As the MRNA winners of the COVID-19 vaccine race turn their sights to illnesses like shingles and the flu, investors and analysts are renewing their focus on innovation in the healthcare sector. If a technology like MRNA can conquer endemic illness and even go on to combat cancer, what other lifechanging innovations could the healthcare sector provide us with? What opportunities could those innovations open for investors?

In the healthcare sector, MacDonald explained, large-cap companies play an outsized role. These firms have the scale to innovate a wide range of products and services on their own and are well positioned to capture value from innovations initiated by smaller-scale companies. The view that these large-caps serve as the fulcrum of healthcare innovation underpins the Harvest Healthcare Leaders Income ETF (HHL).

“When we think about large-cap healthcare, we have to see these companies as innovators,” MacDonald said. “They are always innovating on their own, but they’re also the companies that have the ability to extract value from innovation by smaller-cap firms in the sector.

“Within HHL, we own the dominant companies in the sector, companies with tremendous R&D platforms across subsectors.”

How one ETF captures a universe of healthcare innovation

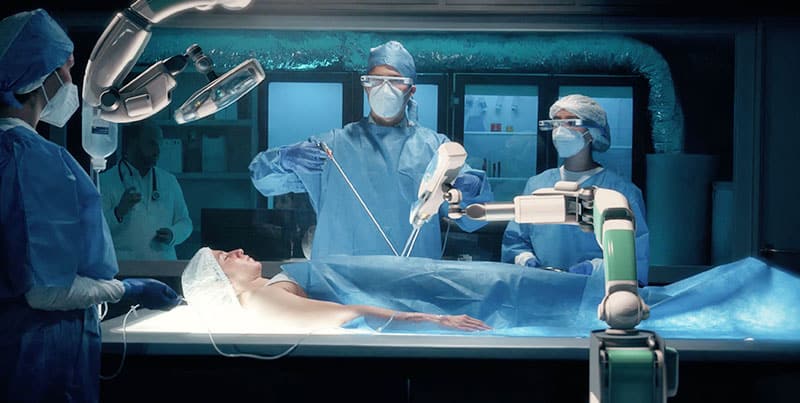

Those subsectors include pharmaceutical companies finding new avenues for MRNA, but they also include the biotech companies like Abbot Labs using phones to better monitor diabetes patients and the med-tech companies like Stryker developing robotic surgery assistants to power less-invasive operations with better outcomes. It even includes healthcare providers like United Health, using and developing new technologies to provide better and more efficient patient care. HHL is set up, through a basket of 20 of the best large-cap healthcare companies, to capture healthcare innovation in almost all its forms.

That diversity of innovation, MacDonald said, is why a large-cap ETF like HHL is so well positioned in the space. He explained that healthcare innovation will generally follow one of two paths. The first is that headline-grabbing, game-changing, blockbuster innovation. That would happen when one company is able to completely change the outcomes for an illness or condition that hasn’t seen much significant improvement. A major leap in Alzheimer’s treatment, MacDonald said, would be one such blockbuster.

The second, far more common path of innovation comes in smaller steps as companies build on the progress others have made. Companies might apply the technology behind an anti-inflammatory drug designed to treat dermatitis being to create a better asthma drug or they might continue to push the remarkable progress already made in using immunotherapy to treat cancers. Many of these innovations won’t grab headlines, but they will change lives and create huge opportunities for growth.

MacDonald explained that he and his portfolio management team can track that growth through statistics on patients using particular drugs or signing up for specific elective surgeries. He can see the demand profile for new innovations, be they blockbusters or steady growers, and track how the positive impacts of these innovations flow from and to the large-cap firms in HHL.

Capturing innovation-driven growth while mitigating innovation-related risk

Innovation can be a double-edged sword. While the growth it drives is remarkable, companies that are overexposed to their R&D pipelines or a single innovation track can be particularly exposed to risk. MacDonald explained that HHL’s investment strategy is designed to capture the near-constant innovation in the healthcare sector while using diversification and a focus on the best companies in the sector to mitigate risk.

Harvest’s approach, across most of their ETFs, begins with a funnel that takes an investable universe like healthcare and narrows it to a group of roughly 85 large-cap companies. Of these top performers, Harvest’s portfolio managers select about 20 stocks to comprise their ETF through a diversification lens that offers broad exposure to innovation and growth while avoiding over-exposure to any particular subsector.

“We’ll miss some of the rockets,” MacDonald said, “but we’ll avoid some of the torpedoes.”

One of those torpedoes is Moderna. While the company may have done well in recent months, and been a significant story through the past two years, MacDonald highlighted the fact that in his eyes, Moderna is singularly exposed to MRNA and its stock has recently taken a beating accordingly. He would rather own a firm like Pfizer which has a deep R&D pipeline covering a range of drugs and medications while partnering with an MRNA innovator in BioNTech.

The result is a basket of companies well-positioned to capitalize on the healthcare sector’s near-constant innovation while offering diversification and stability to counteract any potential innovation-related volatility.

“These are companies that are innovating, which comes with a risk-return association,” MacDonald said, “But given the scale that they have, they can buy assets, de-risk, and continue to extract a significant amount of value from the constant innovation in this space.”

|

By Paul MacDonald, CFAChief Investment Officer |