By Harvest ETFs

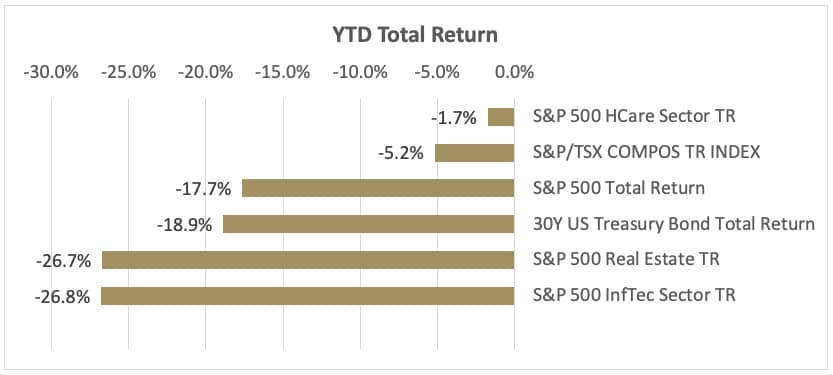

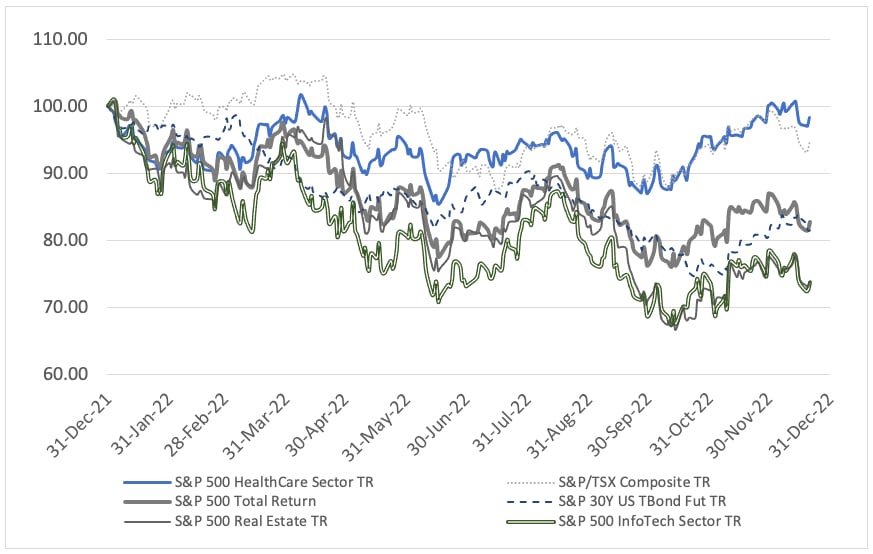

After the euphoria of 2021’s everything rally, 2022 brought many investors right back down to earth. The asset classes that led in the latter periods of the most recent bull market lost ground in this year as the ‘permacrisis’—Collins dictionary’s word of the year—was felt across markets and asset classes since the end of February. We know the story – inflation, supply chain challenges, rate hikes, and war in Ukraine all conspired to wreak havoc. As the below graphs show, few areas of the market were immune from 2022’s tribulations

Source: Bloomberg, Harvest Portfolios Group Inc. December 21, 2022

Sector & Market Returns YTD

Source: Bloomberg | Data as on December 20, 2022; prices normalized to 100 (starting December 31, 2021)

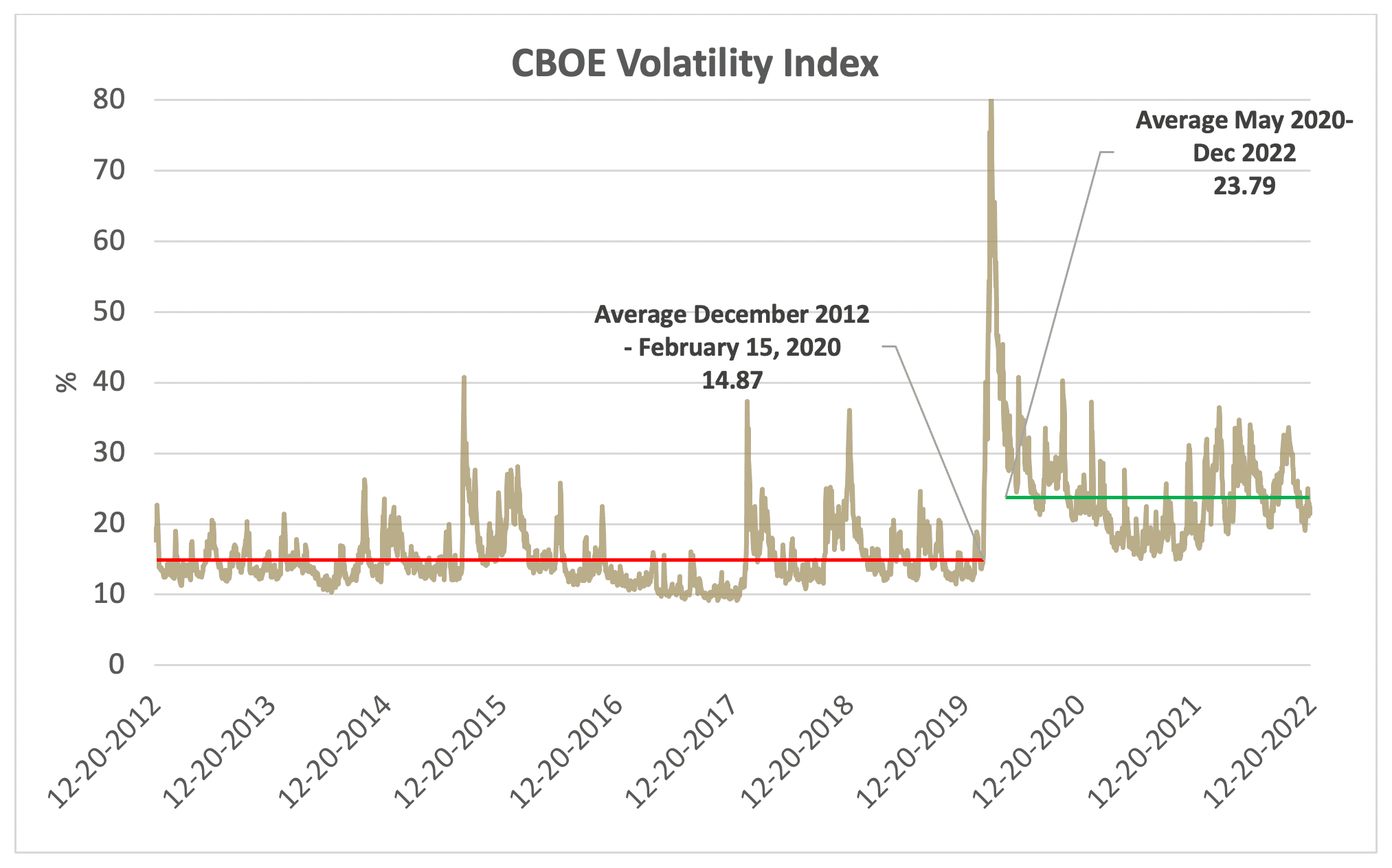

While markets have been decisively in the red for the year, the path has been marked by significant volatility spikes – both to the upside and downside. As a proxy for volatility, the VIX Index, aptly called the CBOE Volatility Index, visually shows the volatility spikes that were experienced by most investors. One can also see that volatility has been at levels on average that are meaningfully higher than in recent history.

Source: Bloomberg, December 20, 2022. Additional Information: https://www.cboe.com/tradable_products/vix/

The dramatic and volatile swings in equity markets outlined above should, in a normal year, have been offset by investors’ bond holdings. That’s the logic of the traditional 60/40 – equity/bond portfolio.

2022 was not a normal year. Rising interest rates pushed down the value of bonds at the same time as equities were falling. The FTSE Canada Universe Bond Index, for example, was down 9.91% YTD as at December 21st.

Certain funds in one asset class, despite the negative overall returns in the market, were able to earn and deliver solid tax efficient cash flows for investors by monetizing some of the market volatility: call option ETFs.

What are call option ETFs?

Call Option ETFs—also called equity-income ETFs—are investment funds which hold portfolios of equities, but use call option strategies to generate income for unitholders. Those call option strategies trade a certain amount of market upside potential for certainty of some cash flows during a specific period– selling the option to buy a stock tomorrow at today’s price for a premium. Call Option ETFs pass those premiums on to unitholders as tax efficient cash flow. They forego a certain amount of market upside, if markets swing higher, but generate a consistent amount of ‘income’. A ‘bird in the hand’ as it were.

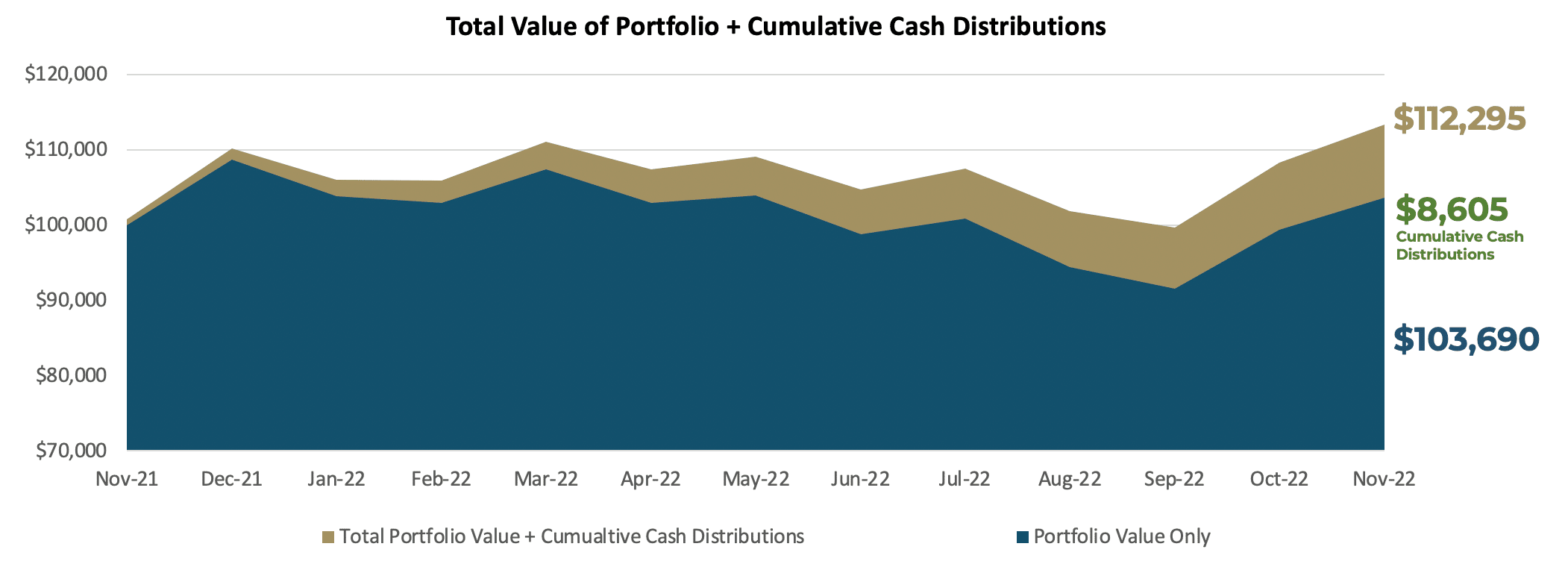

That ‘bird in the hand’ income came at high rates in 2022. Many of Harvest’s call option ETFs had annualized yields more than 8% or even 10% during the year. That income—when considered a portion of total returns—was able to offset some of the losses in underlying equity values through the year, as the below example of the Harvest Healthcare Leaders Income ETF (HHL:TSX) demonstrates.

As at November 30, 2022

For illustrative purposes only. The chart above is based on a hypothetical initial $100,000 CAD investment and only shows the market value per unit of Harvest Healthcare Leaders Income ETF (“HHL”) using the daily market close on the TSX and identifies the monthly cash distributions paid by HHL on a cumulative basis. The cash distributions are not compounded or treated as reinvested, and the chart does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder. The chart is not a performance chart and is not indicative of future market values of HHL or returns on investment in HHL, which will vary.

While the underlying price of the ETF fell and recovered somewhat during 2022, the monthly cash distributions paid by the ETF helped to offset those losses and contributed to the ETF’s recovery.

That ‘bird in the hand’ income could be enough to make call option ETFs attractive for investors during a bear market, but Harvest’s call option ETFs offer an additional benefit that shows itself during periods of volatility and recovery: active management.

Why actively managed call option ETFs offer advantages

All of Harvest’s call option ETFs use an active & flexible call option writing strategy. That means the ETFs’ portfolio managers can sell as many or as few calls as they need to generate the ETF’s monthly distribution—up to a hard 33% write limit. That means at all times a minimum of 67% of each ETF’s holdings is fully exposed to potential market upside. It also allows these ETFs to capture market opportunities in a way that passively managed call option ETFs cannot.

Key to this advantage is the fact that options generate a higher premium when markets are more volatile. When stock prices swing wildly in the way they have throughout 2022, options cost more. Therefore the premium earned is higher. Since call option ETFs effectively sell options, they can generate the cash for their monthly distributions by potentially selling fewer options when markets are volatile. This means that more of the ETF’s portfolio is exposed to potential market upside compared to a passive systematic covered call strategy.

As much as 2022 is being treated as a down year on markets, it’s notable that many of the volatile swings we’ve seen have been to the upside. By earning higher premiums from options during periods of volatility, Harvest ETFs have been able to capture some of those upswings, but have also been able to generate high and consistent cash flows for investors.

Many of the macro conditions that had negatively impacted markets in 2022 have shown signs of abating, too. Inflationary pressures have let off slightly, and the final Federal reserve rate hike of 2022 was only 0.5%—lower than the year’s cadence of 0.75% increases. If a less hawkish fed and signs of inflation dropping manifest more fully in 2023 we may see a market recovery. In such an instance these actively managed call option ETFs will be better able to capture more market upside than a passively managed call option ETF, but until that recovery is in full bloom, the Harvest ETFs can generate significant monthly cash flows.

The right strategy for the right time

In a year where everything seemed to be falling, many call option ETFs offered Canadian investors attractive income yields paid monthly were a source of returns at a time when returns were hard to find. The greater opportunities for upside capture afforded by an active & flexible call option writing strategy may give Harvest’s call option ETFs an advantage over passively managed ETFs.

As predictions for 2023 roll in, with the prospects of both market recoveries and economic recession on the horizon, the aspects of call option ETFs that delivered for investors this past year may prove themselves valuable once again. 2022 may have been the year call option ETFs announced their importance for Canadian investors, but we believe that importance will be borne out in the years to come.