By Ambrose O’Callaghan

In late August, Federal Reserve chairman Jerome Powell caused a stir among the investing community when he provided the strongest signal yet that the US central bank is gearing up for interest rate cuts starting in September.

At the time of this writing, we are just two days away from that crucial decision. So what will this mean for the yield curve, the direction of the Fed, how the change in policy is affecting markets, and the implications for Harvest Premium Yield Treasury ETF (HPYT:TSX) and the Harvest Premium Yield 7-10 Year Treasury ETF (HPYM:TSX) in the final third of 2024? Let’s explore!

How does the yield curve function?

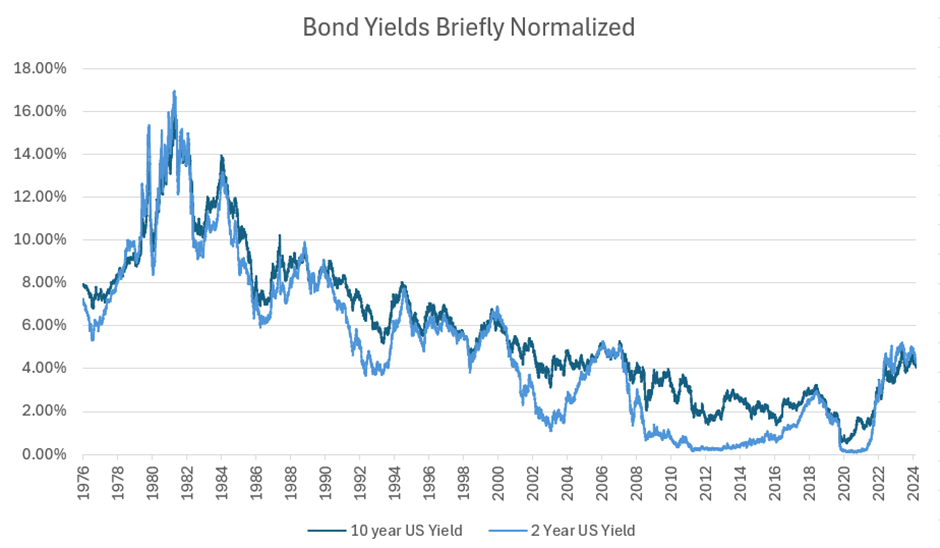

The yield curve, which is a representation of different bond yields across various maturities, can take varying shapes and curvatures. However, the most talked about is the shape of the yield curve that is either normal or inverted. A normal yield curve will have short-term bond yields that are lower than long-term bond yields. This encapsulates the time and risk premium associated with investing further into the future. However, in a period wherein central banks are seeking to slow economic growth/inflation, near-term rates will be raised in a manner that leads to higher short-term yields versus long-term yields. This is called an inverted yield curve, a much rarer occurrence.

Source: Bloomberg, Harvest Portfolios Group Inc., September 12, 2024

In practice, the difference between the 10-year yield versus the 2-year yield of government bonds is the go-to measure or gauge. The yield curve has been inverted for some time and became dis-inverted (Normal) in August 2024. That is a sign that shorter term rates are coming down. This likely precedes meaningful interest rate cuts.

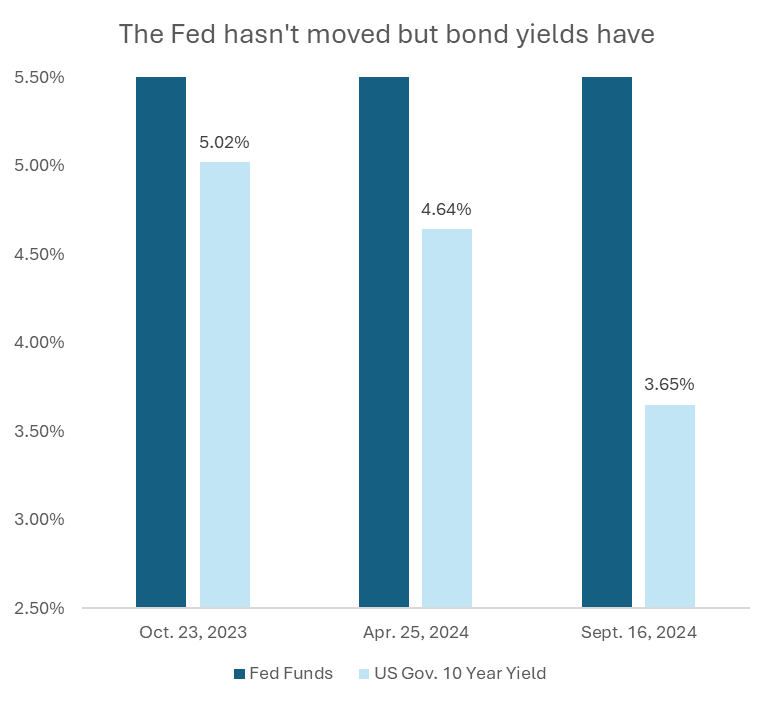

Source: Bloomberg, Harvest Portfolios Group Inc., September 12, 2024

What drives the Federal Reserve?

The Federal Reserve (The Fed) has a dual mandate: To achieve maximum employment, and to keep prices stable. Despite taking on one of its most aggressive interest rate hiking cycles in history to regain price stability, inflation has failed to return to the target of 2%, albeit subsiding in recent months. The lower levels of inflation come with slowing economic data and weaker-than-expected jobs data, which belies the Fed’s goal of achieving maximum employment. So, what’s next?

With inflation coming down, the Fed members seem ready to cut short-term rates to alleviate the negative impact of higher interest rates on the economy. But before we get excited, it’s worth noting that the Central bank tools traditionally take time to filter through to the economy. Interest rate cuts may not have an immediate impact on the economy and broader markets but will filter over time.

Ultimately, this shift in policy should return the inverted yield curve to a normal yield curve.

Rate expectations: What is already priced in?

The next Fed rate announcement meeting is on September 18, and the market is already pricing in the first rate cut. The size of the cut is still up for debate, but it is likely to be 25 basis points, with a smaller chance that it could be larger at 50 basis points.

Looking further out to the Fed’s remaining two meetings for the rest of the year, the market expects the Fed to cut rates again. That would represent a total of 100 basis points of cuts expected by the end of 2024. Moreover, the market has priced in 10 rate cuts, or 250 basis points, of total interest rate cuts. These are priced in and expected to occur throughout 2025 with the ultimate destination of 3.00% on the overnight rate.

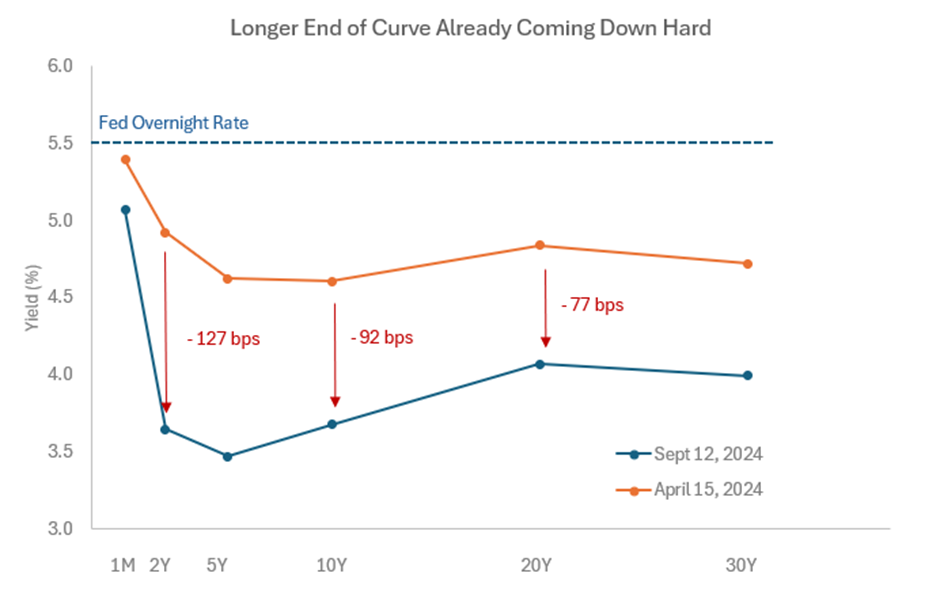

However, interest rates further out the yield curve have also recently moved down quite a bit. This is what’s known in bond-speak as a “bull steepening” — as the curve normalizes yields across maturities shift lower too, and thus bond prices move higher. Indeed, the narrative continues to shift toward the imminent start of this rate cutting cycle.

The 10-year yield was 3.65% at the time of writing. That is already down significantly – 137 basis points – from the peak of interest rates in October 2023.

The implications for the yield curve

What will happen to the yield curve going forward? Portfolio Manager Mike Dragosits, CFA, expects the yield curve to normalize due to several existing factors. The tightening cycle is ending, and the Fed is poised to embark on a rate cutting cycle. So, this would mean that short-term bond yields may fall faster and stay relatively lower than long-term bond yields.

Source: Bloomberg, Harvest Portfolios Group Inc., September 16, 2024

We’ve already witnessed this phenomenon with the 2-year bond yields being lower than 10-year bond yields for the first time in over a year since the curve has been inverted or in negative territory.

The ideal outcome for yields it to get to a point called the neutral rate. That is the point at which yields are in a comfortable spot that allows the economy to continue to grow at a steady pace, maintains healthy employment, and keeps inflation in check. The exact number that qualifies for the neutral rate is always debated.

Meanwhile, the long-term bond yields have already done a lot of heavy lifting to price in the anticipated interest rate cutting cycle. On expectation of a return to a normal yield curve, there have been a decline of 137 basis points on the 10-year bonds, with those bond yields now at 3.65%. Even when comparing to the more recent April 2024 peak, after yields had backed up higher again on a brief pick up in the economy and inflation, we can see the magnitude of the moves in bond yields across the curve have moved significantly lower, especially compared to where the Federal Reserve overnight rate sits.

Source: Bloomberg, Harvest Portfolios Group Inc., September 12, 2024

The market still views a soft landing as the most likely economic outcome, with short-term rates priced to fall to 3.00%, which is roughly anticipated to be the neutral rate.

Where does that leave HPYT and HPYM?

The Harvest Premium Yield Treasury ETF – HPYT – is Canada’s largest covered call bond ETF. It holds longer dated US Treasury bonds that are secured by the full faith and credit of the US government. It employs up to 100% covered call writing to generate high income every month.

If yields on the longer end continue to fall lower, long-term bond prices could see some upward price movement. That would be positive for HPYT from a NAV perspective on any portion of the ETF not capped by the call options written. In executing our covered call strategy for this fund (also for HPYM) the strike levels for the option contracts are reset each month based on price movement. This means new caps are constantly being put in place for the portion written. Ideally, slow, steady yield changes are the most optimal for covered call bond strategies.

Moreover, we must contend with the double-edge sword of volatility. The higher duration level of the bonds in HPYT and sensitivity to even small rate changes mean that the NAV could easily experience volatility. At the same time, higher volatility provides the ability to generate call option premiums at higher levels. Generating high monthly cash flow is the main appeal of this type of ETF.

The Harvest Premium Yield 7-10 Year Treasury ETF – HPYM – writes covered calls on a portfolio of US Treasury ETFs that primarily hold mid-duration U.S. bonds with average maturities of 7-10 years. Bond prices in HPYM are tied more towards the mid-term part of the curve. There could also be some bond price upside as yields adjust to the ultimate outcome in the economy, and as the pace and destination of short-term rates unfolds.

It is crucial to remember that the duration of these bonds and the sensitivity to these interest rate movements is less than in the long-term bucket. Therefore, the NAV should experience fewer price fluctuations. On the other hand, monthly cash flow will be less than the per unit rate of HPYT.

Investors must contend with rate regime transitions and uncertainty in the near term. This is especially true as we head into a heated US presidential election cycle. However, this should translate into greater opportunity to capture elevated option premiums through covered call writing.

We are confident that will bode well for the option premiums generated in our fixed income covered call strategies going forward.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this article including the views expressed is to inform and educate and therefore should not be taken as investment, tax, or financial advice.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.