By Ambrose O’Callaghan

Healthcare is evolving to reflect the needs of aging populations in the developed world, as well as changing spending and priorities of those in the developing world. Together these have an outsized impact on the sector. In a November Insights piece, we’d explored why these long-term drivers made global healthcare a unique long-term opportunity.

That piece highlighted the growth in the proportion of the North American population aged 60 and over – from 23% in 2020 to nearly 30% in 2050. Indeed, that ratio is even more pronounced in Europe, with those over the age of 60% expected to rise from 26% in 2020 to 35% by 2050. Meanwhile, healthcare expenditures in developing markets like China and India have grown at a remarkable rate.

The development of AI has generated a lot of discussion about the systemic changes in healthcare. It is an exciting development, but investors should not expect to see the kind of widespread adoption that justifies the attention, at least in the near term. Today, we’re going to zero-in on areas in healthcare with AI exposure that justifies attention.

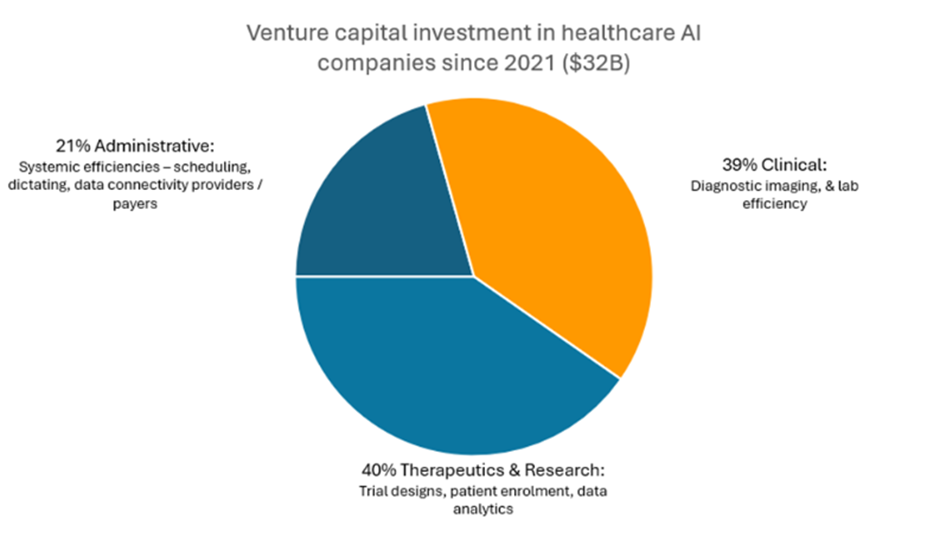

In November, we covered the catalysts and innovations that were present in the healthcare space in 2024. We pointed to a Silicon Valley Bank report that showed investment in healthcare AI was dominated by three spaces: Clinical, therapeutics & research, and administrative, as the chart below illustrates.

Source: AI in healthcare report: Silicon Valley Bank.

AI in healthcare administration

Healthcare organizations are increasingly adopting AI to improve efficiencies from a clinical and operational perspective. This puts AI on a path to transform how healthcare organizations will operate over the long term. AI has impacted administrative areas like scheduling, improving efficiencies in areas like payments, as well as insurance and physician dictating. Some of the companies that have adopted these advancements include UnitedHealth and Elevance Health, which are holdings in the Harvest Healthcare Leaders Income ETF (HHL:TSX).

The administrative side has seen systemic efficiencies adopted which include areas like scheduling, insurance and physician dictating, and adding efficiencies on payments. UnitedHealth Group, a holding in HHL, has trumpeted the benefits of AI in improving its efficiencies. In a page on how it is using AI to “create efficiencies and simplify experiences”, UnitedHealth includes a message from its Chief Digital and Technology Officer; “At UnitedHealth Group, we’re using our AI superpowers in three core ways: we are simplifying the administration processes (including customer experiences); building new data science platforms; and offering medical and clinical insights to help physicians and clinicians focus on what they do best.”

AI in healthcare clinical diagnostics

Clinical diagnostics involves the process of identifying diseases, conditions, or injuries based on the signs and symptoms a patient is having, as well as the patients, health history and physical state. AI is being used in this area to improve the efficiency and accuracy of disease detection, analysis, and even treatment.

According to a study from PricewaterhouseCoopers (PwC), “AI is already being used to detect diseases, such as cancer, more accurately and in their early stages.” A high proportion of mammograms yield false results, according to the American Cancer Society. This has led to 1 in 2 healthy women being informed that they have cancer. AI is enabling healthcare providers to review and translate mammograms 30 times faster and with 99% accuracy. That will reduce the need for biopsies going forward.

AI in healthcare therapeutics research

The clinical trial process is long and arduous for healthcare companies. According to a report from Nature Portfolio, a publication that serves the research community, over the last 60 years, the number of drugs approved in the United States per billion dollars in R&D spending had halved every nine years. Now, it can take more than a billion dollars in funding and a decade of rigorous work to bring a new medication to the market. Half of the funds are typically spent on clinical trials. Moreover, only one in seven drugs that enters phase I trials is eventually approved.

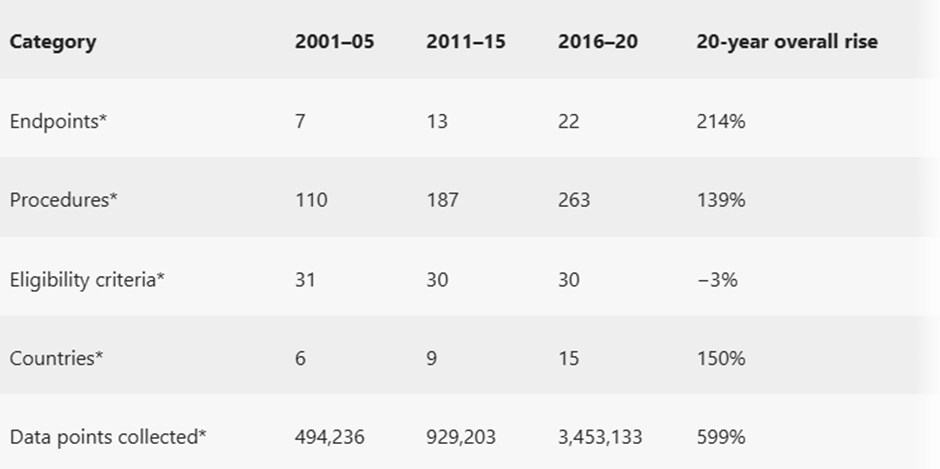

Source: Tufts Center for the Study of Drug Development. *Mean of total numbers.

This chart shows that the number of countries that have conducted clinical trails have more than doubled since the 2001-2005 period. Meanwhile, data points collected have erupted by nearly 600% over the past 20 years. Endpoints – the measurable outcomes that determine if a medical intervention is beneficial to the patient – and procedures – used to measure outcomes – have increased by 214% and 139%, respectively, in that same period.

Advances in AI are being used to potentially shorten these timelines and reduce costs.

Intelligent Medical Objects, a company in Rosemont, Illinois, has developed SEETrials. This method involves prompting OpenAI’s Chat GPT-4 to extract safety and efficacy information from the abstracts of clinical trials. This has the potential to enable trial designers to accelerate the process of checking the work of other researchers that have designed trials, as well as determining their respective outcomes.

Access to healthcare and high monthly income | HHL & HHLE

HHL offers access to a portfolio of 20 large-cap global healthcare stocks, several of which are investing in AI development.

The ETF has paid out a cash distribution every single month since its inception, which represents a decade of strong and steady monthly income. HHL has also been one of the top performers in the healthcare category in Canada over this period.

Annualized Performance

As at December 31, 2025

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 4Y | 5Y | 7Y | 8Y | 10Y | 11Y | SI |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HHL | (1.02) | 9.49 | 12.92 | 10.57 | 10.57 | 7.18 | 6.99 | 5.58 | 8.99 | 9.11 | 8.29 | 7.53 | 7.23 | 7.04 |

| HHL.B | (2.59) | 8.54 | 14.85 | 7.53 | 7.53 | 10.56 | 8.70 | 8.83 | 11.54 | - | - | - | - | 10.78 |

| HHL.U | (0.84) | 10.06 | 13.94 | 12.62 | 12.62 | 8.64 | 8.21 | 6.63 | 9.87 | 10.13 | 9.30 | - | - | 9.58 |

Source: Harvest Portfolios Group, Inc.

Investors looking for higher levels of income and growth potential should consider the Harvest Healthcare Leaders Enhanced Income ETF (HHLE:TSX). This ETF applies modest leverage – about 25% – to an investment in HHL. HHL currently offers a monthly cash distribution of $0.0934 per unit, which represents a current yield of 11.45% as at December 12, 2024.

Annualized Performance

As at December 31, 2025

Source: Harvest Portfolios Group, Inc.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.