don’t necessarily pay much income.

That’s where covered call ETFs come in. For example the Harvest Tech Achievers Growth & Income ETF (HTA:TSX) offers a portfolio of 20 large-cap tech companies, plus a consistent monthly cash distribution generated by an active & flexible covered call option strategy. However, some investors are seeking higher returns and higher income from their tech investments. That’s why Harvest launched the Harvest Tech Achievers Enhanced Income ETF (HTAE:TSX).

How HTAE delivers higher income & growth prospects

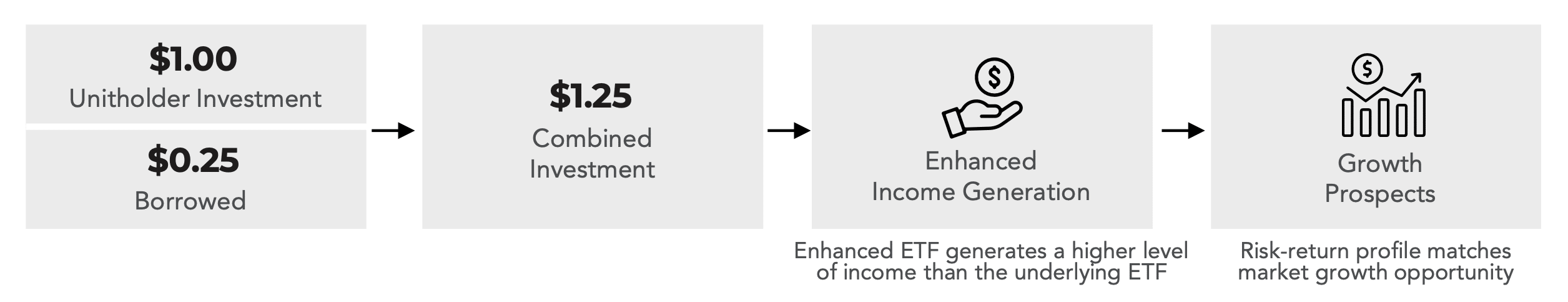

HTAE is designed to deliver even higher income and growth prospects from the same portfolio of tech stocks as HTA. It’s an enhanced equity income ETF, which means HTAE uses a modest amount of leverage (borrowed money) to deliver its higher yield and market growth opportunity.

As the below graphic explains, leverage is an established investment strategy whereby some money is borrowed and invested in a security. In the case of HTAE and Harvest’s other enhanced equity income ETFs the ETFs themselves borrow money at a proportion of approximately 25% and invest that borrowed money in their underlying ETF.

HTAE exclusively holds units of HTA. The leverage component adds to the income generated by HTA and amplifies the ETF’s movement up and down on the market. It therefore generates a higher monthly income distribution and comes with a higher risk-return profile.

Why leverage (borrowed funds) and covered calls work well together

The leverage used in HTAE can be combined with the covered call options used to generate its income distribution. Covered call options strategies involve a degree of trade-off between returns and income. By selling call options on a portion of portfolio holdings, those holdings do not participate in market upside opportunity. While Harvest ETFs use active management to try to minimize the impact of that trade-off, it remains an aspect of all covered call ETFs.

Leverage, however, enhances the upside capture of the ETF portfolio. The borrowed money invested in HTAE’s underlying ETF—HTA—is also partially participating in the market upside potential of HTA’s portfolio.

The leverage can add to the income generated by HTA and it can also contribute to upside capture. HTAE adds modest leverage and invests in units of HTA, that ETF has 20 large capitalization technology (large-cap tech) stocks with an active covered call strategy.

It should be noted, however, that leverage amplifies performance to the upside and downside, and if HTA’s holdings lose value then the leverage in HTAE exacerbates that loss. As a result, HTAE has a higher risk rating than its underlying ETF.

Why a leveraged strategy can suit tech investors

The tech sector has been a market leader for most of the last ten years. Tech companies have been growth engines for investors as their innovations and strong business fundamentals resulted in above average equity returns. However, a high growth industry also comes with risks, and the underlying stocks often benefit when investors are bullish and markets are in a ‘risk on’ environment- meaning investors are more ready to take on risk because they expect returns. HTAE offers opportunity for a ‘risk on’ investor to participate in Tech’s upside.

First and foremost, HTAE’s portfolio is exclusively allocated to the HTA ETF. HTA itself holds a portfolio of large-cap tech companies diversified across subsectors. That means the ETF reduces undue concentration risk, and by focusing on large-cap established businesses its portfolio is less driven by technological hype than some smaller-cap tech companies.

The monthly income generated by this ETF is another key aspect of its total returns. While market values may move up and down on holdings, the monthly cash distributions for HTAE are paid each month. In a down market or an environment where returns are muted, that cash flow can be a contributor to overall total returns.

By combining a portfolio of large-cap tech leaders with high monthly income from a covered call option strategy and modest leverage HTAE can contribute to the returns and income that Canadian investors are seeking.

David Wysocki

David Wysocki is the VP of National Sales at Harvest ETFs. He is a seasoned sales executive who began his career as a financial advisor before taking on a sales role to develop the ETF market for a leading Canadian financial institution. David now leads a large team of sales professionals across Canada. He has a deep knowledge of Harvest products and the broader market and regularly presents ETF insights and macro commentaries to Canadian financial advisors.