By Harvest ETFs

Although Canada has sophisticated and globally respected capital markets, compared to much of the rest of the world Canada still only represents a very small component of the global investible universe.

Canadian Market in a Global Context

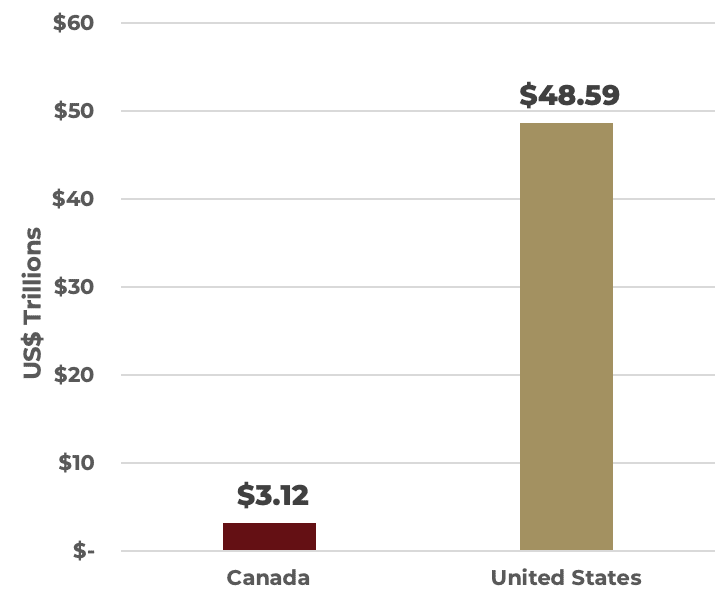

The single largest set of capital markets, on the other hand, are just south of the border. US capital markets hold nearly $48.59 trillion, significantly more than the TSX, LSE, Shanghai Stock Exchange, and Euronext combined.

Source: Bloomberg, March 1, 2022. Based on Bloomberg total market capitalization of all shares outstanding.

So why have investors from around the world built US markets into the behemoths they are today? What does this scale mean for an ordinary Canadian investor? And how can Canadians most efficiently access the scale and opportunity in US markets?

Paul MacDonald, Chief Investment Officer at Harvest ETFs, offered some context on the scale of US markets and why the opportunities present in these spaces are still so important for Canadian investors. While he emphasized that global diversification is important, he reiterated that Canadians can access the widest menu of investment opportunity through access to US equities.

“Despite being a relatively small component of global markets, Canadian investors tend to be significantly overweight Canadian-listed equities,” MacDonald said. “This is known as the ‘home country bias’, and there may be several reasons to overweight a home market, such as estate planning or favorable tax treatments. However, we estimate that over 50% of Canadian portfolios are invested in the local market, and that seems excessive given the opportunities for scale and diversification when looking at other developed markets.”

MacDonald emphasized the sheer scale of opportunity in US markets with a simple comparison of market capitalization. The below chart demonstrates that the United States is still the dominant global market and its’ scale remains unassailable.

US Markets Dominate Scale

“US equities have been a hub for global investors for decades now,” MacDonald explained, “that is because they have a depth, liquidity, and efficiency that’s unmatched on any other global market. Their attraction for investors holds especially true in periods of volatility.

Source: Bloomberg, March 1, 2022. Based on Bloomberg total market capitalization of all shares outstanding.

Many global markets don’t have the same historical track record and don’t hold the kind of high-quality global names you get in US stocks. When investors are uncertain, they go where they know quality lies, and for almost all of modern history that has been disproportionately towards the US markets.”

Moving into US equities also doesn’t mean giving up on global exposure. MacDonald cited the example of the Harvest Brand Leaders Plus Income ETF (HBF:TSX) an equity income ETF comprised of 20 large-cap companies with huge global brands. As of February 28, 2022 the ETF holds companies like Apple, Visa, McDonalds and Disney. These may be companies domiciled in the United States and trading on US markets, but their reach and revenue streams are fundamentally global.

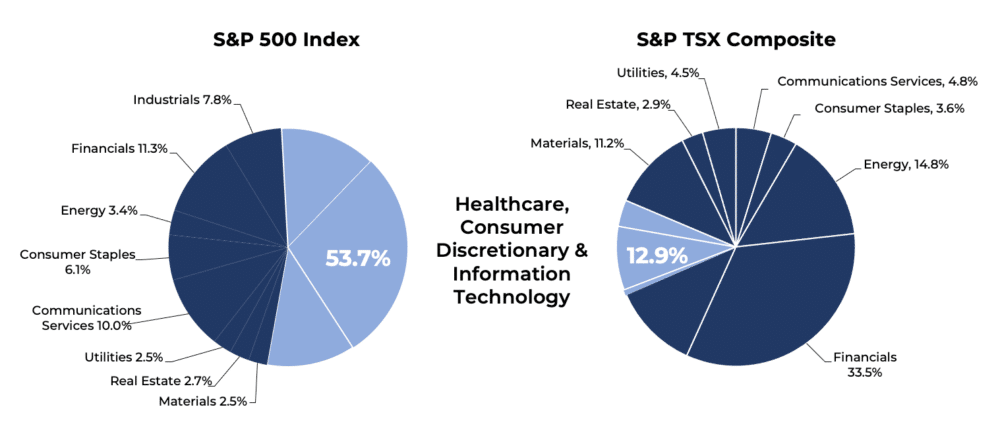

This is especially important for Canadian investors. The diversity of sectors listed on the S&P/TSX Composite index stands in stark comparison to what’s available on the S&P 500. While sectors like Information Technology, Consumer Discretionary and Healthcare are present on the TSX, investors don’t get anywhere near the scale and diversity of these companies as they do on US markets, as the below charts show.

US Offers Significantly More Opportunities in Areas with Secular Growth

Source: Bloomberg, As at February 28, 2022

This is not to say that investing in a larger market from Canada doesn’t come with its own challenges. In addition to the intricacies and costs of investing directly in a market that trades in a foreign currency, the sheer scale and diversity of the US market poses issues for many investors, including Canadians. That’s where ETFs come in.

Harvest has a range of ETFs that invest in US securities and, in the case of some ETFs, investors can choose whether they want to own those ETFs in US or Canadian dollars, as well as hedged and unhedged versions. For investors that may be concerned about US estate issues, investors may also benefit by holding the US securities in a Canadian ETF.

“When Canadians want to invest in US equities, to get that global reach and paramount scale, they should consider ETFs as a means of doing so,” MacDonald explained. “Through an actively managed ETF run by a portfolio management team with decades of experience, they can quickly and easily access the best of the US market without hassles like currency conversion or selecting the securities.”

To find out how your clients can benefit from these equity income solutions call 1.866.998.8298.

For more on Harvest Equity Income ETFs click here.

Quoted in this article

|

Paul MacDonald, CFAChief Investment Officer |