By Ambrose O’Callaghan

Health care has been a consistent performer over the past 15 years, running behind only technology as the most dependable growth sector available to investors. In 2024, the S&P 500 Health Care Index has climbed 4.92% in the year-to-date period as of early afternoon trading on Thursday, June 27, 2024. Moreover, the index is up 10.89% in the year-over-year period.

The healthcare sector has underperformed compared to several of its peers through the first half of 2024. Investors who are hungry for an opportunity should consider seeking exposure to this vital sector. Today, we’re going to examine why healthcare offers an opportunity at this stage and zero-in on Canada’s Largest Healthcare ETF, which offers exposure to some of the top stocks in this space. Let’s jump in.

Tactically positioning within healthcare

Earlier this month, Bank of Montreal (BMO) Capital Markets released an analyst report from Chief Investment Strategy Brian Belski and Head of U.S. Equity Strategy Nicholas Roccanova, CFA. This report concluded that “recent market performance dynamics created attractive opportunities from a sector perspective”.

In its tactical analysis, the BMO report showed that Health Care lagged the broader S&P 500 Index through close on June 11, 2024. The S&P 500 had delivered gains of 12.7% in the year-to-date period compared to gains of just 7.1% for Health Care stocks. Indeed, the Health Care sector had been one of the five weakest, beating out sectors like Industrials and Real Estate but losing out to sectors like Information Technology, Financials, and Consumer Staples.

The BMO report suggested that “the [Healthcare] sector has marginally outperformed, on average, in the months following similar levels historically”. Therefore, the report projected that healthcare stocks were “likely to close the recent underperformance gap” in the months ahead when we account for its historical behaviour.

Healthcare sector fundamentals deserve attention

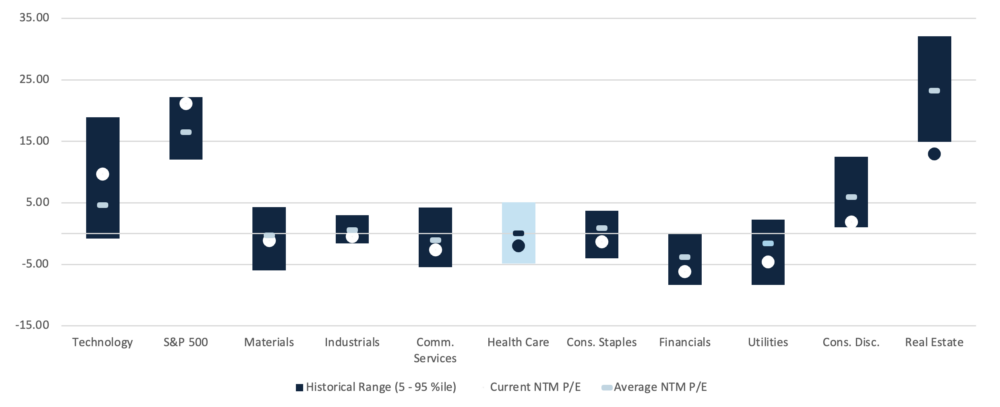

This underperformance is “at odds” with the solid fundamentals that underpin equities in this sector. The report highlights earnings growth that has been lacking. However, it contends that the sector is positioned to move through the “tough comps” of the COVID-19 era into a more favourable period. At Harvest, we have done our own digging that supports the thesis put forth by this BMO analysis. The chart below shows individual Sector Valuations against the valuations of the broader market. Healthcare, as a sector, has demonstrated a favourable forward price-to-earnings ratio compared to most of its peers.

Sector valuations vs. broad market (SPX)

Sectors’ 1 Yr Forward PE vs. SPX (sorted by premium/ discount over hist. average)

Source: Bloomberg, May, 2024 | Historical range from Jan 2000 – Present, except for Real Estate (Sep 2016 – Present)

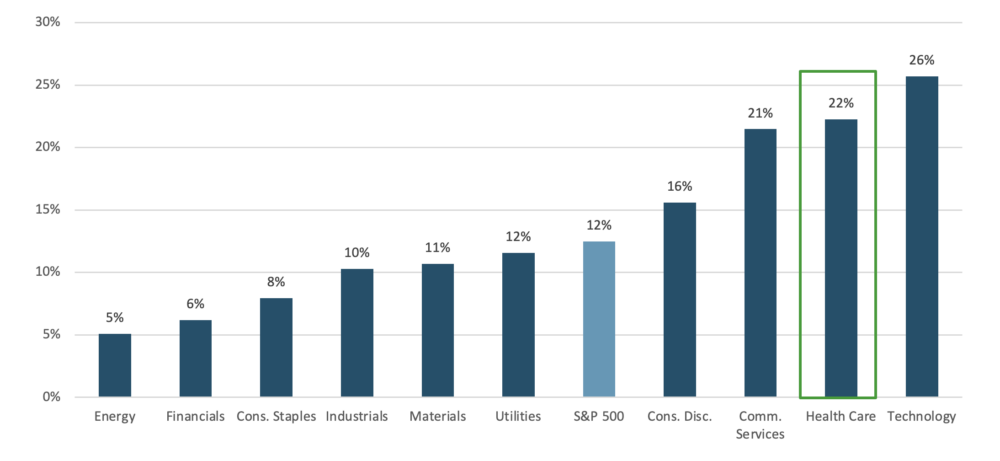

Meanwhile, this chart illustrates the S&P 500 Sector Returns and NTM Earnings Growth. Once again, healthcare has been able to generate forward earnings growth that is bested only by the Technology sector – which has powered North American markets since 2023. See below:

S&P 500 Sector Returns & NTM (Next Twelve Months) Earnings Growth

Source: Bloomberg, as of June 13, 2024. Performance in USD. | NTM Earnings growth = 12 month Blended Fwd EPS (Earnings Per Share)

A Morningstar report from April 3, 2024 also suggested that valuations in the Healthcare sector were attractive in the early spring. Morningstar’s statistical analysis also suggested that the majority of Healthcare industries offered a buying opportunity. “Within the biotech and drug manufacturing group,” says Damien Conover, CFA. “The market is not fully appreciating innovation in several therapeutic areas (including oncology, immunology, and rare diseases), as well as the industry leaders’ wide moats.”

BMO’s composite model illustrated in the report in question lists healthcare as “the second-lowest sector valuation”. This makes the healthcare sector one to watch going forward.

Canada’s largest healthcare ETF fits the frame

The BMO report goes on to advocate for an active approach in response to the opportunity that is present in the healthcare sector. After applying its “stock selection vs. Sector/industry allocation model”, BMO concludes that “it appears that investors should be utilizing an active approach when looking to add exposure within healthcare.”

Afterward, BMO highlighted several healthcare stocks that fit the theme.

The Harvest Healthcare Leaders Income ETF (HHL:TSX) is an equally weighted portfolio of 20 large-cap global healthcare companies. These companies are selected for their potential to provide attractive monthly income and long-term growth. Moreover, HHL employs an active covered call writing strategy on the portfolio to generate high income every month.

HHL boasts several select holdings that fit the list that the BMO report provided. AbbVie is a Chicago-based biopharmaceutical company. Its primary product is Humira, an antirheumatic drug used to treat rheumatoid arthritis. Humira alone is responsible for more than $20 billion in annual sales. Eli Lilly is another pharmaceutical giant that has garnered attention for its manufacture of GLP-1s or weight loss drugs. Namely, it is the maker of Mounjaro and Zepbound.

HHL has delivered a monthly cash distribution of $0.0583 every month since its inception in December 2014. That represents nearly a decade of consistent monthly distributions. Indeed, HHL has paid out more than $450 million in total distributions over that period as of May 31, 2024. Moreover, HHL’s NAV performance has routinely stood above its Canadian peers over the past five years.

On June 25, 2024, Harvest ETFs announced increases to the monthly cash distribution amounts for core ETFs. HHL’s new monthly cash distribution is now $0.0600 – a 2.92% percentage increase per unit. Its estimated new current yield was 8.60% as at June 21, 2024.

Investors who want to take advantage of an exciting investment opportunity may want to seek exposure to a sector that boasts favourable valuations with rock solid fundamentals. Access the top names mentioned overlayed with an active covered call strategy that provides high income every month with HHL in your portfolio.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this article including the views expressed is to inform and educate and therefore should not be taken as investment, tax, or financial advice. Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.