By Ambrose O’Callaghan

There was enthusiasm surrounding the broader economy and the stock market coming into 2025 after strong returns in 2024. The previous GOP administration cultivated a reputation as a market-friendly one in the late 2010s. That momentum ground to a halt due to the COVID-19 pandemic, but the perception of a market-friendly GOP largely remained.

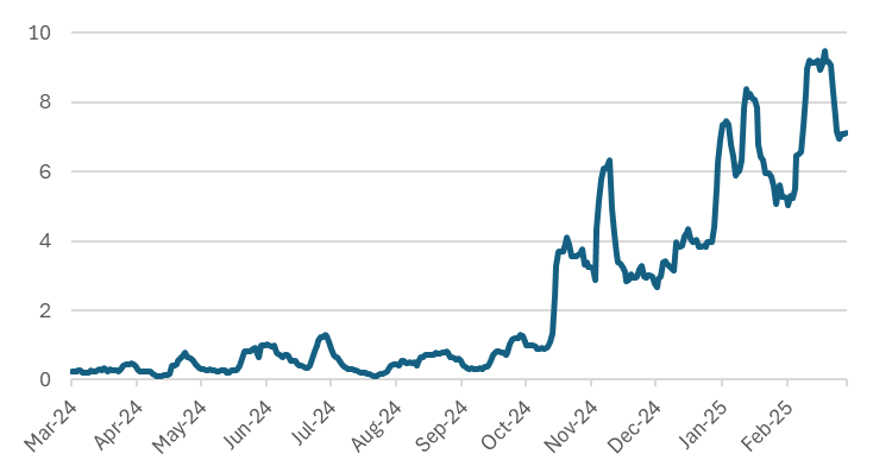

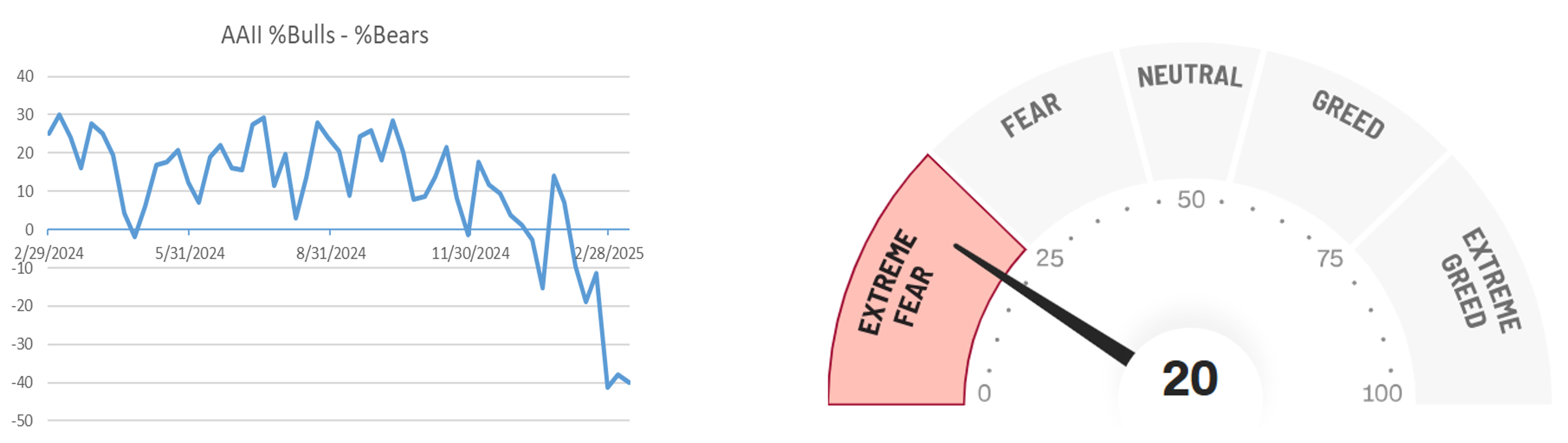

Investor outlook has soured in the late winter and early spring, in large part due to the uncertainty surrounding U.S. government policy, particularly when it comes to tariffs.

Bloomberg Global Trade Policy Uncertainty

Source: American Association of Individual Investors, Bloomberg, Harvest ETFs. As of March 21, 2025.

This uncertainty has resulted in elevated levels of market volatility. Some names have suffered retracements of 50% or more over the past two months. This market is unique in that the sell-off was not triggered by one significant catalyst. Indeed, it is lingering trade policy uncertainty that is fueling negative sentiment.

Source: American Association of Individual Investors, CNN (Fear and Greed Index). As of March 20, 2025.

The S&P 500 has dropped 8% in the year-to-date period as of close on Friday, April 10, 2025. A research note from Vanguard recently speculated that volatility was likely to remain due to factors like policy uncertainty, disruptive currents in the economy like artificial intelligence development, and the shifting policy of the Federal Reserve.

Demand for Low Volatility products has increased in this environment.

Harvest Low Volatility ETFs – A Smoother Investment Experience

Harvest’s new Low Volatility ETF suite could be appealing to defensive and long-term investors. This approach to equity investing is factor-based, disciplined, outcome-oriented, is designed to mitigate risk, as well as provide long-term growth. Moreover, the suite includes a high income solution that generates monthly cash distributions through an active covered call writing strategy.

The Harvest Low Volatility Equity ETF (HVOL:TSX) holds 40 top Canadian equities. These equities will be ranked and weighted by their risk score and market cap weight, with a 4% maximum weight per name. HVOL’s Canadian equities are scored according to risk and fundamental metrics.

Low Volatility – Portfolio Construction

Source: Harvest Portfolios Group, Inc. April 2025.

Low volatility strategies have existed in the market since the 2007-2008 financial crisis. However, these strategies have typically followed a generic approach.

The Harvest approach utilizes multiple risk metrics to achieve its stated goals. These include Beta, Volatility, and fundamental analysis. Harvest emphasizes a robust portfolio construction to achieve a defensive low volatility portfolio and superior upside capture.

The Harvest Low Volatility Canadian Equity Income ETF (HVOI:TSX) builds on HVOL’s low volatility strategy. Meanwhile, it overlays an active covered call writing strategy as it aims to generate high monthly cash distributions, while offering stability and a smoother investment experience.

HVOI will be invested in the same broad universe of established Canadian equities and its portfolio will adhere to the risk and fundamental analysis that underpins the Harvest low volatility strategy. However, that active covered call strategy will enable HVOI to generate the consistent monthly cash distributions that Harvest Equity Income ETFs are renowned for.

Summary

Back in February, we’d discussed that the aggressive trade policy pursued by the new U.S. administration was likely to lead to near and medium-term volatility. That prediction has come to pass as we enter the early portion of the spring season. Fortunately, Canadian investors have options. Namely, there are strong, dependable Canadian companies that can provide strong cover in this uncertain environment.

The Harvest Low Volatility Canadian Equity ETF – HVOL – is a pure low volatility play that also offers a quarterly distribution that will be derived from the dividend payouts from the underlying 40 equities in the portfolio. HVOI offers access to the same low volatility portfolio. However, it overlays that portfolio with an active covered call writing strategy to generate high monthly cash distributions, while delivering the same stable, low-risk portfolio.

Disclaimer:

For Information Purposes Only. All comments, opinions and views expressed are of a general nature and should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or used to engage in personal investment strategies.

Commissions, management fees and expenses all may be associated with investing in HARVEST Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds” or a “Fund”). Please read the relevant prospectus before investing. The Funds’ returns are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.