By Ambrose O’Callaghan

The artificial intelligence (AI) boom has become one of the most powerful forces shaping today’s market and the broader economy. In 2022, the debut of ChatGPT – an advanced large-language model (LLM) – officially put the world on notice. AI had arrived. Further breakthroughs in AI, including more advanced chatbots and data processing, is powering innovation across various industries.

Companies that have developed or deployed AI technologies are attracting billions in capital. This is driving market enthusiasm and heightening competition. Investors are flocking to this burgeoning sector with a litany of opportunities. This includes semiconductor firms that are powering machine learning models, to cloud platforms enabling AI adoption at scale.

A broad AI ecosystem has emerged in this environment. This dynamic landscape has made AI investing a central area of focus. Today, I want to highlight four income-focused ETFs that offer exposure to this exciting space. Let’s jump in.

AI development and the broader tech space

Back in February, we’d discussed how investors could play the AI race following the emergence of DeepSeek. In January, technology stocks were rattled as the Chinese AI model showed capabilities that rivalled ChatGPT and other sophisticated US-made LLMs. On the other hand, the MIT Technology Review detailed why these claims could be misleading. Later figures suggest that DeepSeek was more energy intensive when generating more complex results than its equivalent-sized LLMs.

A report from S&P Global in the summer projected that the generative AI market would deliver revenue growth at a 40% compound annual growth rate (CAGR) from 2024 through to 2029. As far as the US-China AI race was concerned, the report reiterated that “63% of 2024 revenue attributed to AI providers” were based in North America. Moreover, over 250 generative AI vendors made their home in the United States. So, while China’s AI vendor count has increased, the US remains the dominant player in this space.

The Harvest Tech Achievers Growth & Income ETF (TSX: HTA) is an equally weighted portfolio of 20 large-cap technology companies. Currently, that includes big players in the AI space like Apple, NVIDIA, Meta Platforms, Alphabet, Microsoft, and others. For investors who want that tech exposure, and enhanced monthly income, there is the Harvest Tech Achievers Enhanced Income ETF (TSX: HTAE). HTAE employs modest leverage at approximately 25% to HTA’s portfolio to bolster monthly income and growth potential. With the use of leverage, HUTE is classified as an alternative exchange-traded fund, as the leverage amplifies return volatility on both the upside and the downside.

Annual Performance

As at January 31, 2026

Nvidia making strides in 2025

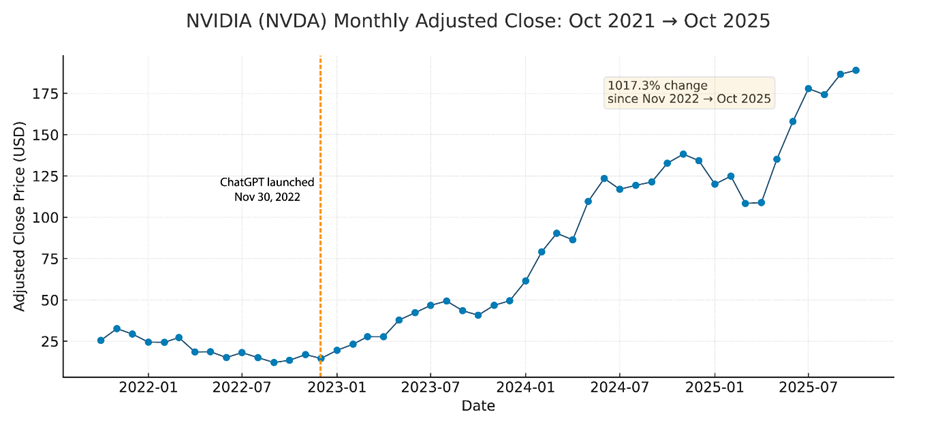

NVIDIA was founded in 1993 by Jensen Huang. The company rose to prominence with a focus on graphics processing units (GPUs) that were primarily used for video games. In 2006, NVIDIA dedicated over $1 billion to develop CUDA, a software platform that enabled GPUs to run parallel programs for a wide range of sophisticated applications. However, it was the introduction of ChatGPT by OpenAI in late 2022 that propelled NVIDIA to dizzying new heights.

Source: NVIDIA historical monthly adjusted close prices (Oct 2021–Oct 2025) from Digrin, retrieved October 2025. ChatGPT public release date (Nov 30, 2022) from OpenAI’s official announcement.

Nearly three years after OpenAI introduced ChatGPT to the world, kicking the AI boom into high gear, the company is now partnering with Nvidia on a massive project. In late September, Nvidia said it would invest as much as US$100 billion in OpenAI to support an enormous build-out of data centres that will be equipped with Nvidia’s chips.

Nvidia also unveiled its second quarter fiscal 2025 earnings in late August. The company delivered record quarterly revenue of US$30 billion – up 15% from the first quarter and 122% compared to the previous year. It also reported record quarterly data centre revenue of $26.3 billion. That was up 154% in the year-over-year period.

Canadian investors can get exposure Nvidia stock with higher monthly income with the Harvest NVIDIA Enhanced High Income Shares ETF (TSX: NVHE). NVHE is overlayed with an active covered call writing strategy to generate monthly cashflow. It employs modest leverage at approximately 25% to bolster its monthly cash distribution and growth potential. With the use of leverage, NVDHE is classified as an alternative exchange-traded fund, as the leverage amplifies return volatility on both the upside and the downside.

NVHE does not pay a fixed distribution but the prevailing market conditions have allowed it to delivered distribution of $0.22 per unit every month since its inception in August 2024.

Annual Performance

As at January 31, 2026

| Ticker | 1M | 3M | 6M | YTD | 1Y | SI |

|---|---|---|---|---|---|---|

| NVHE | 2.76 | (5.32) | 10.37 | 2.76 | 54.99 | 30.21 |

Palantir: A leader in AI-powered security

Palantir Technologies, founded in 2003 by Peter Thiel, Stephen Cohen, Joe Lonsdale, and Alex Karp, specializes in building and deploying software platforms for the intelligence community in the United States, United Kingdom, and a handful of other nations. The company’s namesake – “Palantir” – is the name of the magical seeing stones in the Lord of the Rings series. In the series, the spherical glass-like stone objects are used for communication and intelligence gathering.

In the aftermath of the September 11, 2001, attacks, U.S. intelligence agencies were tasked with fighting a global war on sophisticated terror networks. Palantir’s early innovations sought to integrate large, fragmented datasets that could contribute to actionable intelligence. Its core products include Gotham, an enterprise platform used for planning missions and performing investigations using disparate data, and Foundry, which has been used for data integration and analysis by some of the larger players in the private sector including Morgan Stanley and PG&E.

Palantir launched AIP in 2023, its flagship AI environment. According to the company, AIP will act as a control layer that embeds LLMs and machine learning into defence and enterprise operations. Because of its long history with U.S. government contracts, Palantir is one of the few companies that is trusted to incorporate AI in classified and mission-critical environments.

By 2030, PwC projects that “the integration of AI technologies in areas such as predictive decision-making, collaborative autonomous systems, and dynamic resource management is set to revolutionize military operations, offering unprecedented precision, agility, and resilience”. Palantir is well-situated to take advantage of this trend as it is one of the most relied-upon U.S. government contractors in the space.

Canadian investors can access Palantir in an ETF that is built to generate a high yield, every month – the Harvest Palantir Enhanced High Income Shares ETF (TSX: PLTE). It overlays covered calls and applies modest leverage in an investment in Palantir to enhance exposure and generate high levels of monthly cashflows. Due to the use of leverage, PLTE is classified as an alternative exchange-traded fund, as the leverage amplifies return volatility on both the upside and the downside.

How AI is fueling a utilities growth bomb

Last year, Harvest ETFs Portfolio Manager Mike Dragosits discussed how AI power demand was creating an opportunity in the utilities space in a special Harvest Market Minutes episode. I’d discussed this subject more in depth in an Insights piece titled “How AI is Driving Global Utilities Demand”.

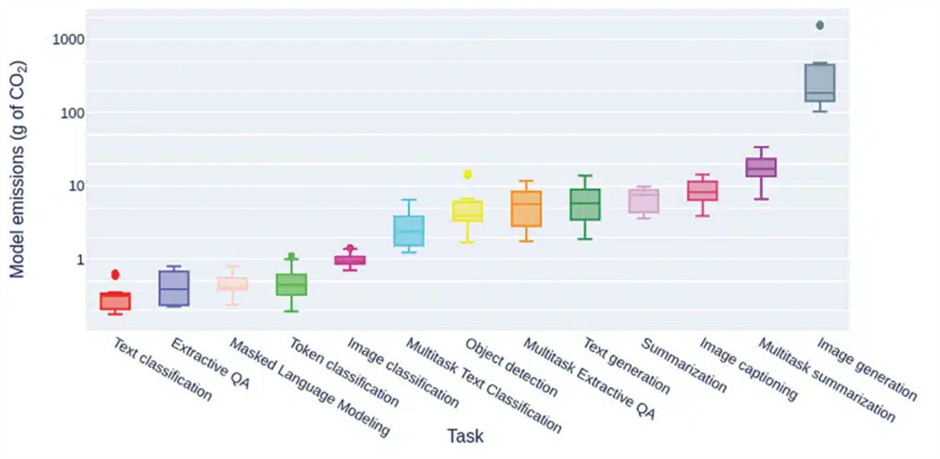

That piece detailed the stark difference in energy consumption when comparing a ChatGPT query to a traditional Google search. With generative AI use exploding, we have been able to more rigorously track the energy consumed by this technology. A piece from Polytechnique Insights projected that “the increase in electricity consumption by data centres, cryptocurrencies, and AI between 2022 and 2026 could be equivalent to the electricity consumption of Sweden or Germany” in that same stretch.

BLOOM is the world’s largest open multilingual LLM. Scientists have estimated that training the BLOOM AI model emits roughly 10 times more greenhouse gases than the average French citizen in an entire year. Of course, more complex queries or requests lead to more energy consumption. Generating an image is far more energy intensive than an image classification, for example. The chart below illustrates the variance in energy consumption to tasks.

Energy Consumption of Generative AI Models

Source: “Generative AI: Energy Consumption Soars”, Polytechnique Insights. November 13, 2024.

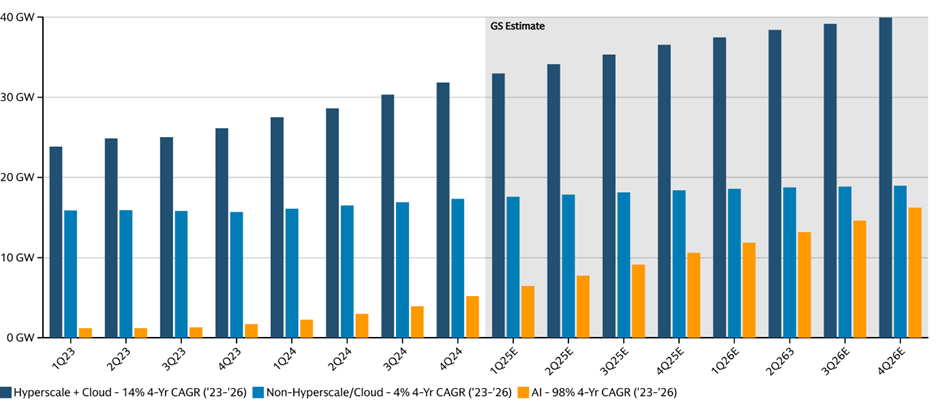

This surge in energy consumption has contributed to a ramp up in power demand. Utilities are well-positioned to benefit in this environment. A recent Goldman Sachs piece showed analysis that estimated current demand for AI would grow from 13% of the overall market to 28% by 2027.

Goldman Sachs Research’s Baseline Forecast for Global Data Center Demand

Source: Goldman Sachs Research, “How AI is Transforming Data Centers and Ramping Up Power Demand.” https://www.goldmansachs.com/insights/articles/how-ai-is-transforming-data-centers-and-ramping-up-power-demand

The Harvest Equal Weight Global Utilities Income ETF (TSX: HUTL) provides Canadian investors exposure to US electric utilities with names like Avangrid, Dominion Energy, FirstEnergy Corp., Eversource Energy, and others. US electricity demand is being fuelled by the AI boom. Moreover, data center markets are concentrated heavily in the U.S., Asia, and Europe. HUTL focuses on a portfolio of global utilities, providing access to this burgeoning space.

HUTL is overlayed with Harvest’s proven covered call strategy. It pays out a monthly cash distribution to its unitholders.

Annual Performance

As at January 31, 2026

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 4Y | 5Y | 6Y | 7Y | SI |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HUTL | 4.37 | 4.59 | 7.59 | 4.37 | 19.18 | 18.02 | 11.22 | 7.47 | 9.47 | 5.24 | 6.88 | 7.09 |

For investors who want even higher levels of monthly income, there is the Harvest Equal Weight Global Utilities Enhanced Income ETF (TSX: HUTE). HUTE employs modest leverage of approximately 25% on an investment in HUTL. With the use of leverage, HUTE is classified as an alternative exchange-traded fund, as the leverage amplifies return volatility on both the upside and the downside.

Annual Performance

As at January 31, 2026

Summary | Accessing the AI boom through Income ETFs

Through this piece, we have charted the Harvest ETFs that offer exposure to a rapidly evolving AI space. This can come through more broad tech access from ETFs with long track records like HTA or HTAE, or exposure to the growth of AI power demand through HUTL or HUTE. Or, from recent Harvest single stock ETFs that have launched since August 2024, including NVHE – a NVIDIA-focused single stock with covered calls and leverage, or PLTE – a single stock ETF that applies covered calls and leverage to an investment in Palantir.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into available Class units of the Fund that you own. If the Fund earns less than the amounts distributed, the difference is a return of capital. Tax, investment and all other decisions should be made with guidance from a qualified.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.