By Ambrose O’Callaghan

Donald Trump overperformed polling and came away with a convincing win to secure his second term in office on November 5, 2024. He will be sworn in as the 47th U.S. President on Monday, January 20th, 2025.

What are the expectations for his next term? What can we learn from the market during previous presidential terms? And where should investors turn in early 2025? Let’s jump in.

Policy expectations for Trump’s second term

The first Trump administration gained international notoriety for its protectionist trade policies. Tariffs are one of the favoured tools of Donald Trump for enacting his “America First” agenda.

Tariffs are equivalent to putting a tax on imports from another country. Effectively a business that purchases goods from the foreign entity pays the additional fee associated with the tariff. The business may pass this on to consumers in the form of higher prices or may decide to take a hit on the margins thus earning less profits. Another impact of tariffs is trying to increase domestic demand and production away from similar imported goods. In his first term, Trump imposed a tariff on one-tenth of U.S. imports. Products like steel, solar panels, washing machines, and Chinese goods suffered. In his 2024 campaign, Trump has threatened to impose a 60% tariff on all Chinese exports to the US.

At the same time, Trump is leaning towards increased deregulation. That holds the potential to drive windfall profits for banks, big tech, as well as selected healthcare and energy companies.

Trump has been a strong supporter of digital assets and cryptocurrencies. He promised to build a government stockpile of Bitcoin at a conference earlier this year, while also pledging to fire U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler, someone who is seen to push for more and stronger regulations. Crypto has been an early winner after Trump’s victory. Bitcoin has climbed to record highs, hitting over US$100,000 in late 2024.

Harvest’s Blockchain Technologies ETF (HBLK:TSX) offers access to equity securities that are exposed, directly or indirectly, to the development and implementation of blockchain technologies. Upward movement in Bitcoin has shown to positively impact crypto miners, and crypto wallet and trading companies within HBLK.

Bank stocks also gained momentum after the Trump win, gaining on the promise of deregulatory measures and pro-growth policies. Some of the “wish lists” drawn up from banking industry bodies include a rolling back of the Basel III Endgame proposals. These rules were introduced to ensure large banks have the capital required to withstand systemic risk events. The rules will come into play in July 2025, applying to all banks with assets exceeding US$100 billion.

This is good news for the Harvest US Bank Leaders Income ETF (HUBL:TSX) which holds the biggest players in the US financial sector. These financial titans are poised to benefit from the expected regulatory rollbacks of the incoming second Trump administration. It offers a consistent monthly cash distribution of $0.09 per unit.

Presidents and markets: A historical perspective

Most new presidential terms start with speculation about the winners and losers from a social, political, and economic standpoint.

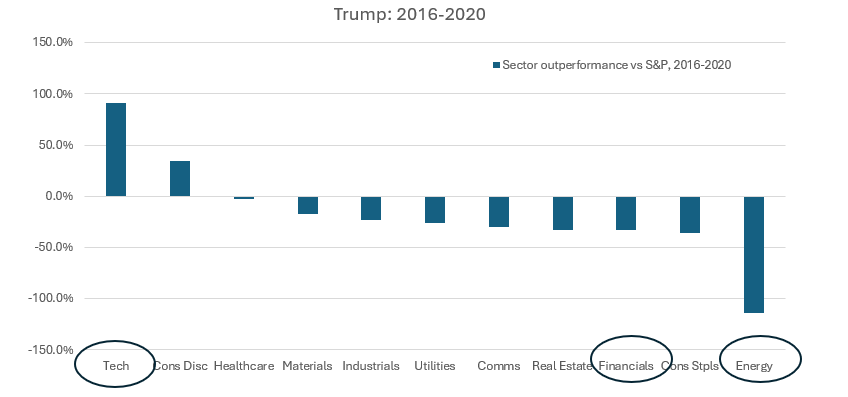

After Trump’s win in November 2016, deregulation and energy were among the biggest expected movers on deregulation – the “drill baby drill” mantra. Instead, Energy and Financials were the worst performing sectors during the Trump presidency. Small and medium sized businesses were also expected to outperform under a Trump administration, but growth from the largest companies won out.

Source: “Blind Pursuit of Trump Trades is a Shortcut to Ruin,” Simon White, Bloomberg, November 7, 2024.

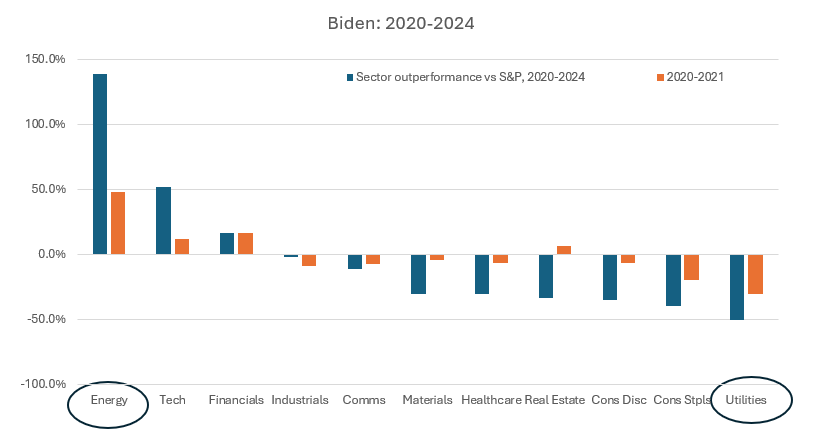

Fast forward to the Joe Biden administration that has run from 2020 through 2024. Coming into the Democratic administration, many investors expected big energy to suffer and projected a comeback for renewables. Instead, Energy turned out the best performance over the course of the Biden presidency.

Source: “Blind Pursuit of Trump Trades is a Shortcut to Ruin,” Simon White, Bloomberg, November 7, 2024.

Under President Barack Obama, the Affordable Care Act (ACA) was billed to be a big win for healthcare. Meanwhile, utilities were set to benefit as the administration was making a push for renewables. The reality? Both lagged over the course of Obama’s terms compared to other sectors.

We can go back even further to the Bush administration. Financials were set to benefit from a big deregulation push. We all remember the 2007-2008 financial crisis and the havoc that resulted on US and global markets.

Key Takeaways

The majorities won by Trump and the Republican party may lead to more durability for the policy initiatives that they have set out. However, there is always considerable uncertainty even when a party has won majorities with a strong mandate. Investors are likely better served by focusing on diversity in their portfolios, fundamentals, and outlooks given where the yield curve and economic cycle is. These strategies have proven to be the most effective over time, while trades based on the winds of political change are far more unpredictable.