By Ambrose O’Callaghan

Harvest ETFs’ coverage of the healthcare sector has been a source of pride for over a decade. Paul MacDonald, chief investment officer (CIO), co-covers healthcare as a primary sector. He has helmed the management of the Harvest Healthcare Leaders Income ETF (HHL:TSX) for its entire lifespan as an ETF.

Since its inception 10 years ago this December, HHL has grown into the largest and one of the best performing healthcare ETFs in Canada. It has delivered over $500 million in total monthly distributions to unitholders since inception.

What sets apart HHL for its healthcare sector coverage in Canada? Where is the healthcare sector headed over the long term? Let’s jump in.

Healthcare investing in Canada

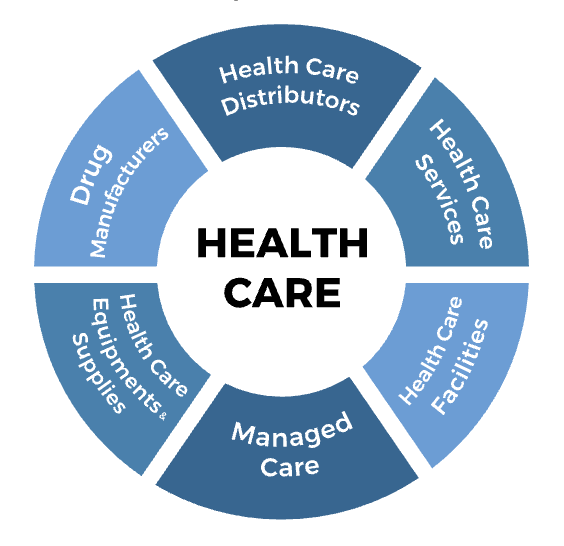

When we say healthcare investing, most individuals typically think of drug companies. Drug manufacturers – both pharmaceutical companies and bio-pharmaceutical companies – are a very meaningful component of the sector. However, healthcare is very diverse and includes companies that manufacture medical devices and equipment, those that are involved in the making of diagnostic tools and lab equipment, companies involved in the ownership of doctors’ networks, as well as facilities and companies like those in the Managed Care segment. These companies facilitate healthcare delivery for both private individuals, while also administering the delivery of healthcare for many of the government Medicare and Medicaid programs.

Healthcare Diversified Sub-sectors with Unique Drivers

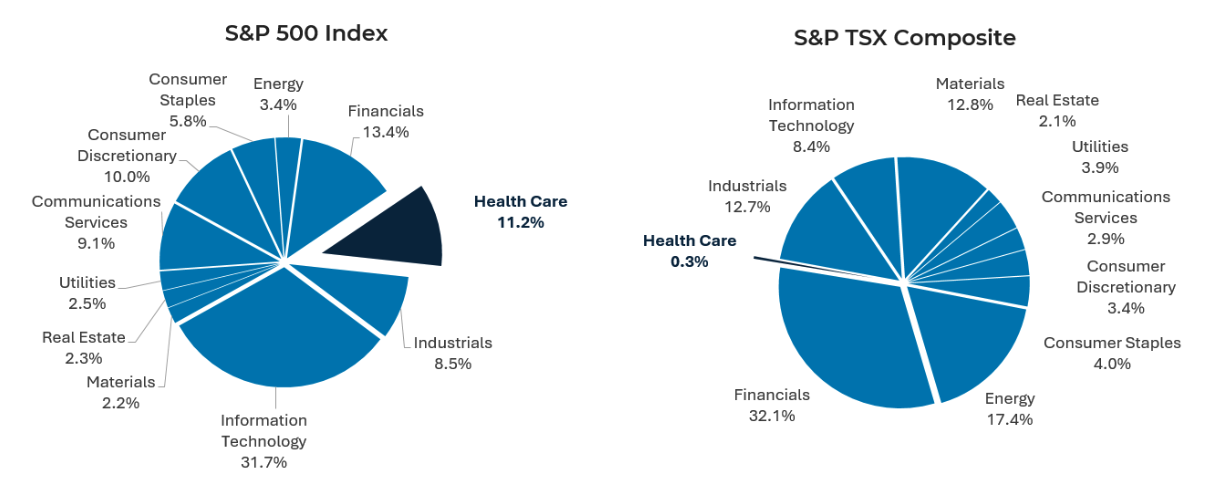

Canada, by comparison, lacks the scale and diversity offered in the United States healthcare market. When we look at the S&P TSX Index, less than 0.5% of the Canadian market offers exposure to the healthcare sector. And the healthcare sector in Canada includes exposure to cannabis and real estate companies. Meanwhile, the healthcare sector in global markets typically makes up between 11% to 15% of the market share.

Healthcare Limited Opportunities in Canada

Source: Bloomberg, as on October 31, 2024.

Canada is home to many wonderful companies. Many of them are oligopolies (companies that can change prices easily to their advantage due to limited competition). These companies have high and extremely consistent cashflows. However, there are very limited investment vehicles for investors to gain access to the scale of healthcare companies that are available in the global market.

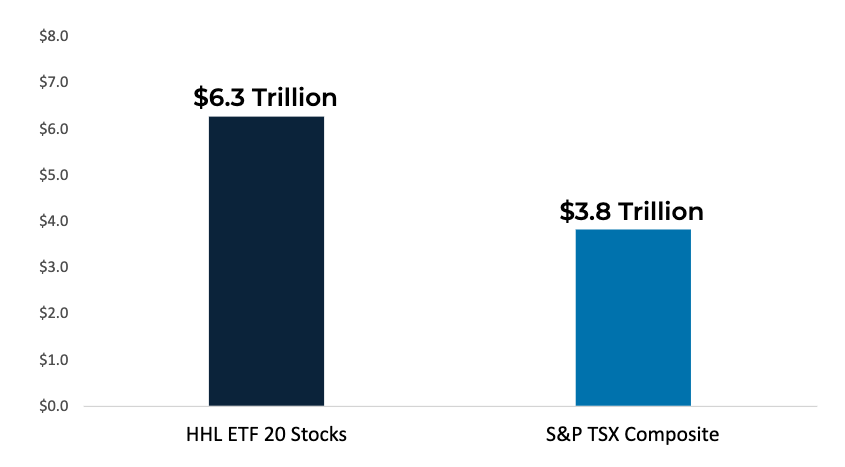

The Harvest Healthcare Leaders Income ETF – HHL – provides that access. It holds 20 stocks that represent nearly 1.7 times the market cap of the entire S&P TSX.

Market Cap of 20 stocks in HHL ETF (CAD$) vs. entire S&P TSX Composite Index

Source: Bloomberg, as at October 31, 2024.

The long-term drivers in healthcare

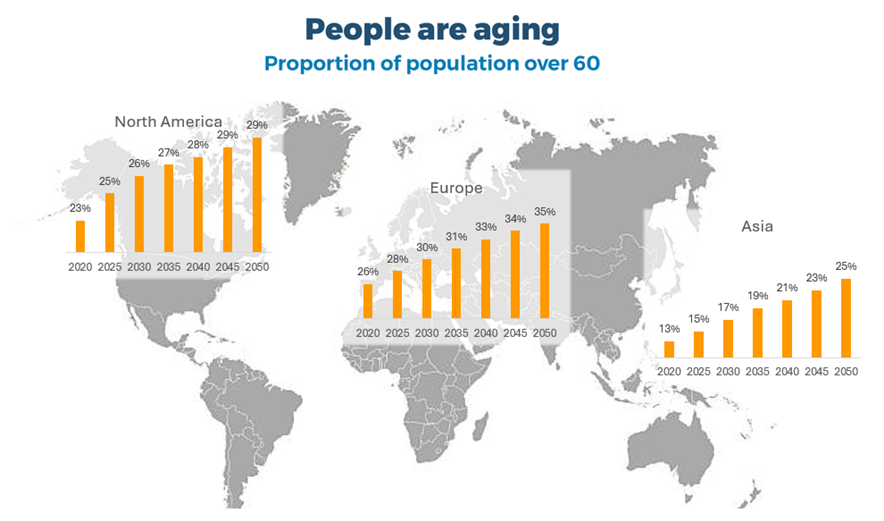

Healthcare has three major long-term drivers: Aging populations, developing markets, and technological innovations.

In most parts of the world, populations are aging.

Source: United Nations Population Division; World Population Prospects, 2021.

In North America, the proportion of the population that is over 60 years of age is expected to grow from 23% in 2020 to nearly 30% by 2050. In Europe, the ratio is even more pronounced with 26% over the age of 60 in 2020 expected to rise to 35% by 2050. But why does this matter?

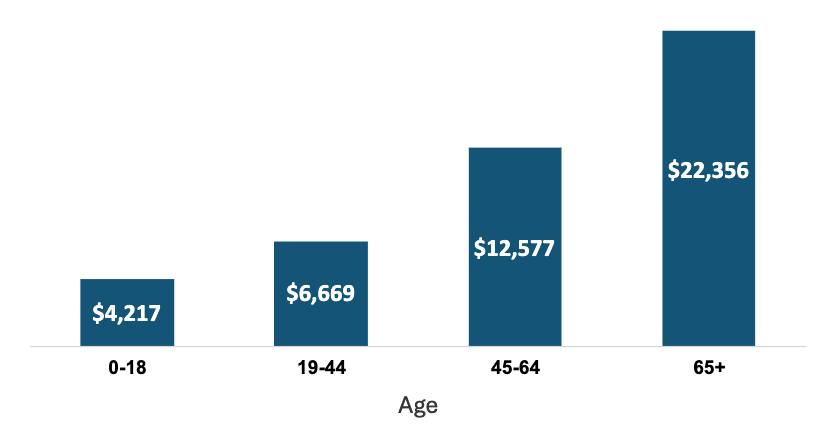

As people age, they spend exponentially more money on their healthcare needs. That means we have a double wave of a large portion of the population moving into the 60+ cohort. That cohort spends more on healthcare. Therefore, aging populations remains a promising long-term driver for the healthcare industry.

US Per Capita Total Personal Healthcare Expenditures

Source: NHE Fact Sheet, CMS.gov. Accessed October 2024. Based on 2020 calendar year.

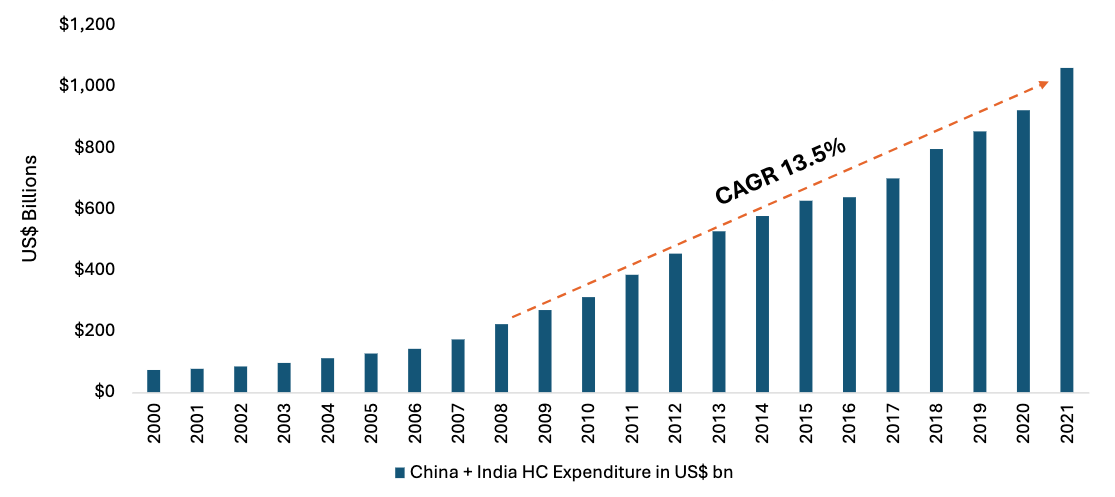

The developing market, which is the second driver, especially evident in markets like China and India has shown remarkable growth in healthcare spending. Healthcare expenditures in those countries has grown at a rapid rate (see chart below).

China & India Healthcare spending

Source: WHO Global Health Expenditure Database, Harvest Portfolios Group, Inc. as of October 2024.

So, aging populations and growth in health expenditure by developing markets are key long-term drivers of healthcare demand.

That brings us to the third driver, technological innovation. This is both a short-term driver and a long-term driver. This is borne out by implication of artificial intelligence (AI), robotic assisted surgeries, and advancements in biotechnology over the past decade. Stay tuned for our next Insights piece, in which will provide a more in-depth analysis of the technological innovation happening in the healthcare space right now.

Canada’s largest healthcare ETF

The Harvest Healthcare Leaders Income ETF is available as HHL in its currency hedged form. Meanwhile, HHL.B is in Canadian dollars and HHL.U is unhedged and priced in US dollars. HHL currently offers a monthly cash dividend of $0.06 per unit.

Annualized Performance (%)

As at October 31, 2025

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 4Y | 5Y | 7Y | 8Y | 10Y | SI |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HHL | 3.54 | 9.61 | 4.06 | 4.56 | (1.30) | 9.87 | 6.07 | 5.45 | 10.08 | 7.96 | 7.68 | 7.00 | 6.60 |

| HHL.B | 4.50 | 11.38 | 6.81 | 3.52 | 1.12 | 11.90 | 8.21 | 9.76 | 12.08 | - | - | - | 10.37 |

| HHL.U | 3.69 | 10.04 | 4.99 | 6.10 | 0.38 | 11.28 | 7.16 | 6.38 | 10.94 | 8.96 | 8.65 | - | 9.03 |

Source: Harvest Portfolios Group, Inc.

For investors who want even higher levels of monthly income and growth potential, there is the Harvest Healthcare Leaders Enhanced Income ETF (HHLE:TSX). This ETF offers exposure to HHL’s underlying portfolio with the application of modest leverage at approximately 25%. That means it is invested 1.25x in HHL. HHLE last paid out a monthly dividend1 of $0.0934 per unit.

Annualized Performance (%)

As at October 31, 2025

Source: Harvest Portfolios Group, Inc.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing.

The current yield represents an annualized amount that is comprised of 12 unchanged monthly distributions (using the most recent month’s distribution figure multiplied by 12) divided by of the closing market price of the ETF. The current yield does not represent historical returns of the ETF but.

The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.