By Ambrose O’Callaghan

Covered call strategies have increasingly captured the attention of investors, money managers, and institutional portfolio managers. This should not come as a huge surprise. The current economic and market environment may spur individuals to seek out the benefits that a covered call strategy can offer.

Canadians are feeling the pinch in 2023

The Canadian economy has been challenged by the most aggressive interest rate tightening policy since the beginning of this Millennium. According to the insolvency firm MNP Ltd.’s latest consumer debt index, Canadians have not been this pessimistic about their financial situation in the five-year history of the tracking model. In the survey, 20% of Canadian respondents said that their debt situation was worse than the previous year. Meanwhile, 25% said that their debt situation has worsened compared to five years ago.

Over half of respondents in the MNP Ltd. Survey said they were $200 away from not being able to cover their bill and debt payments. Moreover, 31% said that they do not earn enough to cover all their expenses. The Maru Household Outlook Index found that 70% of respondents believed that the economy was on the wrong track in the beginning of October. Its latest reading sat at 84, which is the second-worst rating since April 2021.

Back in February 2023, Statistics Canada reported that over one-third (35%) of Canadians said that it was “difficult for their household to meet its financial needs in the previous 12 months”. Moreover, 26% of respondents said that they did not have the resources to cover an unexpected expense of $500.

These conditions have forced many investors to adopt a stricter budget or find a better payout as variable mortgages are coming due and totally resetting monthly budget requirements. That is where the value of a high monthly cashflow can come into play.

The covered call strategy delivers on the need for cashflow

A covered call strategy requires that an investor selling call options owns an equivalent amount of the underlying securities. For example, an investor who holds a long position in an asset then writes call options on that security or asset to generate income. The investor owns a long position in the asset as the cover, meaning the seller can deliver those shares if the purchaser of the call option decides to pull the trigger.

Covered call ETFs also boast other benefits. For one, you can own one ETF that efficiently carries out a covered call strategy rather than having to implement one on your own. Moreover, the cash flow generated on writing call options is typically taxed as capital gains. Owning a covered call ETF allows you to sidestep this little detail and churn out income in a tax-free registered account like a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP).

But what about returns?

Some journalists and financial advisors have criticized covered call ETFs for their returns compared to a conventional ETF that might track an index or specific sector. However, investors in a covered call ETF are often willing to give up on some of the upside in exchange for steady income. Income investors want cashflow, which is why covered call ETFs have gained traction as a desirable product in this environment.

Let’s take a look at the Harvest Canadian Equity Income Leaders ETF (HLIF:TSX). As its product page states, the ETF seeks to provide unitholders with monthly cash distributions, the opportunity for capital appreciation, and lower overall volatility of portfolio returns than would otherwise be experienced by owning equity securities of the Canadian Equity Income Leaders Issuers directly. This ETF currently has a medium level risk rating.

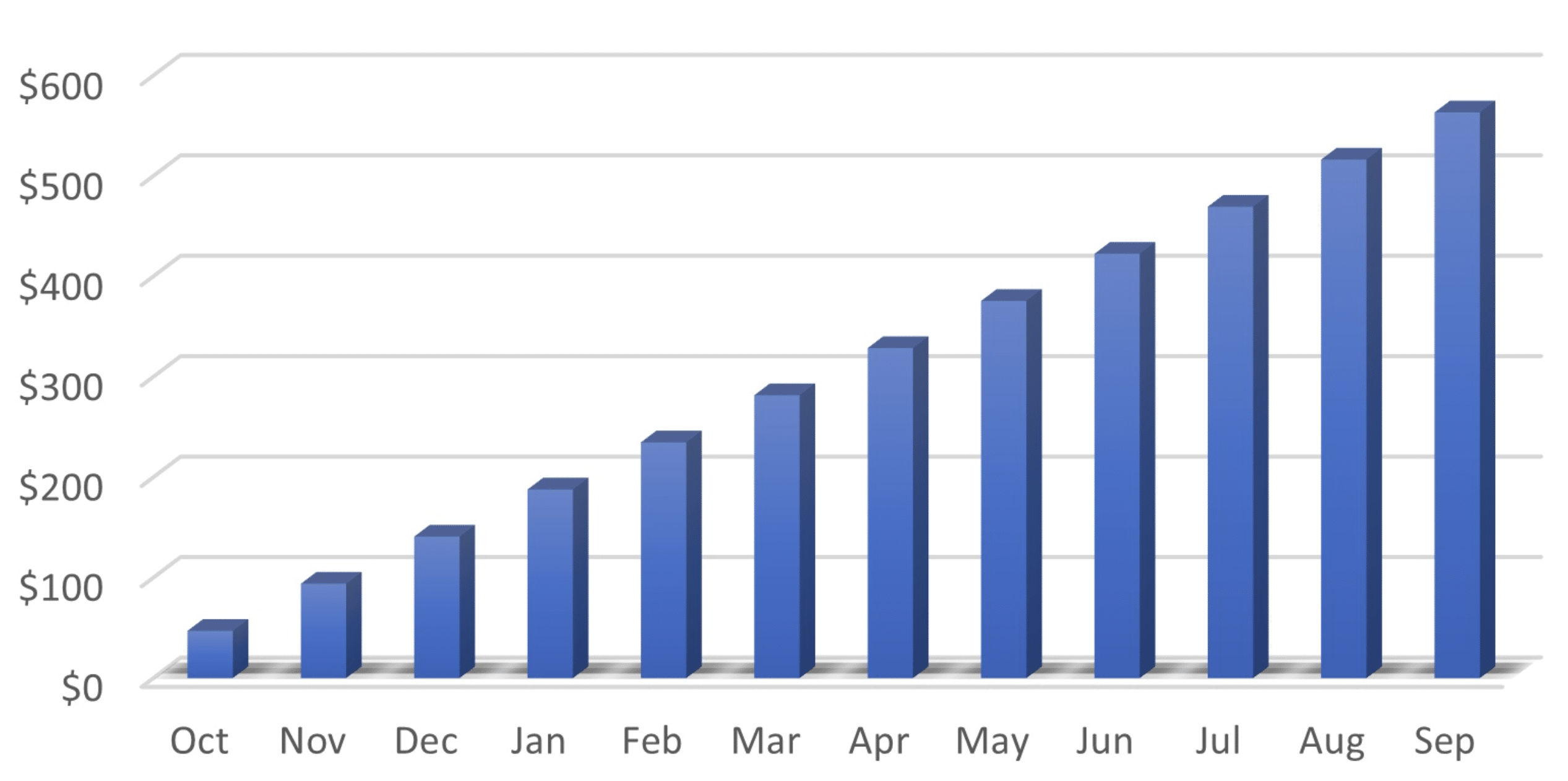

To demonstrate the cash flow potential of a covered call ETF, let’s run a little hypothetical. For that hypothetical, we’ll look to use our 2023 TFSA contribution of $6,500 on this ETF. The HLIF ETF closed at $8.07 per share on Wednesday, October 25. The $6,500 could get an investor 805 units of HLIF going by the close price of $8.07 as of October of 25. HLIF declared a dividend in October of $0.0583 payable on November 9th to unitholders on record as of October 31. If this remains the same over the next 12 months, then it would represent an annualized current yield of 8.86% based on the October 25 purchase price of $8.07. So, our 805 units will net us $46.93 in monthly income in the Tax-Free Savings Account. Which works out to annual tax-free cashflow of $563.16. The chart below shows the hypothetical cumulative distribution cashflow assuming distribution remains constant at $0.0583 over the next 12 months.

These considerations all touch on covered call option ETFs. Harvest ETFs is one of Canada’s best-established providers of these income-generating ETF investments, and that knowledge can be very helpful as Canadians approach the looming RRSP deadline.

HLIF Cumulative Cashflow 1 Year

Based on a hypothetical 2023 TFSA investment of $6,500

Ambrose O’Callaghan

Ambrose O’Callaghan is the Content Editor at Harvest ETFs. Ambrose brings over a decade of experience in the financial services industry to the Content Editor role. He is responsible for providing context to current trends, developments, and analyses to help make sense of the ETF market and emerging themes. With a strong knowledge of the Canadian equity markets and Harvest products, Ambrose regularly provides commentary on a broad array of market topics.