By Ambrose O’Callaghan

The year 2025 has brought significant changes for Canada. In November 2024, Republican Donald Trump won his second Presidential term over Democratic candidate Kamala Harris. The new GOP administration vowed to take an aggressive stance when it came to asserting its interests in global trade. It did not take long for Canada to find itself in the crosshairs in 2025.

In February, the United States took aim at its North American neighbours, imposing tariffs on goods from both nations. The US moved to exempt goods that were compliant with the United States-Mexico-Canada Agreement (USMCA) in March, meaning that over 85% of Canada-U.S. trade remained tariff-free. This somewhat tempered the trade war between the US and Canada.

Still, the trade war shook the Canadian political scene, reversing the fortunes of the ruling Liberal party. These events propelled former Bank of Canada governor Mark Carney to win the Canadian election as Liberal leader, becoming Canada’s 24th Prime Minister. Carney won on a platform of economic nationalism, job creation, and middle-class tax reform.

Now, as we approach the end of a momentous year, the Carney government has sought to reassure the population with its new direction. What can investors glean from the new budget, and Canada’s current economic direction? Today, we will dive into these questions, and target three Canadian-centric Harvest ETFs.

2025 Budget | A new day for Canada?

Meeting the Moment, Building Canada Strong. That is the title and focus of the Liberals’ proposed budget that they released in November 2025. The budget promises to “harness [Canada’s] strengths” in laying out a “generational investment strategy-to supercharge growth and build a clean electricity grid, unlock the full value of our critical minerals, accelerate housing construction, and drive innovation in sectors like artificial intelligence, life sciences, and advanced manufacturing.”

Markets in the U.S. have benefited from AI-fuelled optimism. This has been illustrated in the rise of stocks like Nvidia, Alphabet, and Palantir. However, investors may benefit from diversification away from these mega trends.

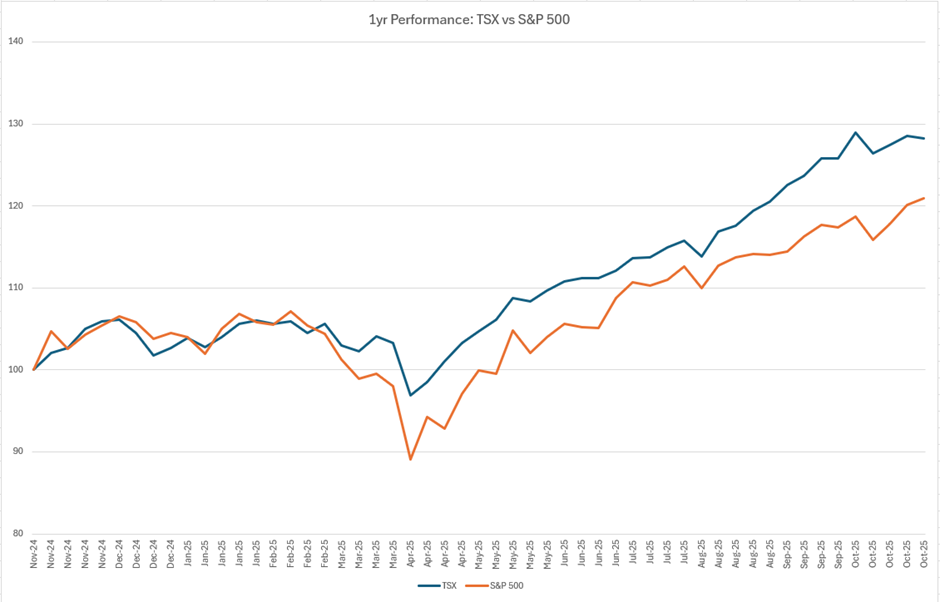

Another development that has potentially flown under the radar is the performance of Canadian equity markets over the past year. In general, non-US equity markets have had a very strong year. Investors have sought to diversify in this uncertain trade environment.

Source: Harvest ETFs, as at November 14, 2025.

This year, the S&P/TSX Composite Index is up 25%, versus 17% for the S&P 500. Moreover, the TSX is slightly outperforming on a five-year return basis as well. The message should be clear: The Canadian market is strong and offers attractive opportunities for investors.

HHIC | Growth-Oriented with Higher Income

Harvest ETFs launched its Canadian High Income Shares™ ETF suite in August 2025. This builds on the Harvest single stock ETF lineup. Currently, there are 10 Canadian blue chip stocks that are part of the Canadian High Income Shares suite, as well as a diversified one ticket solution – the Harvest Canadian High Income Shares ETF (TSX: HHIC).

HHIC Holdings

*Distribution per unit is variable (amount paid may change from month to month)

HHIC utilizes an active covered call option writing strategy. It employs modest 25% leverage, to enhance growth and income potential. It holds companies across major sectors like financials, energy, materials, and telecom. The most established companies in Canada enjoy economies of scale, which help bolster growth objectives over the long term.

Harvest High Income Shares ETFs™ also offer the ability to invest individually in leading Canadian stocks, with additional income generation from an active covered call option strategy. For example, the Harvest Shopify Enhanced High Income Shares ETF (TSX: SHPE). SHPE offers exposure to one of the biggest success stories in Canadian tech. This ETF offers access to a portion of the upside of Shopify, with high monthly income from covered calls and the application of modest leverage.

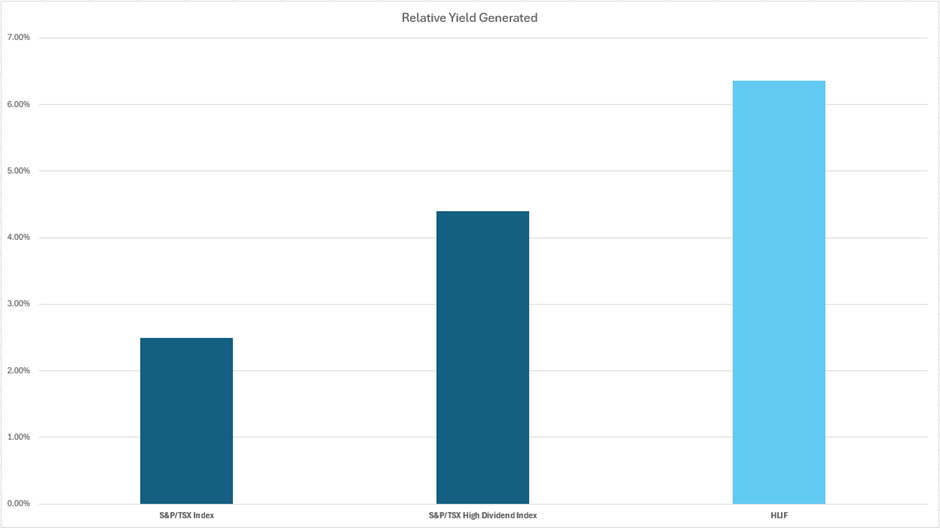

HLIF | Canada’s Dividend Leaders

The Harvest Canadian Equity Income Leaders ETF (TSX: HLIF) focuses on a productive segment of the Canadian equity market: blue-chip dividend payers. Dividend based equities have a strong historical track record in Canada, punctuated by Canadian banks, and supplemented with insurers, pipelines, and telecommunications leaders.

HLIF: Quality companies with long dividend-Growth streaks

53 Years | Canadian Utilities Ltd.

51 Years | Fortis Inc.

32 Years | Thomson Reuters

30 Years | Enbridge

These are four holdings in HLIF that boast some of the longest dividend-growth streaks in the portfolio. A dividend king is a stock that has achieved at least 50 consecutive years of annual dividend growth. Canadian Utilities and Fortis are the only two Canadian equities that have reached this milestone, and both are in HLIF.

Source: Harvest ETFs, as of November 14, 2025.

Annual Performance

As at February 28, 2026

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | SI |

|---|---|---|---|---|---|---|---|---|

| HLIF | 6.40 | 9.17 | 20.18 | 8.56 | 33.92 | 25.74 | 17.49 | 12.85 |

HLIF screens of strong yield, large-cap Canadian equities. The portfolio is made up of 30 dividend-paying equities, broadly diversified by sector. HLIF’s covered call overlay provides additional tax efficient income.

HVOI | Defensive Positioning & 100% Canadian Equities

Low volatility strategies allow investors to stay invested in equities, while reducing their risk exposure relative to broader markets. Typically, broader markets have higher risk associated with them. Last week, we released a piece on why a low volatility strategy could be a worthwhile play in this market: How a Low Volatility Strategy Adds Value in This Market | HVOL & HVOI.

The Harvest low volatility approach utilizes a robust scoring framework. It manages risk to ensure large sector and security bets are not being taken. Historically, low volatility strategies have delivered solid performance, while also managing market risks.

The Harvest Low Volatility Canadian Equity Income ETF (TSX: HVOI) is a broadly diversified strategy with a focus on lower risk equities. It also utilizes a covered call option overlay to provide additional income. As much, it presents an attractive diversification opportunity versus US equities, which tend to be more growth focused.

Summary

The AI boom and other growth trends propelled US equities to new heights in 2025. However, market turbulence has emerged in recent trading days. Investors may seek to create more well-rounded and diversified portfolios by looking outside the United States.

Canada’s recent track record has been impressive, particularly when it pertains to the outperformance of the S&P/TSX Composite Index. Moreover, new leadership has shown more pragmatic, pro-business tendencies toward policy, including infrastructure investment and tax reform. Adding Canadian exposure through well-constructed ETF exposures may yield benefits for investors.

Disclaimer

The content of this article should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or use to engage in personal investment strategies. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into available Class units of the Fund you own. If a Fund earns less than the amounts distributed, the difference is a return of capital. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

The current yield represents an annualized amount that is comprised of 12 unchanged monthly distributions (using the most recent month’s distribution figure multiplied by 12) as a percentage of the closing market price of the Fund. The current yield does not represent historical returns of the Fund.

The Funds that use modest leverage of 25% do so to enhance exposure, directly or indirectly, to the underlying stocks. This places them within the category of liquid alternative ETFs. The use of leverage increases the return volatility, meaning it will amplify both gains and losses.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.