By Ambrose O’Callaghan

In our previous piece, we touched on the healthcare sector from a Canadian perspective. While the Canadian healthcare sector is minuscule, making less than 0.5% of the S&P TSX Index in terms of market capitalization, healthcare is a much larger and more diverse sector from a global perspective. Indeed, even the 20 stocks held in the Harvest Healthcare Leaders Income ETF (HHL:TSX) have a combined market cap that is 1.5 times the size of the entire S&P TSX Index.

The healthcare sector is exposed to three important growth drivers over the long-term: Aging populations (a permanent and non-cyclical driver), developing markets, and technological innovation (both a long-term and short-term driver). That third driver is what we’re going to focus on in this piece.

When we think of technological innovation, we are talking about some of the near-term advancements in areas like pharmaceuticals and biological drugs. Other innovations include medical devices and diagnostic tools, and of course innovations in areas like artificial intelligence. Today, we will also look at some of the practical applications that have emerged in these spaces.

Biological drugs

In the early 2000s, there was this great promise that biological drugs would take off and result in a significant shift away from more chemical-based drugs. However, this prediction would take a long time to come to fruition. Now, we are starting to see the rise of more complicated biological drugs that will be around a longtime in the marketplace.

When we talk about biological drugs, we are referring to drugs that are made from living organisms versus a traditional chemical drug. This is important because biological drugs are much more difficult to replicate. When the patents on these drugs expire, they often maintain strong competitive moats and long lives. Meanwhile, chemical drug manufacturers can fall victim to competitors that produce generic copies.

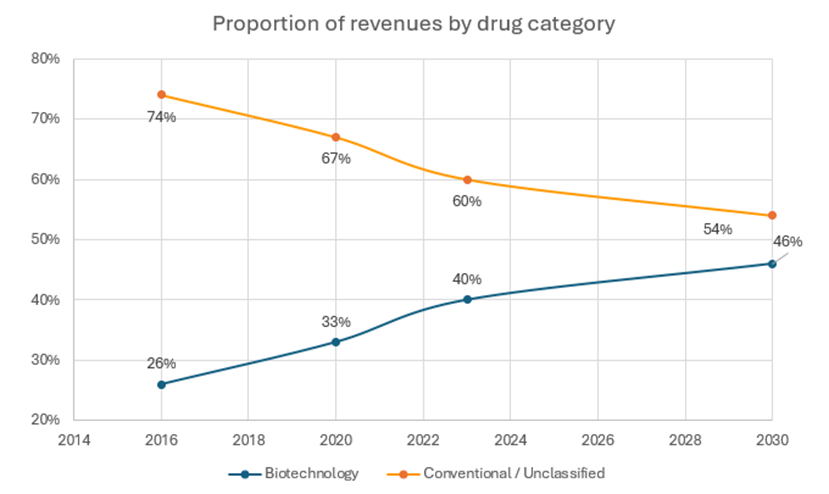

Source: Evaluate Pharma (May 2024), “World Preview 2024: Pharma’s Growth Boost” report by Evaluate.

Within the pharmaceutical drugs space, total revenues for biological drugs are projected to rise from 24% to 40% by 2030. Treatments like immunotherapies and those that treat a wide range of immunological disorders have changed the lives of millions of people. The research and development in these areas should continue to drive amazing innovations and progress going forward.

GLP-1s/Weight loss drugs

One of the hottest areas in recent drug development is the GLP-1 drug class. These are often referred to as the “obesity” or “weight loss” drugs. This class of drugs has dominated the headlines in recent years due to the stunning success rate that has surpassed the capabilities of any drug-based diet solution in the past. These companies have strong revenue forecasts that have made the investing community very excited about the future.

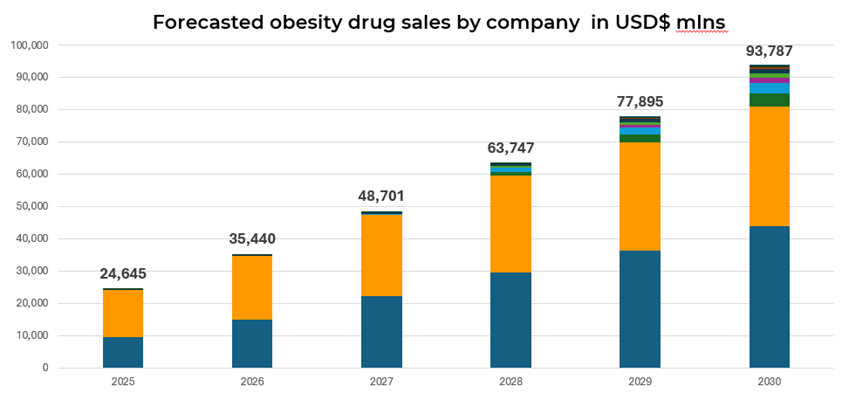

Source: Bloomberg, Harvest Portfolios Group Inc., estimated CAGR 30% p.a. Accessed October 2024.

The potential success of GLP-1s is not just about the commercial viability of a drug that is able to deliver weight loss. Rather, it is the additional benefits that are afforded by GLP-1s that are starting to show through various trials. For example, some trials have demonstrated significant reductions in major cardiovascular events and sleep apnea. Moreover, a study published in the British Journal of Pharmacology suggested that GLP-1s have “received attention as a potential anti-addiction treatment”.

There are many companies who want a piece of the US$100 billion+ market that is expected to be generated from the revenue of GLP-1s. So, there is expected to be fierce competition both in the drug manufacturer space itself and in the investing world. Of course, competition needs to produce either better efficacy, safety, or improved delivery. That is a difficult task.

Investors can expect to see higher multiple stocks impacted if this does come to pass. We love the innovation and growth in this space, which is why Eli Lilly & Company is one of our 20 holdings in HHL.

Medical tools and devices

Drug development is not the only area where we have seen technological advancements. Medical tools and devices have seen advances in areas like new ablation technology from Boston Scientific for treatments for arrythmia, or Abbott Labs with its continued glucose monitoring. One of the areas that is garnering significant interest is in the robotic assisted surgery market.

These are highly sophisticated tools that allow surgeons to be more precise. This results in better patient outcomes, faster recoveries, and lower readmissions.

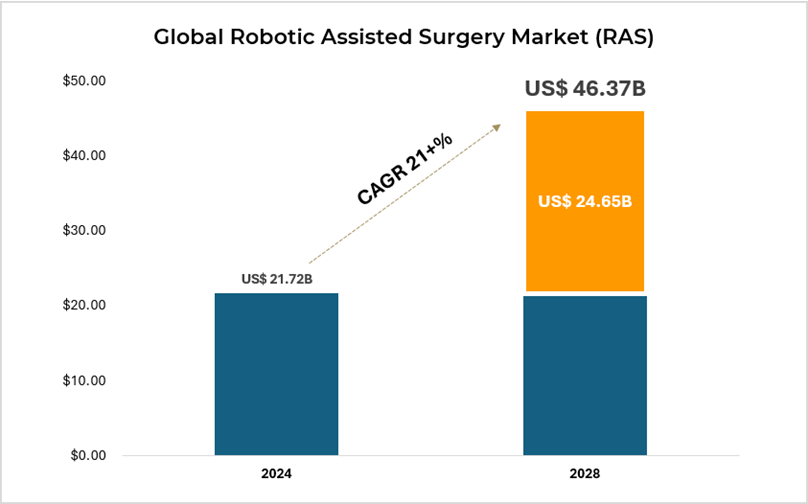

Source: Itd, R. And M. (n.d.). Global Surgical Robot (by type & region): Insights & Forecast with potential impact of COVID-19 (2024-2028). Research and Markets – Market Research Reports. https://www.researchandmarkets.com/reports/5531032/global-surgical-robot-market-by-type-and-region

This market is forecast to see revenues nearly double by the end of this decade. Within HHL, we have several companies that are positioned in this market. These include pure play Intuitive Surgical, and more diversified companies like Stryker, Medtronic, and Johnson and Johnson.

Artificial intelligence in healthcare

Finally, it would not be an innovation piece if we did not touch on artificial intelligence. AI has generated a lot of talk about the systemic changes in healthcare. That is very exciting. However, in practice, we have not seen the kind of widespread adoption that justifies the attention. Areas that have seen exposure are often atypical of what readers may think.

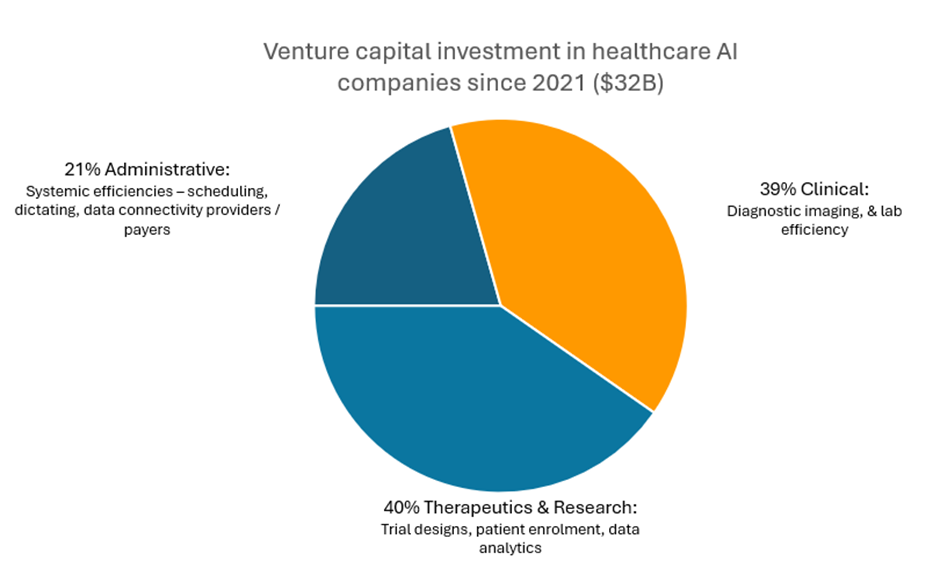

Source: AI in healthcare report: Silicon Valley Bank.

On the administrative side, we have seen various systemic efficiencies using AI. These include areas like scheduling, adding efficiencies on payments, and insurance and physician dictating. Because of this, companies like UnitedHealth and Elevance Health in Healthcare Leaders have been very large investors in various AI partnership and acquisitions.

On the clinical diagnostic side, we have seen more meaningful practicality where companies like Agilent Technologies, a maker of lab and diagnostic equipment, uses AI for instrument monitoring and workflow efficiency. Meanwhile, Abbott has AI powered heart imaging software to give a better view of heart vessel blockages. So, we are seeing practical AI applications while on the R&D side we do see it being used in data analytics. It has also been used in trial design and patient enrolment.

AI adoption may not be as widespread as some have been led to believe. However, we do think the promise is there and we are now starting to see more applications.

HHL and healthcare innovations

Healthcare benefits from long-term permanent and non-cyclical drivers of aging populations, developing markets, and long-term technological innovation. The innovation we see across drug development and medical devices is exciting. Meanwhile, the promise and application of AI are very much shorter-term drivers for now.

Our portfolio management team sees the recent political rhetoric as passing. Ultimately, the foundations for longer-term investors remain very much intact in the healthcare space.

HHL invests in a portfolio of 20 large-cap diversified healthcare stocks on an equal weight. It has paid the same higher distributions for 118 consecutive months and will reach its 10 years of existence on December 18, 2024.

Disclaimer

The content of this article is meant to provide general information for educational purposes. The view expressed should not be construed as investment advice. Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.