By Ambrose O’Callaghan

There is renewed focus on innovation in the health care sector in 2024 due to several exciting advancements. PricewaterhouseCoopers (PwC) international recently released a report wherein it projected that the health care industry was poised for strong growth in the years ahead. Moreover, healthcare is also viewed as a defensive play in the face of broader economic headwinds.

Harvest ETFs look to target high-quality industry leaders in several promising sectors. The Harvest Healthcare Leaders Plus Income ETF (HHL:TSX) offers steady income and growth opportunities from large-cap US healthcare leaders.

What are GLP-1s and why should investors care about them?

GLP-1 agonists are a class of type-2 diabetes drugs that improve blood sugar control and have shown to contribute to considerable weight loss in users. According to research from the Mayo Clinic, weight loss can vary depending on the dose of GLP-1 drugs. However, studies have shown that these drugs can lead to a weight loss of about 10.5 to 15.8 pounds when using liraglutide. Others have found that lifestyle changes, combined with a GLP-1 variant, led to an average of 33.7 pounds lost. Weight loss was only 5.7 pounds for those who did not take the drug.

Doctors are still studying the reasons why GLP-1s lead to weight loss. These drugs do appear to curb hunger and slow the movement of food from the stomach to the small intestine. Beyond weight loss, these drugs have also shown potential to lower the risk of heart disease, such as heart failure, stroke, and kidney disease.

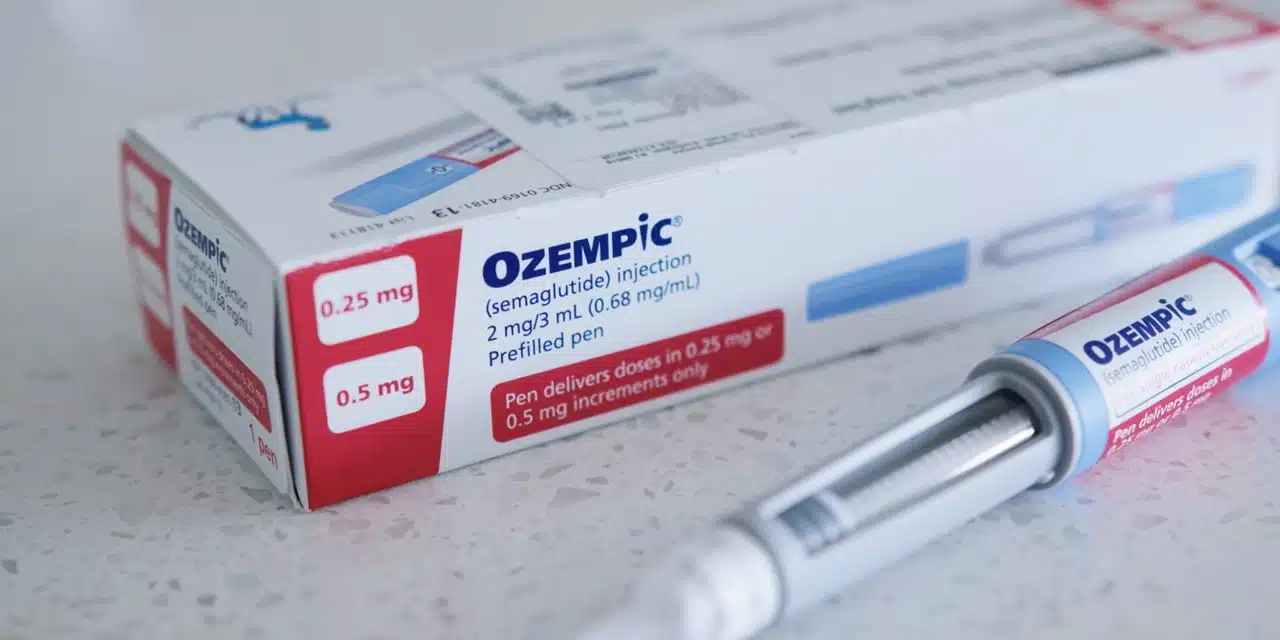

The potential of this class of weight loss drug has inspired enthusiasm among the investing community. In September, BMO Capital Markets’ analyst Evan David Seigerman released a note that projected the global market for novel weight-loss drugs like Novo Nordisk A/S’s Ozempic and Wegovy are positioned to dominate the North American market. Indeed, Seigerman predicted that the market could reach $70 billion in the United States alone. Meanwhile, Goldman Sachs estimated that the market could reach $100 billion by 2035.

Why the HHL ETF has stood above other healthcare ETFs . . .

The HHL ETF aims to take advantage of global trends driving long-term growth in the health care sector. It seeks to achieve this through diversified exposure to 20 large capitalization global healthcare stocks. Beyond that, this Canada healthcare ETF seeks to provide attractive monthly income as well as opportunity for capital appreciation.

One of the health care stocks that boasts a nearly 5% weighting in this ETF is Eli Lilly And Co. This Indiana-based company is engaged in the discovery, development, and marketing of human pharmaceuticals to a global client base. Eli Lilly’s experimental weight loss drug tirzepatide helped patients achieve a 26% weight reduction on average following extended use or intensive lifestyle changes.

What is the difference between the HHL ETF and the HHLE ETF?

Harvest Healthcare Leaders Enhanced Income ETF (HHLE:TSX) is an ETF that is built to deliver enhanced income and growth opportunities by applying modest leverage to an investment in the HHL ETF. Meanwhile, it offers access to the same portfolio of large-cap US healthcare companies.

This healthcare ETF provides unitholders with high monthly cash distributions. That strong monthly cashflow can be a fantastic boon as Canadians are faced with rising costs in the current economic climate. This ETF last paid out a monthly distribution of $0.0913, which represents a current yield of 10.3% as at January 29, 2024.

Ambrose O’Callaghan

Ambrose O’Callaghan is the Content Editor at Harvest ETFs. Ambrose brings over a decade of experience in the financial services industry to the Content Editor role. He is responsible for providing context to current trends, developments, and analyses to help make sense of the ETF market and emerging themes. With a strong knowledge of the Canadian equity markets and Harvest products, Ambrose regularly provides commentary on a broad array of market topics.