How Harvest Equity Income ETFs can help meet your retirement needs.

Registered Retirement Savings Plans (RRSPs) are Canada’s most popular retirement savings vehicle for good reason. You get a tax deduction for the contributions you make, plus the amount saved which grows in a tax-sheltered account. But in the end the government wants the tax to be paid. So, in the year you turn 71 an RRSP must be converted into a Registered Retirement Income Fund. (RRIF). Thereafter you must draw down the fund each year by amounts according to tables set out by Ottawa. Any changes to withdrawal rates are made by Parliament.

Learn more about RRIFs

How Harvest ETFs can help?

Harvest ETFs offers equity growth-focused and equity income Exchange Traded Funds (ETFs) that can be part of a retirement plan. The Harvest philosophy is to offer simple, transparent, fee competitive ETFs that own successful dividend-paying global businesses which grow over time. In the past, in a low interest rate environment, investors who have relied on bonds and bond-like investments for retirement income altered their strategy to include a higher portion of stocks.

The Harvest Way

At Harvest, our Equity Income ETFs can play a key role in retirement strategies. These income and growth focused ETFs offer tax efficient current yields between 5% and 8% and are suitable for Registered Retirement Savings Plans (RRSPs) and Registered Retirement Income Funds (RRIFs). How do we achieve those yields safely? First, we choose global leaders. These companies have significant size, scale and financial strength as well as a history of profitability in all economic cycles. Second, we enrich the returns with a covered call strategy. We are among the largest option writing firms in Canada. The strategy adds to the basic dividend income by selling a portion of the potential rise in stock price in exchange for a fee. The fee limits the gain a bit, but it also acts as a cushion if share prices fall, because the fee is kept no matter what. Fixed income has a role in portfolios, but we believe the call to equity income is growing in these times of low interest rates and longer retirements. The Harvest Way is simple: Long term growth through the ownership of great businesses, while generating a steady income along the way.

Equity Income ETFs

Building a retirement Income strategy with Harvest ETFs

Manage your retirement with solutions designed to help generate steady retirement income. As retirees make the move from contributing to savings to withdrawing from them, their priorities can also change to focus on capital preservation, as well as growth, tax efficiency and estate objectives. The underlying ETFs used in the example below are for illustration purposes to show how an allocation to Harvest Equity Income ETFs can offer steady income with portfolios invested in companies that are well established, with strong balance sheets and consistent earnings growth.

Harvest Retirement Income ETF Options

| Current Distribution Yield* | ETF Name | |

6.14% |

Harvest Brand Leaders Plus Income ETF |

|

7.91% |

Harvest Healthcare Leaders Plus Income ETF |

|

7.16% |

Harvest Equal Weight Global Utilities Income ETF |

|

4.46% |

Harvest Tech Achievers Growth & Income ETF |

|

6.42%Yield Average (Current) |

*Current Distribution Yield is calculated by multiplying the monthly distribution rate by 12 which is divided by the closing month-end market price of the ETF. |

As at December 31, 2021

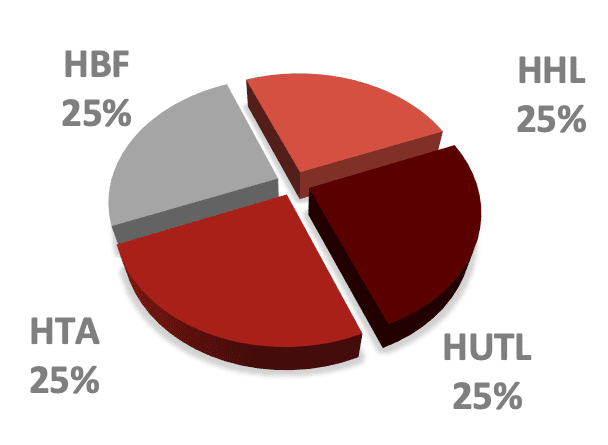

Portfolio Allocation

Top 10 Holdings

As at December 31, 2021

| HBF (Brands) | HHL (Healthcare) | HUTL (Utilities) | HTA (Tech Achievers) |

| Procter & Gamble McDonalds Microsoft PepsiCo Accenture Apple Johnson & Johnson Nike UnitedHealth |

Zoetis AbbVie Abbot Laboratories Bristol-Myers Squibb UnitedHealth Amgen Inc. Eli Lilly and Company Thermo Fisher Anthem Inc. Novartis AG |

E.ON SE PPL Corporation Uniper SE Consol Edison Emera Incorporated FirstEnergy Corp. Fortis Inc. Fortum Oyj The Southern Company American Electric Power Company Inc. |

Advanced Micro Devices Apple Accenture PLC Broadcom Applied Materials Keysight Technologies Intuit Cisco Systems NVIDIA QUALCOMM |

To find out how your clients can benefit from these equity income solutions call 1.866.998.8298.

For more on Harvest income products please visit