By Paul MacDonald

Weight loss drugs have been one of the major pharmaceutical stories of 2023. Treatments for diabetes with drugs like Ozempic and Mounjaro have upended how we view a wide range of chronic illnesses related to obesity given their strong results in trials for people with obesity that do not have diabetes.

These drugs share common solution to obesity-related illness: glucagon-like peptide 1 (GLP-1). GLP-1 effectively mimics incretin, the hormone released by the human brain after eating, telling us we are full and releasing extra insulin into the bloodstream. Effectively, these drugs can lower an individual’s appetite and by slowing the movement of food from the stomach, make them feel full sooner and for longer. There appears to be other benefits as well, with researchers finding some of these drugs may lower risk of heart and kidney disease, with improved cholesterol and blood pressure, although it is unknown if this is due to the actual drug reactions or a function of the weight loss.

Controlling appetites could be a key solution to the global obesity epidemic which the World Health Organization estimates impacts hundreds of millions of people around the world. These drugs could play a key role in preventative medicine, delivering better patient outcomes, and improving general health. These drugs could also open up a market estimated to be upwards of US$ 50 billion by 2030.

Weight Loss Market Size

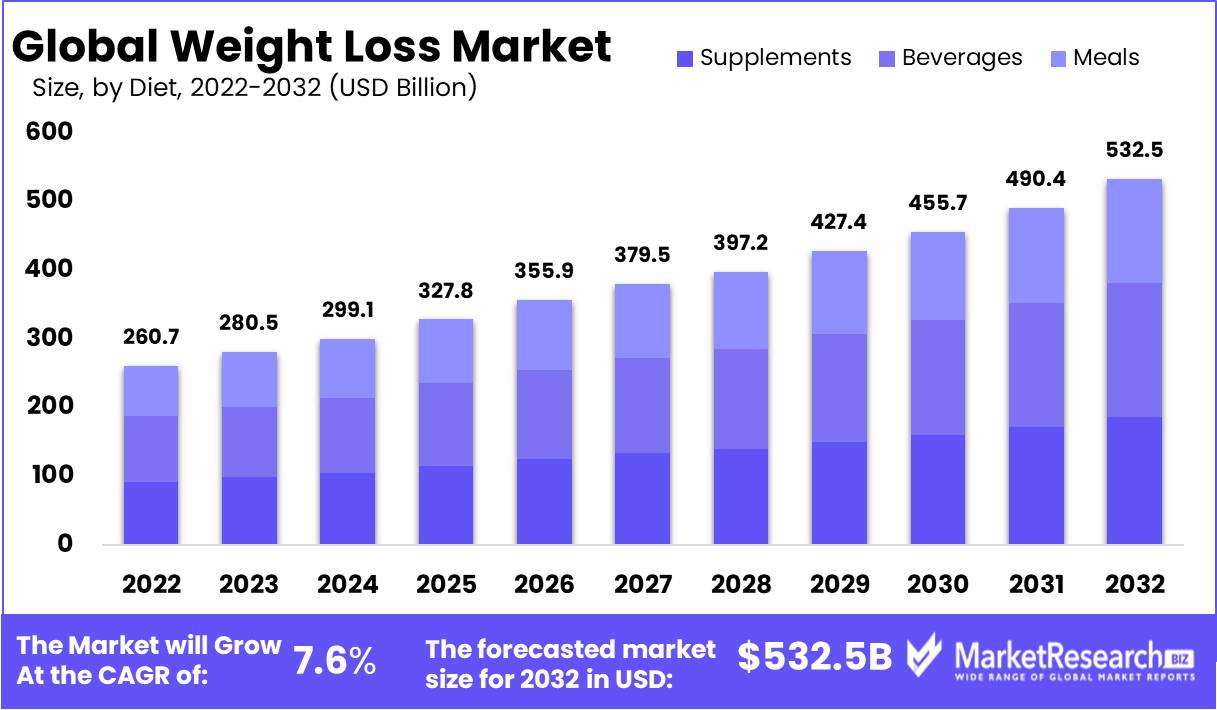

The global weight loss industry is already worth over $280 billion and some estimates have that number rising to over $500 billion by 2032. That’s a market predominantly defined by supplements, fitness equipment & services, and diet meals. The arrival of pharmaceutical drugs with clinical trial results showing weight loss rates higher than 20% could add another $50 billion to that market.

Weight loss and healthcare are deeply interconnected markets. Many healthcare companies offer services related to weight loss outside of these new drugs. That could include weight loss surgeries and treatment plans offered by managed care companies. The weight loss market also includes a diverse array of companies that we would argue fall outside of the traditional healthcare sector. These include supplements manufacturers, diet food providers, and fitness companies.

Notably, the weight loss industry and the healthcare sector share some key growth drivers.

Populations in North America and Europe are aging, and as we age we come to need more healthcare services overall. Aging is also associated with an increase in body fat percentage and likely greater need for weight loss services to prevent weight-related health issues.

The weight loss market has a wide variety of drivers and opportunities, many with direct connections to the healthcare sector. By innovating these new weight loss drugs, large-cap pharmaceutical companies have opened a new way to meet the growing global need for weight management and opened a huge market in the process.

Ozempic has dominated the headlines–what’s coming next

There are currently only two GLP-1 drugs approved in the U.S. for weight loss. Saxenda was approved in 2014 and is a daily injection and the significantly more effective Wegovy was approved in 2021. Ozempic and Wegovy have the same active ingredients, however Ozempic is currently only approved for those with diabetes, however is being prescribed “off-label” for obesity and has already found markets beyond its initially intended population of diabetics. Trial results found the drug helped overweight or obese adults lose up to 15% of their body weight. Ozempic was launched with a popular marketing campaign and has already accrued high-profile proponents among Hollywood celebrities and leading executives, however is not approved for weight loss as of yet.

However, Ozempic is far from the only game in town. US pharmaceutical firm Eli Lilly has reported results for three different weight loss drugs. Perhaps its most recognizable drug in that suite is Mounjaro, which is considered a GLP-1 class, however does have different mechanisms of action. The trials of which have shown it led to weight loss of about 22.5% in people who were obese or overweight but in non-diabetic populations. Eli Lilly is pushing for fast track approval given the positive results.

Other major pharmaceutical companies like Pfizer and Amgen and others are moving quickly to innovate their own weight-loss drugs and capture some of the opportunity in this market.

How to invest in weight loss drugs? Consider healthcare stocks

Investors are already keen on the companies innovating these weight loss drugs. As more companies launch their drugs and gain market share many investors will be asking how they can invest in this emerging trend and potentially massive market. While the potential is massive, there have been a lot expectations built into the valuations of the companies, which means the winners will be dominant, but the science will dictate who is going to be the winners. Any upset could result in share price volatility for those that are likely to lose market share.

At Harvest ETFs we believe in a large-cap diversified strategy for capturing emerging trends like weight loss drugs.

By holding large market capitalization companies in a sector exposed to this trend, and investor can access the leaders of an industry and the companies that are either leading innovation or capturing value from that innovation through ownership of key distribution or manufacturing channels. In the case of weight loss drugs that means large-cap pharmaceuticals and managed care companies to access as much of the patient experience as possible.

By diversifying exposure across a wide range of these leading companies, investors can gain a more multifaceted exposure to a trend. That diversification can also help manage risk associated with innovations. For weight loss drugs that means investing in many different companies with exposure to this trend, so that if one company’s drug fails a clinical trial, that result doesn’t torpedo the whole portfolio.

This approach is built into the Harvest Healthcare Leaders Income ETF (HHL:TSX). HHL is the largest US Healthcare ETF in Canada. It holds 20 large-cap healthcare stocks with exposure to a wide array of subsectors, such as managed care, medical devices, and biotechnology. It also holds a number of large-cap pharmaceutical companies, many of which are already innovating weight loss drugs.

By holding a wide range of these companies the HHL ETF can offer Canadian investors exposure to the long-term positive trends that come with the $50billion weight loss drug market, while also ensuring appropriate diversification and access to other long-term positive trends in the healthcare sector

Paul MacDonald

Paul MacDonald is the Chief Investment Officer and Portfolio Manager at Harvest ETFs. He has over 20 years investment management experience and currently leads the Harvest investment team. He oversees all of Harvest’s ETF strategies, leads Harvest’s covered call options trading, and plays a key role in new product development. He is considered an industry expert on call options strategies and the Healthcare sector, with regular media appearances on BNN Bloomberg and in the Globe & Mail.