By Ambrose O’Callaghan

Harvest Premium Yield ETFs will offer monthly cash distributions paid twice monthly. The Harvest Premium Yield Enhanced ETF (TSX: HPYE) provides access to a diversified portfolio of dominant, industry-leading US equities.

What are the advantages of exposure to a core US equities portfolio? How does the Harvest Premium Yield strategy work to generate twice monthly income from this portfolio? Let’s jump in.

The Core US Portfolio | Leadership in Key Areas

In 2026, seven stocks represented over half of the S&P 500’s gains through the year. Six of the seven equities are holdings in this core portfolio. Moreover, each of these names have exposure to the artificial intelligence (AI) theme.

Tech Titans

The technology space was dominated by the AI theme in 2025. Goldman Sachs estimated that AI hyper-scalers invested nearly US$400 billion 2025. For 2026, that number is expected to rise above US$500 billion. These three tech firms are sure to play an outsized role in this space going forward.

NVIDIA has grown into one of the preeminent U.S. technology giants on the back of the AI revolution. It is driving advancements in accelerated computing, data centres, gaming, and crucially in generative AI with its cutting-edge hardware and software. NVIDIA made up 15.5% of the gains for the S&P 500 in 2026.

Alphabet is a multinational technology company, the world’s third largest by revenue, with brands that include the Android operating system, Chrome browser, Pixel phones, YouTube, and more. Shares of Alphabet were responsible for 13.5% of the gains for the S&P 500 in the previous year.

Microsoft is another technology giant that has been a crucial player in the industry since its founding in the mid 1970s. Some of the most notable companies under Microsoft’s umbrella include Activision Blizzard, LinkedIn, GitHub, Skype, and others. Microsoft is making massive investments in AI infrastructure, including a nearly $20 billion commitment to Canada to build additional data centres.

World Leaders in Banking

US banks thrived in 2025, with some key names delivering record revenues. This was driven by heightened Wall Street activities, particularly in areas like mergers & acquisitions (M&A). Banks also benefited from easing regulations.

JPMorgan Chase & Co is the largest bank in the United States and the largest in the world by market capitalization. The bank finished 2025 with US$362 billion in stockholders’ equity and over US$4.4 trillion in assets. JPMorgan remains a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. In 2025, JPMorgan reported revenues of US$45.8 billion.

Goldman Sachs is one of the largest investment banks in the world, delivering revenues over $58 billion in 2025 and net earnings over $17 billion. The bank delivered its highest year ever in equity trading fees, rising 23% while total trading climbed 16% compared to 2024 levels. Goldman’s renowned mergers & acquisitions advisory business posted profit growth of 41% in 2025.

Bank of America is the second-largest bank in the U.S. and the second largest in the world by market cap. In 2025, Bank of America posted total revenues of $113 billion and net income of $30.5 billion compared to $27 billion in the prior year. The bank projected further economic growth in the year ahead, underpinned by more clarity in the regulatory environment and in the areas of tax and trade.

Powerhouse Brands

HPYE also offers exposure to some of the world’s foremost brands. These companies boast global reach, strong financials, and dominant market shares in their respective sectors. They possess long track records of resilience through various market cycles.

McDonald’s is one of the largest fast food chains on the planet. Since its rapid expansion in the 1950s and 1960s, McDonald’s has grown into a global icon, with more than 40,000 restaurant locations around the world. Over a quarter of those locations are located within the United States. In 2025, McDonald’s same-store sales rose 2.4 percent. However, there were challenges in the form of inflationary pressures in areas like wages, food, and paper costs.

Walmart is the world’s largest company by total revenue, registering over US$680 billion in 2025 alone. It is also the largest private employer on the planet with over 2.1 million employees. Walmart saw its global advertising business climbed 27% to US$4.4 billion in 2025. Meanwhile, its global inventory went up 2.8%. Walmart also had its largest dividend increase in over a decade.

ExxonMobil is one of the largest U.S. companies by revenue, and the largest investor-owned oil company in the world. The company was formed in 1999 with the blockbuster merger of Exxon and Mobil. Oil prices declined towards the end of 2025, as concerns regarding oversupply and tariffs outweighed rising geopolitical risks. Still, in Q3 2025 ExxonMobil posted strong earnings of US$7.5 billion and cash flow from operations of US$14.8 billion.

An Innovative Income Strategy | High Yields Paid Twice Monthly

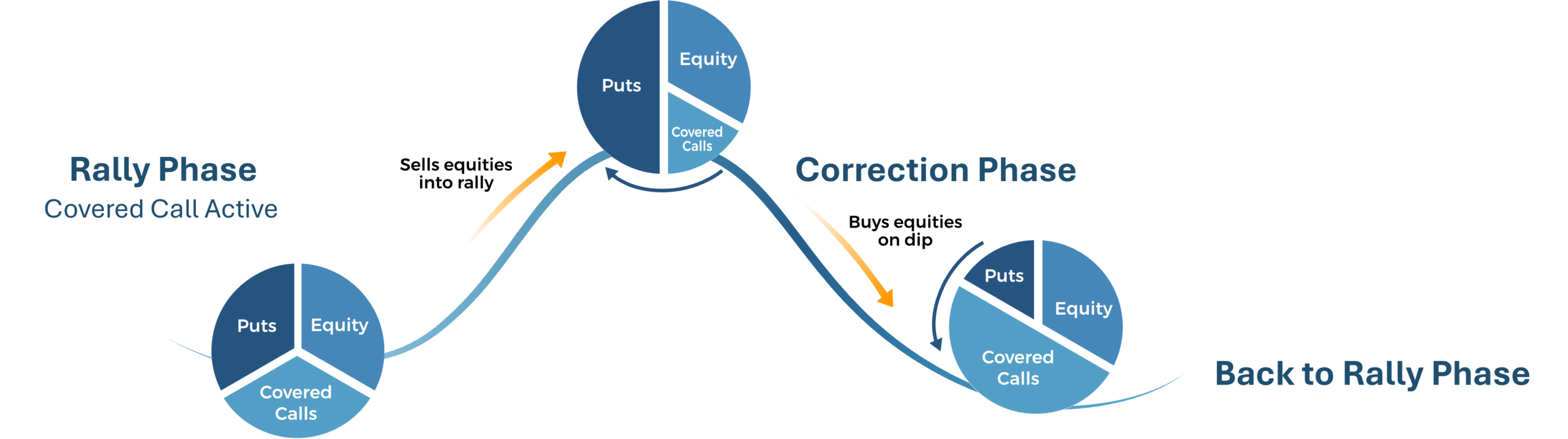

The Harvest Premium Yield active equity income strategy is built on the utilization of written puts, covered calls, and cash borrowing. Illustrated below as the wheel, showing a strategy that aims to generate income based on changing market conditions.

Dynamically Adjusting to Markets

This strategy plays out as follows: as equities rally, a portion of calls will be assigned. Allocation then shifts to OTM puts. This is done to generate income, and rebuy equity at lower prices. As equities fall, a portion of puts will be assigned. In this bearish environment, allocation shifts to OTM calls, designed to generate income, and sell equity at higher prices. This strategy also allows for the ability to hedge with downside puts.

In addition, using a combination of written puts and cash borrowing, the Harvest Premium Yield Enhanced ETF offers levered exposure to enhance income and growth potential.

Core US Equity Leaders and High 2x Monthly Income

The Harvest Premium Yield Enhanced ETF (TSX: HPYE) allows investors to access dominant, industry-leading U.S. equities in a core portfolio. It is the first of two Harvest ETFs – along with the Harvest Premium Yield Canadian Bank ETF (TSX: HPYB) – that will pay income twice every month to unitholders. This provides for additional cash flexibility mid-month, compared to traditional income ETFs that pay bi-monthly.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into available Class units of the Fund you own. If a Fund earns less than the amounts distributed, the difference is a return of capital. Any security mentioned herein is for information purposes and should not be taken as an invitation to purchase or sell such security.

The Funds are categorized as a liquid alternative ETF. This means they have the ability to use leverage and can invest more than 10% of their assets in a single issuer. The Funds employ modest leverage which can amplify both gains and losses. Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.