By Chris Heakes, MFin, CFA

Senior Portfolio Manager

There are strong tactical reasons, from an investment standpoint, for investors to consider allocating to non-Canadian stocks. There are many meaningful investment opportunities that lie outside the Canadian border. After all, Canadian equities represent about 3% of Developed and Emerging market equities.

Meanwhile, the United States represents 67% of the world’s equity market. This is without mentioning the powerhouse global stocks that include Microsoft, NVIDIA, Amazon, and Costco, among many others. These are dominant global leaders that investors often consider allocating to in some form.

All non-Canadian equities will trade in currency other than Canadian dollars. That has implications for the total return of a portfolio. Security selection and asset allocation tend to be the primary driver of overall total portfolio return. However, currency can also be an important component in the overall return profile of non-domestic investment returns.

Harvest ETFs Investment Associate Muneeb Moin provides a breakdown of currency hedging in the ETF space in the video below.

Unhedged equity investments

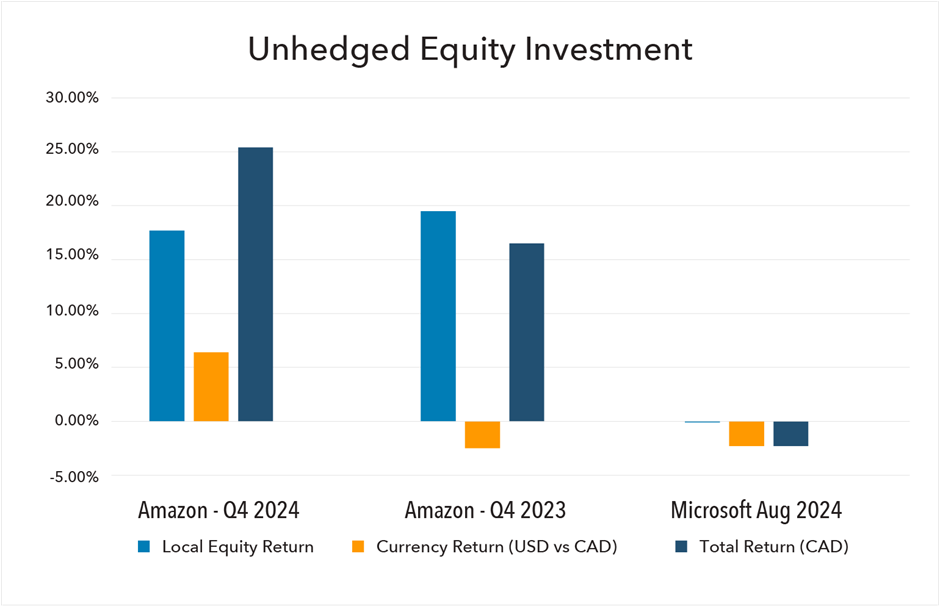

For an unhedged equity investment, the approximate math to consider is:

Here is an illustration of how this process has played out for two top US stocks:

Source: Bloomberg

Over time, US Dollar currency (USD) unhedged equity exposures have tended to deliver similar returns, with less volatility versus USD hedged equities.

|

Index |

Annualized Return |

Volatility |

|

Solactive GBS United States 500 Hedged to CAD Index |

10.00% |

15.60% |

|

Solactive GBS United States 500 CAD Index |

12.30% |

12.10% |

|

May 2006 to January 2025 |

||

Source: Solactive, February 2025.

This follows from the diversification benefits of having USD exposure over time. However, in shorter time frames the currency tends to fluctuate according to its own drivers. Such fluctuation may increase or detract from overall total strategy returns. A good example that’s currently playing out is the ongoing trade tensions between the US and its counterparts, which could drive currency fluctuations in the near term.

The latest additions to the Harvest Single stock ETFs product lineup – MSTY, CONY, PLTE, METE, TSLY, and HHIS, are not currency hedged, and as such are subject to currency fluctuations.

The product line as a whole, the Harvest High Income Shares ETFs, offers exposure to select US companies on both an unlevered, and modestly levered (~25%) basis, with a covered call writing strategy overlaid up to 50% of the position to generate high monthly cash distributions. In addition, these give Canadian Investors the opportunity to gain exposure to Non-Canadian equities at a reasonable cost compared to buying the stocks directly. The use of leverage on the enhanced version will elevate the risk rating slightly.

The application of leverage and the use of covered call among other market factors can further influence the returns of the Harvest High Income Shares.

The Harvest High Income Shares are TSX traded, and as such investors can gain access to the US powerhouses that they hold.

For those investors wishing to consider currency-hedged investment exposures (which aim to mitigate the impact of currency fluctuations), Harvest offers many ETFs on a currency hedged basis, such as the Harvest Healthcare Leaders Income ETF (HHL:TSX), the Harvest Tech Achievers Growth & Income ETF (HTA:TSX), the Harvest Diversified Monthly Income ETF (HDIF:TSX), and others.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.