By Ambrose O’Callaghan

On September 28, 2023, Harvest ETFs announced the launch of the Harvest Premium Yield Treasury ETF (HPYT:TSX).

At the time, Harvest sought to provide investors with exposure to the US Treasury fixed income market, while incorporating a covered call option strategy to generate high levels of monthly income. HPYT aimed to combine the safety and strength of investing indirectly in US Treasury bonds with the higher income potential and tax-efficiency of Harvest’s trusted covered call option writing strategy.

“As a market leader in active covered call strategies in Canada,” said Harvest ETFs President and CEO Michael Kovacs. “We take that expertise to a new level with HPYT.”

How has the interest rate evolved since HPYT was launched last year? Where does HPYT stand after trading on the market for 12 months? What does the future hold for this Fixed Income ETF?

How are current rates impacting US Treasury yields?

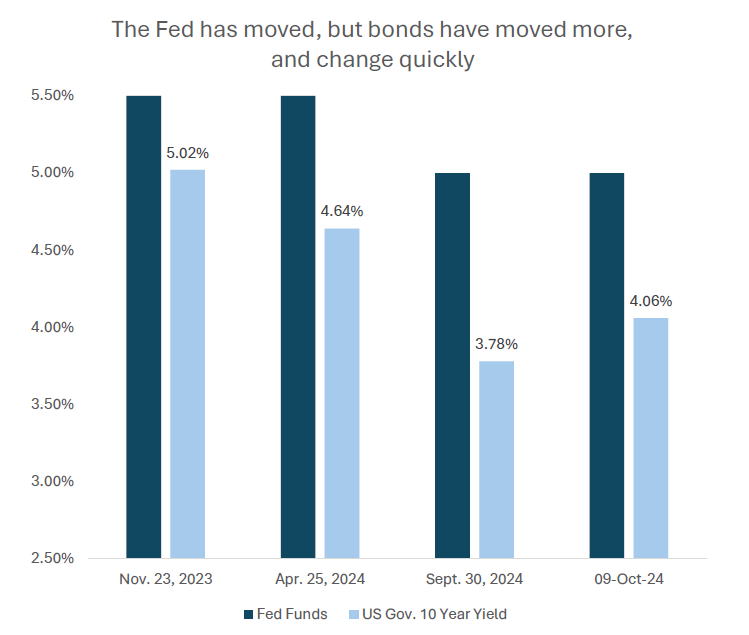

In mid-September, Harvest ETFs CIO Paul MacDonald discussed what investors should expect ahead of a crucial US Federal Reserve meeting. The investing world had anticipated either a 25 or 50 basis point cut. Those that were hoping the Fed would hit the ground running were gifted with the latter. On September 18, 2024, the Fed announced that it elected to cut interest rates by 50 basis points. As of today, oddsmakers are projecting four more interest rate cuts in 2025 and two more cuts in 2026. This environment has spurred many investors to take a longer look at US Treasury securities.

Back in August, we covered the inverse relationship between bond prices and interest rates. A gradual rate softening environment could be very positive for long-term US Treasury prices in the near term.

So, why did the Fed cut rates more aggressively in September?

“Economic data has been slowing,” said Harvest ETFs CIO and Portfolio Manager Paul MacDonald, CFA. “Meanwhile, overheated inflation has continued to trend lower. Employment data sets were weaker than expected in August. This prompted the Fed to cut more aggressively. Jobs data through early October has remained supportive of a soft landing. This has spurred the market to expect fewer cuts for the rest of the year and into 2025.”

Source: Bloomberg. Harvest Portfolios Group, Inc., 2024.

Why did bond prices move lower when the Fed moved forward with a larger-than-expected rate cut?

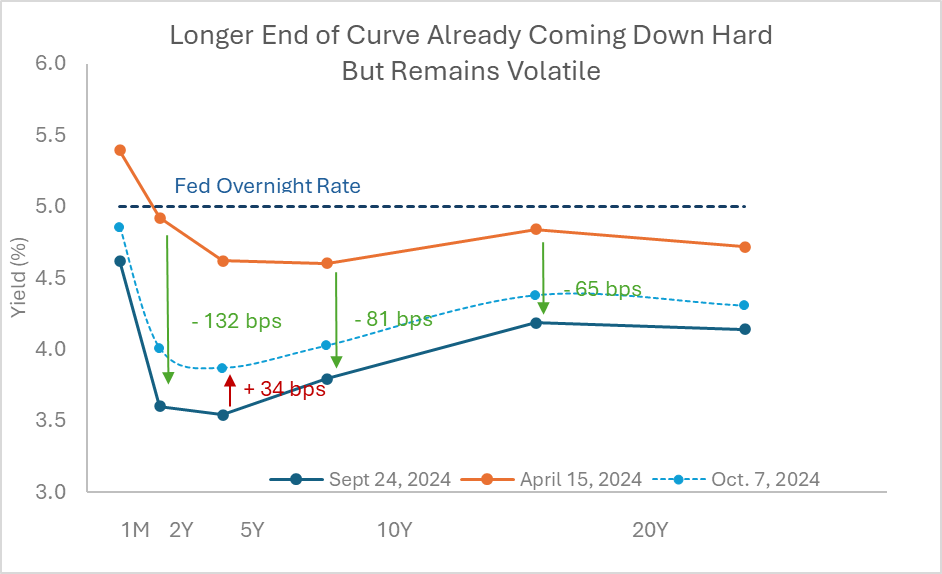

“There can be many factors that highlight the impact of the Federal Reserve cutting interest rates and its impact on the yield curve,” continued Paul MacDonald. “And bond prices are impacted by many factors. However, a key is the impact of bond yields of similar durations. So, a bond with a 10-year duration, will be impacted by changes in the 10-year interest rates.”

Source: Bloomberg. Harvest Portfolios Group, Inc., October 7, 2024.

“Looking at the yield curve, one can see that, across most maturities, yields have come down significantly.”

What could change this environment?

“Potential headwinds include the China stimulus driving commodity prices,” said Paul MacDonald. “Supply disruptions in oil, potentially causing a spike in inflation and necessitating further rate increases. Or, the Fed could be late and jobs data could deteriorate, fuelling a recession.”

HPYT | Canada’s largest covered call fixed income ETF

As of September 30, 2024, HPYT is Canada’s largest covered call fixed income ETF. The ETF possesses over C$500 million in assets under management (AUM) at the time of this writing. Moreover, when paired with the Harvest Premium Yield 7-10 Year Treasury ETF (HPYM:TSX), which offers investors exposure to mid-duration US Treasury ETFs overlayed with an active covered call strategy, this makes for the largest covered call fixed income ETF lineup by AUM in Canada.

Where is HPYT headed?

Long term Treasuries have historically performed well in a rate cutting environment. Harvest’s active covered call writing strategy can create additional value due to the higher yield that is generated through the call options written. Covered calls may cap some upside potential as rates fall, but that is bolstered by the premiums that are earned.

Meanwhile, HPYT has demonstrated that high premiums effectively offset declines in a rising/high-interest rate environment.

At launch, HPYT announced a monthly cash distribution of $0.15 per unit. That represents a current yield of 16.1% as of close on September 30, 2024. The ETF has delivered its $0.15 per unit cash distribution in every month since its inception. Moreover, HPYT has generated total distributions of $1.80 per unit since its launch. When we calculate its total return, the current NAV price plus total distributions paid since inception, HPYT has a total return of 8.45% in the year-over-year period.

Where is HPYM headed?

Mid duration treasuries also have historically performed well in a rate cutting environment. Harvest’s active covered call writing strategy can create additional value due to the higher yield that is generated through the call options written. Covered calls may cap some upside potential as rates fall, but that is bolstered by the premiums that are earned.

Given the fact that HPYM has less duration than HPYT, it does mean that the amount of premiums that can be earned from the covered call writing is lower. However, should we enter a period where interest rates across durations move higher, the volatility to the downside will also be less for HPYM.

At launch, HPYM announced a monthly cash distribution of $.08 per unit / month when it launched in January of this year. Performance will be available once it passes its one-year anniversary.

Summary

HPYT has attracted over half a billion in AUM since its debut. Over that 12-month period, it has consistently delivered monthly cash distributions of $0.15 per unit. This represents a very high 16.1% current yield as at September 30, 2024. It has generated total distributions of $1.80 over its lifespan.

On top of its high monthly income distributions, HPYT is an interesting target in this interest rate environment. A steady reduction in interest rates, which oddsmakers expect in the years ahead, could potentially lead to much higher US Treasury securities prices going forward.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A, Class B or Class U units of the Fund. If the Fund earns less than the amounts distributed, the difference is a return of capital. Tax, investment and all other decisions should be made with guidance from a qualified professional. The current yield represents an annualized amount that is comprised of 12 unchanged monthly distributions (using the most recent month’s distribution figure multiplied by 12) as a percentage of the closing market price of the Fund. The current yield does not represent historical returns of the ETF but represents the distribution an investor would receive if the most recent distribution stayed the same going forward.