By Ambrose O’Callaghan

The utilities sector is made up of companies that provide essential services for everyday needs. These are essential services, including providing natural gas, electricity, water, and telecommunications.

Utilities have acted as a reliable source of income for investors who value cash flow in their portfolios. Moreover, a portfolio of global utilities is worth consideration in an investment environment that has been rattled due to tariffs and the resulting trade tensions. Global utilities can act as a potentially strong defensive play in this period of market volatility and uncertainty.

Why are utilities considered a reliable income source?

Utilities provide stable, consistent cash flow due to their essential services and regulated revenue models. That makes these companies ideal sources of income for investors. That is especially important for retirees who are looking for stability in their portfolios. The chart below illustrates that global utility issuers offer attractive cash flow. The Harvest Equal Weight Global Utilities Income ETF (HUTL:TSX) stands out as it offers investors access to this traditionally defensive equities sector, steady cash flows, low volatility metrics, and high monthly income through Harvest’s trusted active covered call writing strategy.

How do utilities perform during market downturns?

Historically, utilities have proven to be more resilient during market downturns. After all, people still need natural gas, electricity, and water, regardless of economic conditions. That makes utilities less volatile and better able to weather market turbulence giving it the characteristic of being a defensive sector.

Looking back through history, our investment team identified three stages of a rate cycle and its impact on utilities.

Stage of the Rate Cycle and Utilities

Source: Harvest Portfolios Group, Inc. 2024.

Stage one is Correction, when policymakers move to increase interest rates. This stage is a generally weak backdrop for the utilities space.

Stage two is the Peak/Transition, when the interest rate cycle tops-out, and the transition begins. Historically, this has been a positive period for utilities stocks.

Stage three Landing, which can result in two separate outcomes: A Soft Landing or a Hard Landing.

In a Soft Landing, as interest rates are coming down, economic activity ramps up and businesses continue to deliver growth. That is a positive climate for utilities and especially for the broader stock market.

A Hard Landing occurs when the economy pulls back too much. That spurs a recession and a likely downturn for stocks. Historically, utilities have outperformed their competition in this scenario.

Utilities have tended to be more resilient during market downturns because of their defensive characteristics. That is, a steady, regulated, fundamental business model.

What are the current market dynamics making utilities a strong investment right now?

In addition to the anticipated benefits from Peak/Transition stage, Utilities are positioned to benefit from a shift in power demand due to technological advancements like artificial intelligence (AI).

Back in July 2024, we’d explored how AI is driving global utilities demand. Indeed, generative AI tools like ChatGPT are far more power intensive than Google searches. As generative AI proliferates, more power will be required to take advantage of that. Earlier in a May 2024 research note, Goldman Sachs projected that by the end of the decade data centers would consume 3-4% of overall power compared to 1-2% in the present day.

Fundamentally, increased power demand expectations have jumped to the forefront in the utilities space. The rise of technological advancements like AI set up a reliable tailwind for this sector going forward.

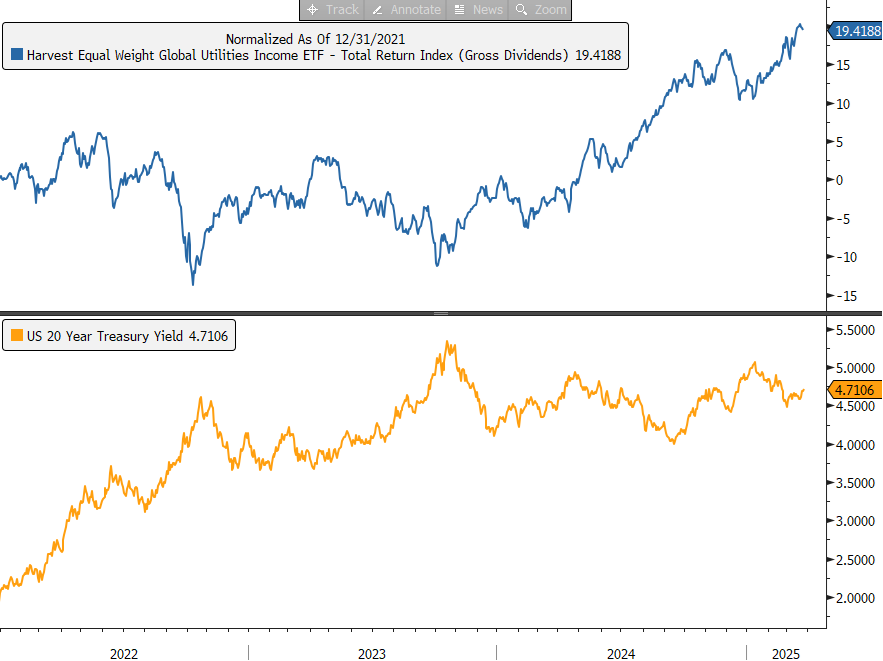

The stable dividends of utilities and long-term growth potential provide a good hedge against economic uncertainty. From a market perspective, the interest rate cutting cycle in the United States has started. In March 2025, the US Federal Reserve kept interest rates steady but slashed their economic growth forecasts due to the risk presented by rising trade tensions. Trade policy uncertainty looks like it is here to stay in the near to medium-term, which could lead to further interest rate reductions going forward. That could be bullish for utilities, as this chart from 2024 illustrates:

Falling Yields Boosts Utilities

Source: Bloomberg, Harvest Portfolios Group, Inc., March 26, 2025.

At the longer end of the curve the downward move in interest rates was already priced in, and yields have moved down dramatically. To reiterate, this falling yield environment is generally a good one to be in for interest-rate sensitive areas, with steady earnings, like utilities. Lower rates are helpful, both from a business leverage and cost perspective. It is also helpful in terms of utility stock valuations.

Why should investors consider HUTL for utilities exposure?

The Harvest Equal Weight Global Utilities Income ETF (HUTL) offers access to a diversified portfolio of high-quality utilities with a focus on income generation. HUTL provides an easy way for investors to gain access to the global utilities sector without the requirement to pick individuals stocks. That makes HUTL worth consideration in retirement portfolios that are focused on stability and high income.

This portfolio offers exposure to the largest North American and European utilities, including high-quality pipelines and telecoms, with a focus on high and sustainable dividends. HUTL last delivered a monthly cash distribution of $0.1216 per unit.

For investors who want the potential for even higher capital growth and monthly income, there is the Harvest Equal Weight Global Utilities Enhanced Income ETF (HUTE:TSX). This ETF applies modest leverage at 25% in HUTL. HUTE last paid out a monthly cash distribution of $0.0880 per unit.

Disclaimer:

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds”. Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.