By Avinash D’Souza

Introduction

The surge in Bitcoin adoption fueled by “Crypto Week” legislative momentum, record-breaking Bitcoin ETF inflows surpassing USD $1.18 billion in just one day, and Bitcoin’s ascent to new all-time highs above USD $123,000 are impressive milestones. Their convergence creates a compelling backdrop for the Harvest Bitcoin Enhanced Income ETF (HBIX:CBOE) and the Harvest Bitcoin Leaders Enhanced Income ETF (HBTE:CBOE). Both HBIX and HBTE are income-generating strategies that capitalize on Bitcoin’s elevated volatility. They use modest leverage to enhance exposure while providing downside protection through a covered call overlay that’s used to generate income.

“Crypto Week” Catalyst

The U.S. House Republicans’ “Crypto Week” initiative represents a pivotal regulatory moment. It saw lawmakers prioritizing legislation of digital assets (e.g., cryptocurrencies like bitcoin, Ethereum, stablecoins) and reviewing multiple crypto-related bills including the CLARITY Act, the Anti-CBDC Surveillance State Act, and the Senate’s GENIUS Act. For the first time, lawmakers are working toward codified rules for crypto markets — offering the promise of regulatory clarity, better investor protection, and more market stability.

This regulatory clarity coincides with unprecedented institutional adoption, as evidenced by Bitcoin ETFs in the U.S. logging an inflow of USD $1.18 billion on Thursday, July 11, 2025- their largest daily inflow of 2025.

The coming together of regulatory momentum and increased institutional investments suggests a “legitimization flywheel” is forming that rotates from: Clearer regulation → More institutional comfort → Larger capital flows → Market maturity → Transparency for Investors

Market Dynamics

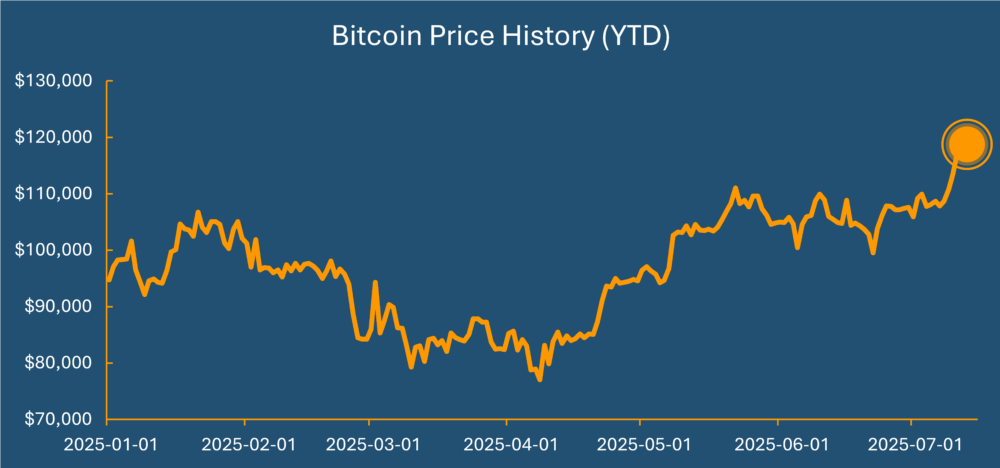

- Bitcoin Performance: Bitcoin surged to new highs above $123,000 for the week of July 7th, the cryptocurrency was up nearly 10%, recording its best performance since April 2025

Source: Bloomberg, as at July 15, 2025.

- Institutional Momentum: Globally, corporate Bitcoin acquisitions have surpassed ETF purchases in the first half of 2025. This was driven by publicly listed companies acquiring over 245,000 BTC; a 375% increase on a Year-over-Year basis and more than double the net inflows from Bitcoin ETFs. Although ETFs hold the largest amount at over 1.4 million BTC, the momentum has clearly shifted. Public companies now hold roughly 855,000 BTC, about 4% of the total supply. This makes Q2 2025 the third consecutive quarter where public firms have outpaced ETF accumulation.

- ETF Market Growth: This year, global digital asset products have attracted a net inflow of USD $18.96 billion, with Bitcoin representing nearly 83% of those inflows. Total Bitcoin ETF assets under management have exceeded USD $50 billion, with cumulative net inflows reaching USD $36.9 billion since early 2024. Weeks of consistent inflows confirm that what we’re seeing is not a retail-driven frenzy, but a steady pipeline of capital from asset managers and corporate treasuries.

The Case for HBIX & HBTE: Bitcoin Exposure with Enhanced Income

Harvest Bitcoin Enhanced Income ETF (HBIX)

HBIX provides direct exposure to the performance of Bitcoin while simultaneously generating additional income through an active covered call strategy. It offers investors access to:

- Underlying Asset: 100% allocation to established Bitcoin spot ETFs

- Leverage: Modest 25% leverage for enhanced income potential and growth potential

- Income Generation: Active covered call writing strategy targeting monthly distributions

Its primary benefit lies in providing direct exposure to the performance of Bitcoin while enhancing income opportunities.

Harvest Bitcoin Leaders Enhanced Income ETF (HBTE)

HBTE provides exposure to the Bitcoin ecosystem through 15 leading publicly-traded companies. It offers investors the benefits of:

- Portfolio Composition: Companies deriving value from Bitcoin holdings, mining, or Bitcoin-related services

- Leverage: Modest 25% leverage for enhanced income potential and growth potential

- Income Generation: Active covered call writing strategy targeting monthly distributions

Its key advantage is a diversified portfolio with exposure to the Bitcoin ecosystem enhanced by operational leverage.

Side-by-Side Summary

| Features | HBIX | HBTE |

| Core Exposure | Bitcoin price via ETF | Top 15 Bitcoin ecosystem companies |

| Holdings Exposure | Single asset (Bitcoin via ETFs) | Diversified: Multi-company and multi-sector |

| Covered Call Overlay | Active, up to 50% | Active, up to 50% |

| Leverage | ~25% | ~25% |

| Last Monthly Distribution | $0.24/unit | $0.33/unit |

| Risk Rating | High (Bitcoin volatility) | High (equity + crypto correlation) |

| Tax-Advantaged Eligible | Yes (RRSP, TFSA, etc.) | Yes (RRSP, TFSA, etc.) |

| Management Fee | 0.65% | 0.75% |

Strategic Outlook

- Crypto Week Momentum: Both HBIX and HBTE have benefited from renewed enthusiasm for Bitcoin and its ecosystem, with strong gains in June as institutional and retail interest accelerated.

- Long-Term Growth: Bitcoin’s capped supply and increasing adoption continue to drive long-term value. Meanwhile, companies within the ecosystem stand to benefit from rising transaction volumes, mining profitability, and infrastructure demand.

- Income Focus: Both funds offer a rare blend of exposure to high-growth digital assets and potential for monthly income—attractive to income-seeking investors who might be concerned about crypto’s volatility.

- Harnessing Volatility: Bitcoin and crypto equities are known for extreme volatility, which usually equates to risk. Harvest’s dynamic approach to option-writing capitalizes on this narrative – the presence of volatility creates opportunities to generate high premium income.

Both ETFs can be used in a diversified portfolio and is a consideration for investors seeking capital growth potential with monthly income from exposure to Bitcoin and its ecosystem.

Portfolio Boost: Income and Growth Potential enhanced by modest leverage (25%)

| Investment Features | HBIX / HBTE |

| Exposure to digital assets | Spot Bitcoin (HBIX) + Bitcoin-related equities (HBTE) |

| Monthly income | Covered calls support monthly income generation |

| Volatility management | Income helps to smooths out return profile |

| Thematic growth | Long-term belief in blockchain, miners, exchanges |

Conclusion

Bitcoin is evolving into a “macro asset” (an asset that’s more sensitive to macro-economic factors like inflation and interest rate etc.) from being viewed as a high-risk outlier—2025 is the year of balance sheet allocation, not YOLO bets.

With bitcoin’s price swings and macro uncertainties in the background, income-enhanced strategies like HBIX and HBTE offer something rare: an opportunity to tap into Bitcoin’s growth and its expanding ecosystem — all while generating monthly income.

HBIX and HBTE are not just a bet on Bitcoin; they’re assets that can be used to provide regular cashflows—while the future unfolds.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. This article is meant to provide general information for educational purposes. Both ETFs are classified as alternative exchange traded funds: they use a 25% leverage based on their net asset value. Leverage amplifies both the upside and downside returns and therefore introduces higher return volatility.