Insights

Stay informed and educated with topical insights from Harvest ETFs professionals

Canada Core | 3 Homegrown Harvest Income ETFs

Investors seeking to access a resurgent Canada may want to consider the Harvest Canadian High Income Shares ETF (TSX: HHIC) and others.

Fixed Income Trends | Fall 2025

The Harvest Premium Yield Treasury ETF (TSX: HPYT) and other bond ETFs continue to be impacted by shifting trends in the fixed income space.

Global Utilities: A Defensive Play in a Volatile Market | HUTL & HUTE

Consider the Harvest Equal Weight Global Utilities Income ETF (HUTL:TSX) as a market opportunity exists in global utilities.

Drip ETF Investing in Canada: Pros and Cons

The Harvest Distribution Reinvestment Program (DRIP) reinvests income paid to…

Navigating Volatility with Asset Allocation ETFs

Investors grappling with higher volatility could turn to asset allocation ETFs like the Harvest Diversified Monthly Income ETF (HDIF:TSX).

Fund Spotlight: Harvest Travel and Leisure Income ETF (TRVI)

In the Money Focus piece, we are highlighting the Harvest Travel & Leisure Income ETF (TRVI:TSX), an income-focused travel portfolio.

Canada’s Great Companies Make The HLIF ETF Worth Consideration

Canada is home to great companies with strong cash flow, which you can access with the Harvest Canadian Equity Income Leaders ETF (HLIF:TSX).

The Yield Curve in 2025: Striking a ‘Happy Medium’

The shifting yield curve means that investors may want to consider the merits of the Harvest Premium Yield 7-10 Year Treasury ETF (HPYM:TSX).

7 Common RRSP Questions, Answered

Money Focus has answers for burning RRSP questions that Canadians might have on their minds, including how to use contribution room.

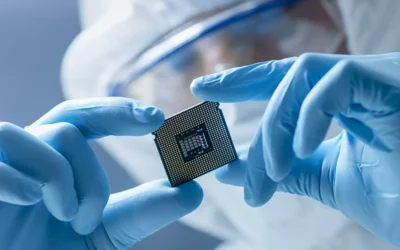

Tech, Tariffs, and Back to Basics

By James Learmonth Geopolitical and trade policy uncertainty remain elevated, yet the technology sector continues to demonstrate resilience. While market volatility is inevitable, innovation and strong fundamentals have historically driven long-term growth in the...

Fund Spotlight: Harvest Diversified Equity Income (HRIF)

By Caroline Grimont If there’s one thing that Canadian investors love, it is dividends and income. And for certain types of investors, chasing dividends makes sense. Say for example, you’re at, in, or near retirement. In those circumstances, you may want to replace...

Disclaimer

For Information Purposes Only. All comments, opinions and views expressed are of a general nature and should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or used to engage in personal investment strategies.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds, managed by Harvest Portfolios Group Inc. (the Fund(s)). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A, Class B or Class U units of the Fund. If the Fund earns less than the amounts distributed, the difference is a return of capital. Tax, investment and all other decisions should be made with guidance from a qualified professional.

The current yield represents an annualized amount that is comprised of 12 unchanged monthly distributions (using the most recent month’s distribution figure multiplied by 12) as a percentage of the closing market price of the Fund. The current yield does not represent historical returns of the ETF but represents the distribution an investor would receive if the most recent distribution stayed the same going forward.

Certain statements in the Harvest Insights are forward looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS.

FLS are not guarantees of future performance and are by their nature based on numerous assumptions, which include, amongst other things, that (i) the Fund can attract and maintain investors and have sufficient capital under management to effect their investment strategies, (ii) the investment strategies will produce the results intended by the portfolio managers, and (iii) the markets will react and perform in a manner consistent with the investment strategies. Although the FLS contained herein are based upon what the portfolio manager believe to be reasonable assumptions, the portfolio manager cannot assure that actual results will be consistent with these FLS.

Unless required by applicable law, Harvest Portfolios Group Inc. does not undertake, and specifically disclaim, any intention or obligation to update or revise any FLS, whether as a result of new information, future events or otherwise.