By Harvest ETFs

What is a Covered Call ETF?

A covered call ETF is a type of exchange-traded fund (ETF) that seeks to generate income by selling call options on stocks held within the portfolio. The ETF typically holds a diversified basket of stocks and sells call options on a portion of those stocks, with the goal of earning additional income from the option premiums.

The strategy of selling covered call options can be a useful way to generate income, as the option premiums received can boost the overall return of the portfolio.

Covered call ETFs can provide investors with a way to gain exposure to a diversified portfolio of stocks while generating additional income through the sale of call options. However, it’s important for investors to understand the risks involved in this strategy, including the potential for limited upside and the possibility of losses if the underlying stocks decline in value.

As with any investment, it’s important to carefully evaluate the risks and rewards of a covered call ETF before making an investment decision. Harvest ETFs offers a wide suite of covered call option ETFs, click here to learn more about them.

Benefits of Covered Call ETFs

There are several potential benefits of covered call ETFs.

One of the main benefits of covered call ETFs is that they can generate additional income for investors. By selling call options on some of the stocks within the portfolio, the ETF can earn premiums, which can help to boost the overall return of the fund.

Another potential benefit of covered call ETFs is that they can provide some protection against market downturns. Since the ETF is selling call options on some of the stocks it owns, it may be able to generate additional income even if the underlying stocks decline in value.

Covered call ETFs typically hold a diversified basket of stocks, which can help to reduce the overall risk of the portfolio. By spreading investments across multiple companies and industries, investors can reduce their exposure to individual stock or sector risk.

Harvest Healthcare Leaders Income ETFs offer an effective way to increase income yield through their active and flexible covered call option strategy. Along with the advantages previously mentioned, this approach gives portfolio managers the ability to seize potential market upswings by writing calls on select parts of the portfolio.

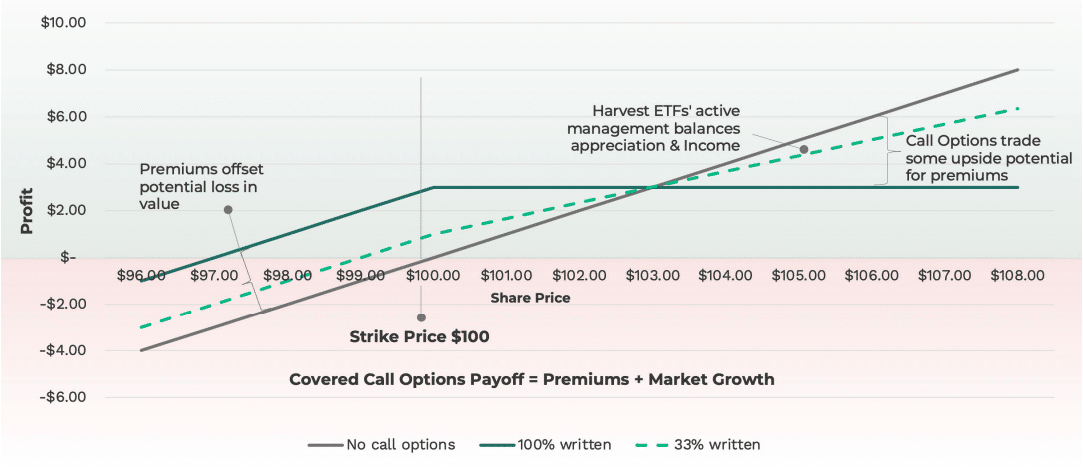

How Harvest ETFs Strikes a Call Option Balance

Source: Harvest ETFs

How do Covered Call ETFs Make Money?

Covered call ETFs generate income by selling call options on the underlying stocks held in their portfolio. When an investor buys a covered call ETF, they are essentially buying a portfolio of stocks that have covered calls written on a portion of them.

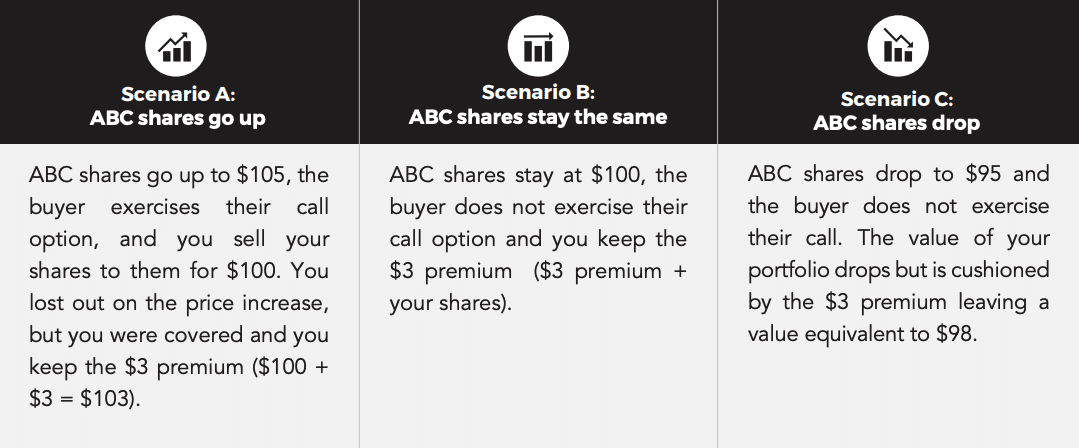

Covered call ETFs generate income by selling call options on the underlying stocks in their portfolio. When an investor buys a covered call ETF, they are acquiring a portfolio of stocks with written covered calls on a portion of them. The ETF, when selling a call option, receives a premium and assumes the obligation to sell the underlying stock at the strike price. Conversely, the buyer of the call option pays a premium and gains the right to purchase the underlying stock at the strike price.

This premium represents the income earned by the covered call ETF. If the stock price remains below the strike price until the option expires, the option will not be exercised, and the ETF will keep the premium as profit. If the stock price rises above the strike price, the option will be exercised, and the ETF will sell the underlying stock at the strike price, the ETF will still keep the premium as a profit and will have benefited from the rise in the stock price on the unwritten portion of the stock held in the portfolio.

Premiums from the covered call strategy are generally taxed as capital gains and therefore more tax efficient than many other sources of investment income.

The income generated by the covered call options can be distributed to investors as distributions or reinvested to grow the ETF’s net asset value (NAV). In either case, the covered call strategy aims to generate a steady income stream while potentially limiting downside risk by selling call options at a higher price than the current stock price.

Harvest Equity Income ETFs and Enhanced Equity Income ETFs are investment vehicles designed to provide investors with regular income while also providing the potential for long-term capital appreciation. Both of these types of ETFs pay distributions on a monthly basis, typically in the form of cash, which allows investors to benefit from the power of compounding.

Compounding is the process by which an investment’s earnings are reinvested to generate additional earnings over time. By receiving regular monthly distributions and reinvesting those funds back into the ETF, investors can take advantage of this compounding effect. Over time, this can lead to significant growth in the value of an investment, as the reinvested earnings generate even more earnings.

Are covered call ETFs Worth It?

Whether covered call ETFs are worth investing in depends on your investment goals and risk tolerance

Income Generation: Covered call ETFs can be a good option for investors seeking income generation. By selling call options on the underlying stocks, these ETFs can generate income, which is then distributed to investors in the form of dividends or reinvested to grow the ETF’s NAV.

Lower Volatility: Covered call ETFs may provide lower volatility than traditional equity ETFs since the call options sold by the ETFs can provide a cushion against potential downside risk.

Opportunity Cost: The downside of selling call options is that it limits the upside potential on a portion of the underlying stocks. If the price of the stocks rises above the strike price of the call options, the ETF will not participate in the full upside potential. This means that the ETF may underperform compared to traditional equity ETFs in a bullish market.

Costs: Covered call ETFs may have higher expense ratios than traditional equity ETFs due to the added cost of implementing the options strategy. Investors should carefully consider the costs associated with these ETFs.

The decision to invest in covered call ETFs ultimately depends on an individual’s investment goals, risk tolerance, and overall portfolio strategy. Harvest ETFs offers a suite of different equity income ETFs that use a covered call strategy to provide investors with these benefits while targeting different segments of the market. They offer another category of ETFs with enhanced equity income that invest in underlying equity income ETFs with the addition of modest leverage.

At Harvest ETFs, we take an active approach with its covered call option strategies. In all of Harvest’s equity income ETFs, calls are limited up to 33% of the underlying portfolio in order to keep the majority of the ETF exposed to market upside potential. The premiums received from selling the options are used to generate income for the fund, which can be distributed to shareholders as dividends.

Three Outcomes for Covered Calls in Different Market Scenarios

Source: Harvest ETFs

Deciding if a Covered Call ETF is right for you

Covered call ETFs can be a useful tool for investors seeking to generate income from their investment portfolios while potentially reducing downside risk. By selling call options on underlying assets, these ETFs can provide a steady source of income that can help offset any losses from the underlying assets. However, as with any investment, there are risks involved and investors should carefully consider their investment objectives and risk tolerance before investing in covered call ETFs.

If you’re interested in learning more about covered call ETFs with Harvest, consider exploring our options here. With careful consideration and due diligence, these ETFs can potentially enhance your investment portfolio with a reliable stream of income.